The year 2023 holds few certainties, but financial crimes and scams will be among next year’s sure bets.

The past year has seen any number of headlines and breathtaking heists that spotlight how creative bad actors have become, how they’ve fine-tuned their scams and schemes to follow the money and take it away from innocent victims — individuals, families and businesses among them.

Emerging from the pandemic, all things — especially payments — have skewed digital and faster. Cryptocurrency-related crimes, like the one in which the Department of Justice (DOJ) is in the midst of investigating a Nov. 11 crypto hack of FTX that garnered $372 million right on the heels of the firm’s Chapter 11 bankruptcy, are only among the “splashiest” of crimes.

Full Scope Yet Unknown

We won’t know the full tally of what the financial cost was in 2022 for a while, and the holiday season, as always, provides fertile ground for fraud. In a nod to how global financial crime has become, headed into the end of the year, the U.K.’s Financial Conduct Authority (FCA) said it has issued over 1,800 warnings about potential scam firms so far in 2022, 400 more than the previous year.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Perhaps no surprise, demographics and the use of technology play a role in who gets targeted. Younger consumers, and the ones wielding devices to get all manner of everyday financial tasks done, are especially at risk. According to the Consumer Protection Data Spotlight report from the Federal Trade Commission (FTC) released Dec. 8, “Gen Xers, millennials and Gen Z young adults (ages 18-59) were 34% more likely than older adults (ages 60 and over) to report losing money to fraud” online.

Advertisement: Scroll to Continue

Banks and other financial services firms stand at the vanguard — and are a point of entry — in the midst of the battle of financial crime.

The report “The State of Fraud and Financial Crime in the U.S.,” a PYMNTS and Featurespace collaboration, found that 62% of large banks report increases in financial crime. The average cost of digital payments misuse for financial institutions (FIs) last year topped $120 million.

Drill down a bit, and using the parameters introduced in late 2022 as part of the Federal Reserve’s FraudClassifier model, authorized party fraud is tied to roughly half of fraud volumes. In that case, transactions where authorized parties were manipulated translate into roughly a quarter of those volumes and 19% of dollar amounts tied to fraudulent transactions.

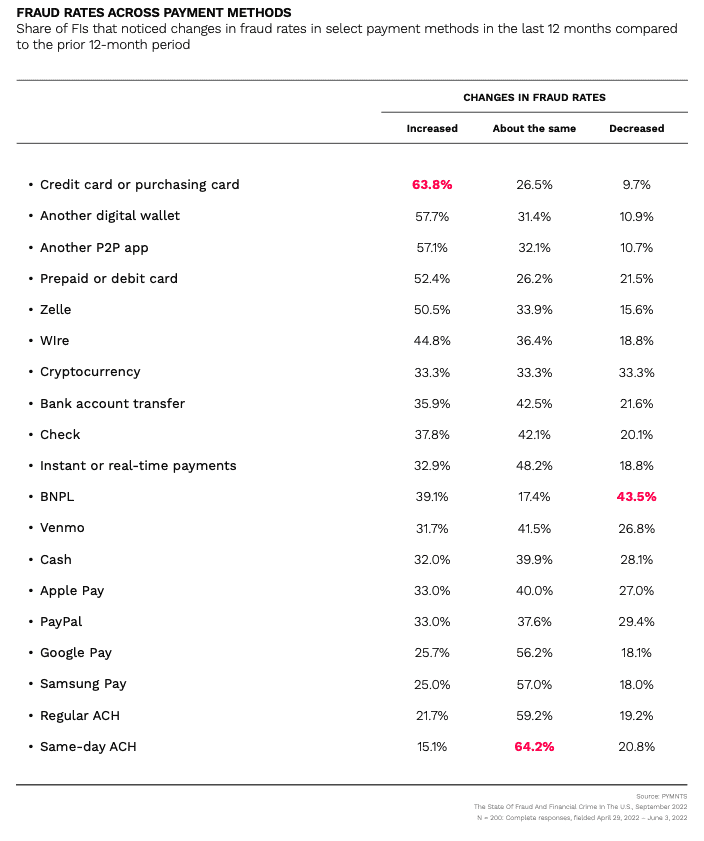

“Trust” scams (i.e., where fraudsters pose as family, friends, coworkers or potential romantic prospects) have accounted for about 12% of fraudulent transactions. And no avenue of payments is safe, as all saw fraud rates at least about the same, or higher, which indicates how tough the battle really has been and will be.

But FIs aren’t standing still. PYMNTS and Featurespace found that 95% of anti-money laundering (AML) executives considered it a high priority to use innovative solutions to improve fraud detection and AML compliance, including machine learning, artificial intelligence (AI) and cloud-based platforms. As many as 48% of the respondents reported they are using new technology controls. Of the firms using these advanced technologies, 50% are increasing their use of real-time decisioning and alerts.