Consumers enjoy the convenience of instant payments using apps like Venmo, Cash App and Zelle. As the use of these faster payments has increased and become mainstream, however, so have fraud-related issues. Twenty-three percent of peer-to-peer (P2P) platform users have sent funds to the wrong person, and 15% have been victims of at least one scam, for example.

In response to these crimes, regulators and multiple U.S. senators are demanding stronger customer protections against fraud and scams perpetrated against consumers using instant payments.  The primary protections invoked include Regulation E of the Electronic Fund Transfer Act and increased controls designed to protect customers from harm.

The primary protections invoked include Regulation E of the Electronic Fund Transfer Act and increased controls designed to protect customers from harm.

Fraudsters often have the upper hand

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

While it is fair to be concerned about regulations, the real danger is the cybercriminals, who have been busy. With 48% of users having never heard of P2P fraud, a percentage that jumps to 56% when looking at just baby boomers, the fraudsters have an advantage against this lack of awareness.

Sixty-nine percent of U.S. consumers know they will be held liable for funds lost due to scams, errors or any other issue when using an instant payment platform, but research shows that just 44% of these consumers believe they should be held liable.

Businesses and banks are fighting back

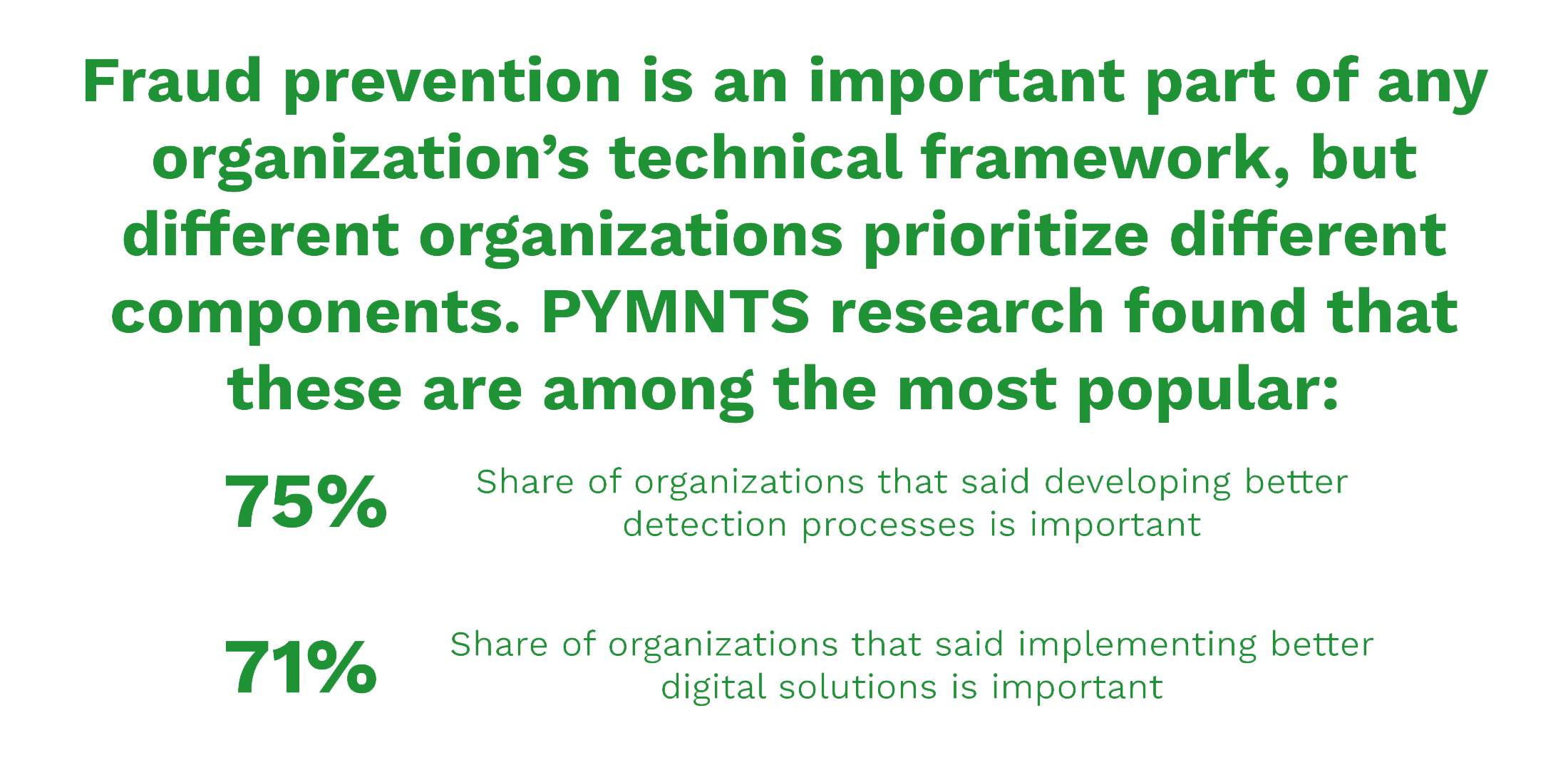

There are steps that financial institutions, companies and consumers can take to protect from instant payments fraud. According to a recent report, 80% of organizations with faster payments and fraud reporting in place said they track both unauthorized and authorized fraud.

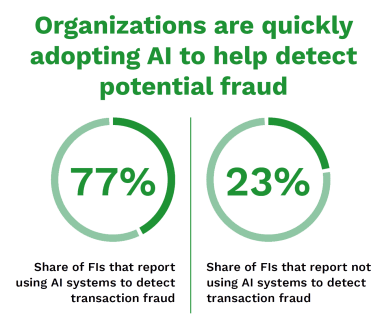

Forty-eight percent of the respondents reported that they are using new technology controls. With most companies trying to reduce friction while reducing fraud, it pays to employ multiple forms of technology, including ransomware protection, artificial intelligence, fraud prevention and authentication tools.

Of the firms using these advanced technologies, 50% are increasing their use of real-time decisioning and alerting, 40% rely on artificial intelligence and machine learning and 30% are improving authentication techniques in an effort to fight fraud and keep consumers safe.

Doing this protects both the business and its customers. It enables the firm to take advantage of instant payments, leading to improved customer satisfaction and staying on the safe side, well away from fraudsters.