With a 2% gain, things are already looking up for the FinTech IPO Index.

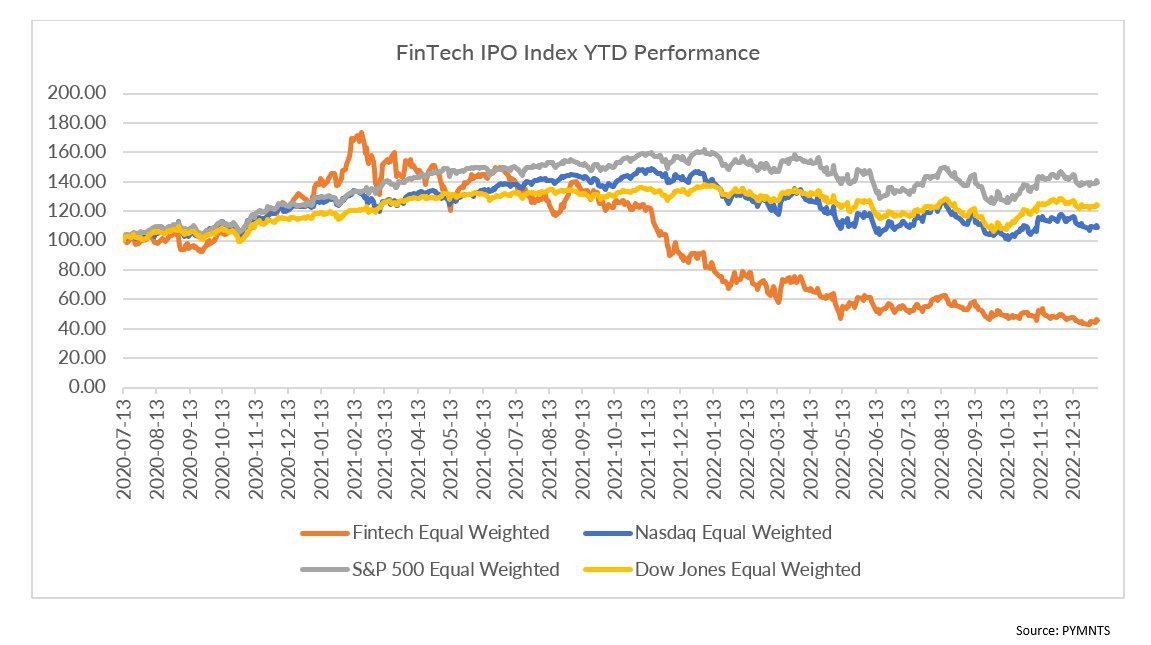

That statement shows just how low the bar has been set for the group, which, as spotlighted here, got cut in half — and then some — last year.

We’re being only a bit tongue in cheek here — a few trading days does not a trend make, and a low single digit percentage point rally is only a blip — and there are roughly 51 trading weeks left in the year. The long road of 2023 stretches ahead of us, and the problems of 2022 remain intact.

Those problems have much to do with interest rates, because the specter of higher rates remains one that hangs over stocks in general, and the FinTech IPO names in particular.

Economic data released Thursday (Jan. 5) show that the labor market is still tight. The ADP National Employment report showed that private payrolls grew by 235,000 positions last month. Tight labor conditions portend higher wages, which translates down the line to inflation.

Inflation drags on corporate and consumer spending, which in turn hits digital upstarts’ revenues, and delays profitability (many of the names in our group have yet to stanch the flow of red ink).

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Relief Rally or Dead Cat Bounce?

Thursday’s trading action is emblematic of the relief rally — if we want to call it that — that’s been in the works, at least for some individual names.

Indeed, some of the FinTech stalwarts have been up double digit percentages as measured from the last trading days of a 2022 no one wants to remember.

A relief rally would need to show some staying power; a “dead cat” bounce would be one that simply sees a share price downdraft continue after a few days’ worth of rebound. The saying goes, in Wall Street parlance, that even a dead cat will bounce if it falls far enough and hard enough.

Despite the overall downdraft in stocks on Thursday in the broader markets, Katapult was up 12%, and through the past several sessions has rocketed up 35%. The name has springboarded off a late December announcement it has partnered with iBUYPOWER, which manufactures high-performance custom gaming PCs, to provide consumers with a path to purchase gaming equipment.

Paysafe has gathered 31% through the past five sessions. The company said near the end of last year that ING Germany, the third largest bank in Germany, had partnered with Paysafe’s cash arm viafintech to enable users to make cash deposits or withdrawals from participating retailers.

Hippo Insurance has also gained 31% through the same timeframe, trailed only slightly by Blend, up 30%.

Futu Holdings was up 11% on Thursday, though is down more than 21% through the past five sessions, a downtrend that follows news that the China Securities Regulatory Commission said that the company violated laws by letting mainland-based consumers make cross-border transactions.

Corrective measures will be in the works, per reports, and the company has been required to stop taking in new accounts from customers on the mainland. Separately, the company said that it has postponed its planned dual listing on the Hong Kong Exchange.

The next few weeks will be telling. Earnings season begins in earnest at the end of next week, when the big banks start reporting their results. And credit card/consumer spending metrics and mortgage originations will say a lot about the future prospects of the names in the FinTech IPO Index, as so much depends on individuals and families continuing to open their wallets.

The common theme that runs through it all is that the digital disruptors need the consumers and businesses to keep on transacting.