With data showing consumers cutting back retail subscriptions, merchants must rethink how to reduce churn.

And with more subscribers reining in spending, sticky.io President and CEO Brian Bogosian said the “do I really need this” scrutiny over keeping or dumping a subscription cannot be taken lightly.

“I think that consumers are creating a higher bar for merchants to provide enticing offers to get traction,” Bogosian told PYMNTS’ Karen Webster in a recent conversation.

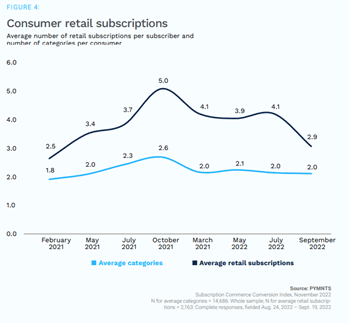

His comments reflect findings in the new “Subscription Commerce Conversion Index: Subscribers Seek Affordability And Convenience,” a PYMNTS and sticky.io collaboration, that found that the average number of subscriptions per subscriber has dropped to the lowest level since early 2021. At the same time, the average consumer held just 2.9 subscriptions in September, down from 4.1 in July and down about 40% from the peak of five different recurring purchase plans in October 2021.

The “great unsubscribe,” as it is often called, puts the onus on subscription merchants, Bogosian said, to not just provide flexibility and options to subscribers who need to take a break, but also to come up with creative ways to add value to their offerings to make them more essential and less discretionary.

In short, he said, creative bundling, better pricing and value to the consumer are what is needed.

“If you are a merchant that has a variety of different products, you may choose to bundle a nonessential product with an essential product that they get for free or heavily discounted on the nonessential item to continue to receive these products and to opt into new offers,” he said.

It’s the new math of subscriptions, and consumers are very good at it, but he said merchants need to be even smarter about it lest they join the ranks of the paused — or worse — the canceled.

Subscription Commerce Conversion Index: Subscribers Seek Affordability And Convenience

Pet Food Lessons for Merchants

One area that seems immune to subscription cancellation is pet food and supplies, which are essential in that pets must eat but discretionary in that we don’t need a subscription box to procure pet food. It can be bought at any grocery store, chain pharmacy or pet supply store.

To keep it arriving at the door — which is to say, to retain that subscriber — Bogosian noted that subscriptions make things easier and keep pets fed. That’s valuable to pet owners and pets.

“You know that you feed your dog twice a day. You know when you’re going to run out,” he said. “Lots of people are the same with something that’s an essential product like pet food. If you aren’t getting it delivered, you don’t find out that you’re out until you’re out.”

He added, “it’s a convenience factor, and it’s also value. Some of these pet food companies are very ingenious around bundling products and providing discounts and a lot of other incentives for people to opt-in and to stay in.”

It shows that discretionary and essential can be blended to an extent, which is a creative strategy for giving subscribers pause before they press “pause” on a subscription.

This can extend to baby food and other essential items but can still be obtained by going to the local store. He said, “the requirement for how much you need is also a lot more predictable” in such cases, which is another data point merchants can use to their benefit.

The new “Subscription Commerce Conversion Index: Subscribers Seek Affordability And Convenience” notes that huge competitors like Amazon Subscribe & Save are putting more pressure on merchants without that kind of scale or ability to eat shipping costs.

Bogosian said, “They’re so massive that you have to believe that to some degree, the impact to them is more of a macroeconomic statement than it is around products, merchants, or subscriptions. There’s just been a bit of a change in people’s appetite for committing to future payments when they’re concerned about making ends meet every month.”

See also: Is Data the Cure-All for Subscription Retention and Churn?

Predictive Analytics Helping Spot Trends

As for the 2023 outlook on subscription commerce, the push is on to employ data and more creative bundling to fortify subscriptions against the pause and cancel reflex.

Bogosian told Webster this is taking the form of more users of his platform seeking data that will help fight churn and keep consumers engaged even with the economy pressing down.

“We’re getting a lot more feature requests on our platform for being able to get more data and being able to massage that data in a number of other ways creatively to be able to understand more about those consumers,” he said.

He added, “there’s a much deeper examination of customer data and being able to then translate that into more competitive offers, more compelling offers, ones that extend customer lifetime value, predict churn, and provide offers to consumers that they would find enticing.”

Where he sees data making the biggest difference in 2023 is identifying gaps and opportunities for subscription offerings that make sense to consumers despite the macro headwinds.

“Predictive analytics is an area that we’re investing a lot of time and money and right now because we think that providing merchants with things that they can predict what’s going to happen before it happens helps them in so many different ways,” Bogosian said.

Having data “that translates into understanding what your requirements will be, and if you don’t like those results, finding ways to come up with different marketing, pricing, and bundling alternatives that can shift the change and change the trend” is an area of heavy focus now.