A potential housing sector recession is on the horizon, with new construction and building permits falling as homebuilder confidence has sagged to its lowest level in a decade. The industry is taking measures to entice buyers — but, at the same time, it is facing more burdensome compliance evaluations on federally contracted projects. As costs continue to rise, construction firms are aiming to compete.

Staying ahead is more difficult when slow payments disrupt projects, which can keep firms in a stressful cycle of filling cash flow gaps to keep projects moving.

This edition of the “B2B And Digital Payments Tracker®” explores how the construction industry is tackling the problem of slow payments and rising above challenges to drive cash flow stability and business growth.

Around the B2B and Digital Payments Space

Construction companies are experiencing major issues due to late payments, and they are becoming more prominent. There was a 53% increase last year in the total of late payments for wages and invoices across the construction industry, with 37% of firms reporting they had to halt or delay projects — an increase of 28% from the previous year.

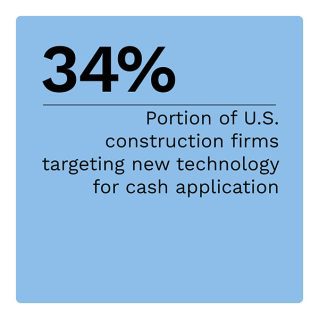

The construction industry is increasingly turning to technology, especially as the economy and new construction market present upcoming challenges.  Nearly half of those surveyed indicated that investing in technology was a number one priority over the next year, with 40% increasing their budget for technology additions. To remove friction, contractors are tapping automation, particularly for back-office processes, and new digital payments.

Nearly half of those surveyed indicated that investing in technology was a number one priority over the next year, with 40% increasing their budget for technology additions. To remove friction, contractors are tapping automation, particularly for back-office processes, and new digital payments.

For more on these and other stories, visit the Tracker’s News and Trends section.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

An Insider On Driving Business Growth By Prioritizing Payments

Receiving payments on time is a longstanding headache for most construction companies, and the cash flow issues late payments cause can quickly snowball into larger problems when not addressed. Focusing on digital solutions that prioritize payments and build a culture of on-time payments can reduce frictions contributing to late payments.

To get the Insider POV, we spoke with Patricia Bonilla, owner and president at Lunacon Construction Group, to learn more about driving business growth by prioritizing payments.

Slow Payments Drag Contractors’ Cash Flow

Slow payments comprise 12% of total construction costs, with one in three contractors forced to finance cash flow needs and add carrying costs like interest. Waiting more than 90 days for payment is common for many and increases the risk of becoming cash flow negative.

As customer expectations for more convenient and secure payments accelerate, more construction firms are using software to track and process payments and track payment paperwork. Nearly eight in 10 construction firms note the ability to accept electronic payments helps them get paid faster.

More firms are eyeing new technologies to get paid faster to manage cash flow better and avoid productivity or quality issues on projects. To learn more about how slow payments impact cash flow in the construction industry, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “B2B And Digital Payments Tracker®,” a collaboration with American Express, examines how construction firms can build better cash flow with digital payments.