As we’ve learned in the payments industry, this also means reinventing the way people pay.

The catchphrase above comes from the startup MyCheck — one of many that offers apps that let consumers pay for their food in restaurants without whipping out a credit card. But, it might as well be the tagline for any of the emerging startups that are attempting to disrupt the restaurant space by removing the friction from restaurant payments by enabling pay at the table, check splitting and a variety of other ways to pay using a mobile device and an app when dining out.

Last week in PYMNTS’ Mobile Transaction Tracker, we offered an in-depth look into one of the newest players in the restaurant block of apps — PaidEasy. PaidEasy’s technology seamlessly integrates with merchants’ existing POS without any extra steps, hardware or connector. The app allows patrons to do basic functions like split tabs and tip, and pay the bill, but the company differentiates itself by allowing consumers to open a bill the minute they step in an establishment, which can be viewed at any time to check how much they’ve spent, and can be closed on demand.

But there are a slew of other players:

MyCheck — Like PaidEasy, aims to take the friction out of the payments process — especially with groups. MyCheck launched in 2011 as a mobile payment service aimed at consumers who dine out, and it works with major restaurant chains.

Advertisement: Scroll to Continue

Cover, which lauds itself as the app where patrons can “dine without waiting for the check” also features similar perks, like bill paying and check splitting.

Then there’s Reserve, which allows customers to do exactly what its name suggests: reserve a table – as well as pay for the bill in-app at the end of the meal. Once reserved with a restaurant, the establishment can seamlessly add items to the bill that can be paid out on-demand by the customer.

Dash is another mobile dinning app that yes — you guessed it, let’s users pay the bill and split the check. Something unique to Dash, however, is its integration of Venue Vibes, which allows patrons to view the real-time gauge of a restaurant’s “atmosphere” to determine if it’s busy, or even if it’s the right setting for the particular outing.

Then there’s the granddaddy of them all, OpenTable, which now offers Pay with OpenTable, allowing patrons to both book a reservation and pay in-app.

To better, ahem, digest the busy space that the mobile dining app startup space has become, here are some quick facts about the newest players in the market in the past few years.

- Features: Bill pay, check splitting, built-in mobile coupons, interactive customer reviews, restaurant search

- What Sets It Apart: No added hardware for POS integration; iBeacons that allow a patron to start the bill upon arrival and end the bill upon leaving; Automatic tab closing feature; one-on-one review that creates interaction directly between owner and patron.

- Recent Funding: $50,000 seed money in November 2014. Currently in beta testing mode and fundraising.

- Features: Pay at table or counter, tip adding, check splitting, ordering ahead, delivery, loyalty, gift cards, push notifications, mobile wallet integrations

- What Sets It Apart: Push notifications from restaurant to customer; tailor-made loyalty rewards built directly into the app; direct POS integration with no extra hardware; unique POS reporting tools

- Recent Funding: $5 million, led by Spain-based bank Santander Group

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

- Features: Add table upon arrival, bill pay, automatic tipping, bill splitting, emailed receipts, restaurant search

- What Sets It Apart: Works with specific restaurants to create seamless experience; featured in New York City, Bay Area and recently expanded to L.A., receipts automatically billed to customer

- Recent Funding: $7 million total raised

- Features: Mobile bill pay, mobile reservations, concierge service that makes the payment for the customer, restaurant sorting feature (name, location or price)

- What Sets It Apart: Automatic bill pay through the account the bill was reserved through; no need to open or close tab; seamless and invisible payment experience.

- Recent Funding: $15 million from angel investors — including Jared Leto and rapper Will.i.am

- Features: Bill pay, bill splitting, starting a bar tab, app is integrated with most bar and restaurant POS systems

- What Sets It Apart: Its Venue Vibes, the feature that uses a venue’s POS system to reveal crowd levels and atmosphere in real time. With classifications of “lively,” “active,” “relaxed,” and “quiet” – patrons get an idea of what the feel of the room is.

- Recent Funding: $1.9 million from various investor groups at the start of 2014.

And these five are just the tip of the iceberg of all the apps trying to enter the market (many of which may never make it to the press or even out of beta stage). Still, the mobile dining space is becoming quite crowded — even for the rapidly evolving payments industry. So to sift through the clutter some more, we’ve gathered another batch of stats that provide a better look into why the mobile restaurant app scene seems to be thriving and why investors are so hungry to put their millions toward the next big thing in the mobile dining app.

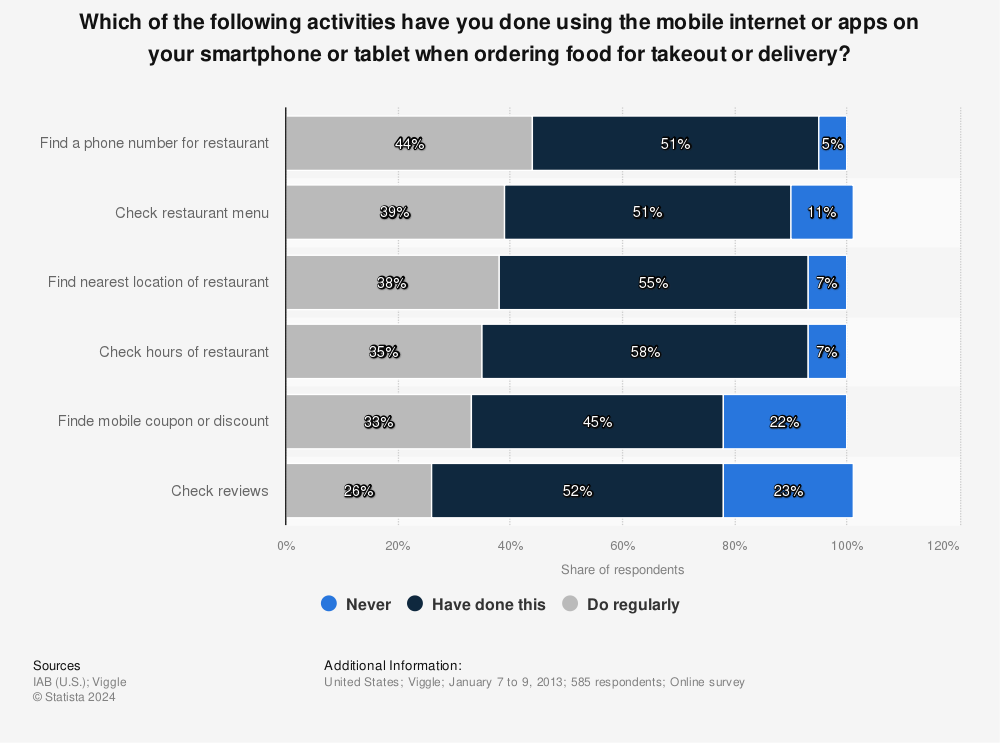

While the apps above are designed to get customers in restaurants for dining, recent statistics show that the apps are right on money with what consumers are using their mobile devices for. Most of these features that a majority of consumers indicated partaking in, like finding info for a restaurant, checking a menu, finding the nearest location of a restaurant, checking hours, finding mobile coupons, and checking reviews are all integrated into the mobile dining experience.

This recent data from Statista shows how consumers are using mobile for dining out, which shows they are consistently turning toward mobile for their ordering experience — whether it be in-restaurant, takeout, or delivery.

While those stats point to a number of key areas, it also highlights how consumers may view mobile coupons as part of their mobile payment experience.

Mobile coupons have been a hot topic in mobile transactions, as the trends seem to show that consumers are turning to their mobile devices to find those deals. But the trend now, however, is integrating those mobile coupons into the in-app experience so the friction of using a coupon has been taken out of the equation as much as the payment process itself.

Take PaidEasy, for example. For customers who want to find a restaurant running a special that night, they can select from any number that restaurants may push out to PaidEasy users who can directly apply those offers in-app – no longer worrying about scanning a QR code or mobile coupon.

“We’ve built the loyalty right in,” PaidEasy CEO Gregg Jackowitz told PYMNTS in an interview. “We’re trying to encompass everything you need all in one place.”

And that’s what the rest of the apps on the market are also trying to emulate. The one-stop shopping model for restaurants and restaurant-goers to turn to for the dining and mobile payment needs. But just like the mobile payment app space, the mobile dining app space is getting crowded — and it’s going to be a tougher competition with players like OpenTable integrating payments into its app.

Only time will tell how this buffet of mobile payments dining apps play out in the consumer market.