PYMNTS Intelligence: Confronting the Challenge of B2B Payments Fraud

Fraud is a concern on the minds of many corporate decision-makers at present, and with good reason: Nearly half of the organizations worldwide experienced some form of fraud within the last 24 months, including 52% of those with annual revenues over $10 billion. Of the latter, almost one in five reported an incident whose financial impact exceeded $50 million.

A recent report found that despite the many challenges facing companies, the one they rank first on their list is identifying business-to-business (B2B) fraud, cited by 72% of surveyed companies across North America and the United Kingdom. Second on that list was understanding financial risks, at 71%.

B2B fraud receives less exposure than consumer-related fraud, but its growing prevalence is becoming increasingly apparent. An astonishing 98% of B2B firms reported fraud attacks in 2021, losing an average of 3.5% of their annual revenues to this scourge.

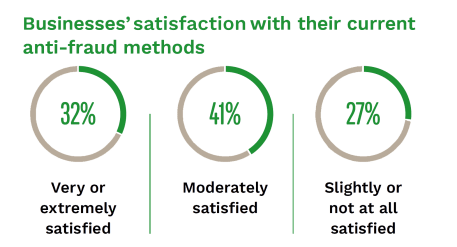

More than two-thirds of that group said they were not very satisfied with their current fraud prevention methods. Automation of digital identity verification, however, offers a powerful solution that can boost companies’ satisfaction with their anti-fraud platforms.

The Changing Face of Fraud

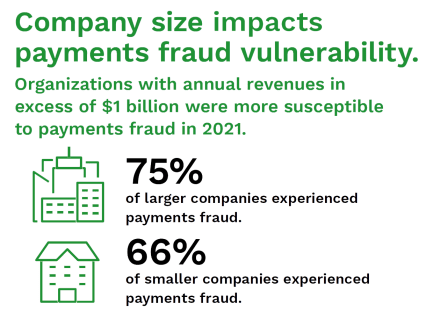

Overall, the share of organizations targeted for payments fraud actually declined in 2021, following a peak in 2019, when 81% reported being targeted. Of course, this does not mean that fraud is in decline, but simply that fewer companies were being targeted, and some forms of payments fraud grew during the pandemic. The share of organizations experiencing automated clearing house debit payments fraud increased to 37% in 2021 from 34% in 2020, while check fraud remained the top source, though unchanged from 2020, at 66%. The plateau in check fraud likely reflects the fact that companies shifting to digital payments solutions used fewer checks for B2B transactions.

There is evidence that fraud attacks are becoming more frequent among financial institutions (FIs) in particular. A recent PYMNTS survey found that 62% of all FIs are seeing increases in financial crime. At the same time, the size of the problem is slowing the response of many FIs, with executives saying they are overwhelmed by the scale and complexity of the issue. Sixty-six percent of respondents said that complex regulatory compliance matters have discouraged them from implementing new anti-fraud solutions, while 58% deemed modern fraud schemes too sophisticated for any solution to be effective.

Sixty-six percent of respondents said that complex regulatory compliance matters have discouraged them from implementing new anti-fraud solutions, while 58% deemed modern fraud schemes too sophisticated for any solution to be effective.

Realizing The Technological Advantage

Another recent PYMNTS study reported that 68% of B2B marketplaces and firms in the retail and manufacturing sectors are only moderately to not at all satisfied with their fraud detection systems. Thirty percent of these businesses have lost 3.5% or more in annual sales to fraud. In addition, legacy fraud prevention measures actually do damage, as more than half of organizations implementing manual anti-fraud solutions fail to accept new customers due to fraud concerns, compared to 31% of those using automated technology. Surveyed FIs that employed advanced-technology fraud mitigation platforms for anti-money laundering operations reported the smallest shares of transactions that led to fraud losses among respondents.