PYMNTS Intelligence: Bringing Wholesale Improvements to Cross-Border Payments

As central banks roll out central bank digital currencies (CBDCs) for both wholesale and retail use cases, public-private partnerships are expected to play a pivotal role. This is especially true for cross-border payments, where wholesale CBDCs are anticipated to improve transaction efficiency and security. Public-private partnerships are seen as critical for interoperability among wholesale CBDC systems.

The multi-CBDC platform mBridge, for example, uses blockchain created specifically for cross-border transactions. For this platform, the Bank for International Settlements is collaborating with central banking authorities in China, Hong Kong, Thailand and the United Arab Emirates to support real-time, peer-to-peer cross-border transactions. This public-private partnership has enabled a modular system that satisfies the regulatory needs of various jurisdictions.

The Benefits of Wholesale CBDCs

While many are becoming familiar with the concept of CBDCs as central banks explore the potential of digital assets, an understanding of the difference between retail and wholesale varieties remains less mainstream. Retail CBDCs are transactional, government-backed digital currencies used by consumers and businesses, and they can be either token- or account-based.

Wholesale CBDCs are intended for interbank transfers and settlements, with accounts available only to member banks. These may be simpler to launch than retail CBDCs due to their limited impact on individual consumers and the number of successful pilot programs already in place. In the absence of real-time payment rails, wholesale CBDCs can help countries leapfrog intermediary steps toward a more modern banking system.

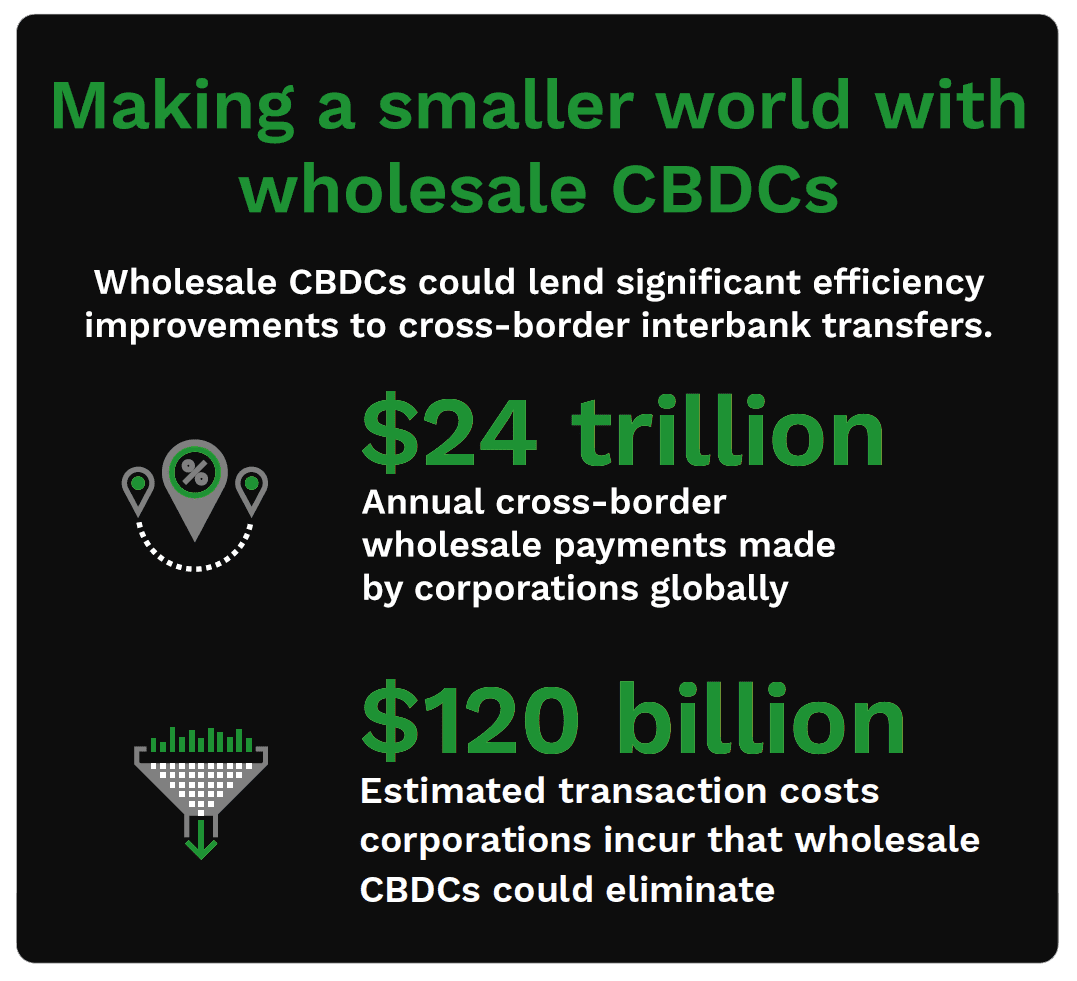

CBDCs offer a number of benefits in cross-border transactions. With the ability to complete transactions in real time and at any time, a full-scale multi-CBDC network enabling wholesale payments would greatly improve the efficiency of global cross-border payments. Additionally, such a network could save corporations more than $100 billion annually in transaction fees while also adding transparency and reducing transaction times.

The Give-and-Take of Public-Private

Among countries that have launched or piloted CBDC solutions, public-private partnerships are common. Private entities are able to enhance the CBDC ecosystem by bringing specific expertise and targeted knowledge. This permits central banks to focus on issuance while exploiting the competencies that private firms have already invested in developing.

The most obvious benefit of partnering with the private sector comes in implementation, but private sector expertise is also essential at the development phase as standards are created and tech stacks are formulated. Governments are also able to concentrate on monitoring and supervision while private sector partners accelerate compliant innovation.