Inflation’s impact on the affordability of housing is putting the American dream of home ownership further out of reach for more consumers, with even renting now outpacing the financial realities of more people.

PYMNTS has assiduously tracked the effects of inflation from the start of the current economic crisis, and our seventh study, “Consumer Inflation Sentiment: Rising Housing Costs Deflate Economic Optimism,” found many people with a somewhat grim resignation as it relates to housing.

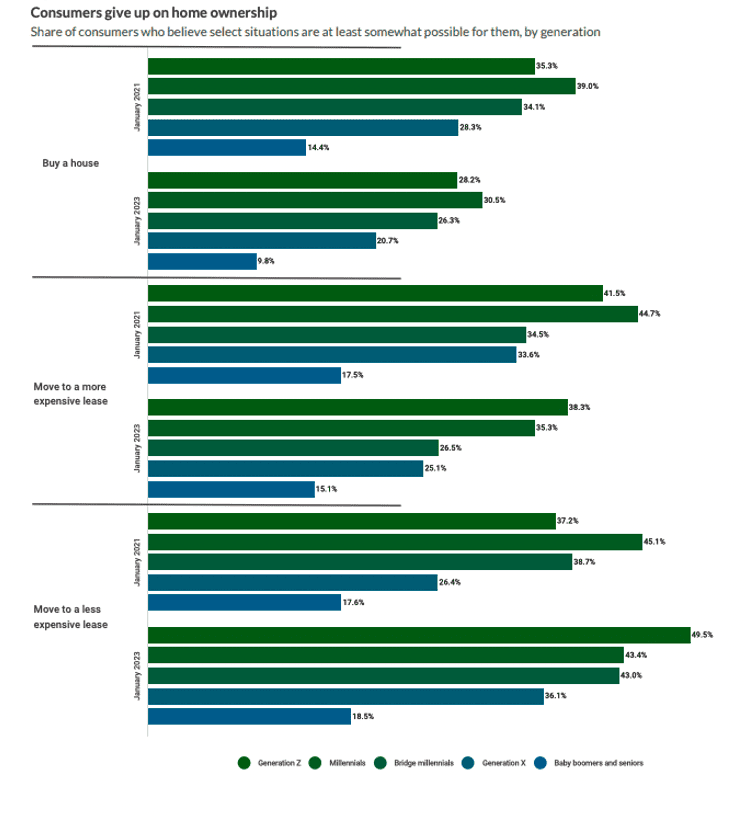

In a January survey of over 2,000 U.S. consumers, standout findings included the fact that the number of consumers who said homeownership is achievable fell by over one-quarter (24%) in the past year.

“Currently, 23% of non-owners think buying a house is within reach, yet 30% believed the same in January 2021,” the study found. “Thirty-five percent of Gen Z consumers believed purchasing a home for themselves was within reach in 2021, while just 29% do now.”

After the housing market collapse of 2008, which was partly caused by overbuilding, the number of new houses and residential properties declined radically by some estimates, in some ways mirroring the current situation in the car market in which demand is far outstripping supply.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

That’s part of the problem, but inflation is the ultimate villain in this unfolding story as skyrocketing prices are putting even step-up rentals beyond the grasp of millions of U.S. consumers.

PYMNTS found that upgrading to a better rental unit seems less attainable now than in 2021, as the study stated that “just 27% of renters now [say] they think it is at least somewhat possible for them to upgrade to a more expensive place. This reflects a drop from 34% two years ago.”

Thirty-five percent of renters surveyed said they’re considering downgrading to a less expensive rental to reduce their housing costs.

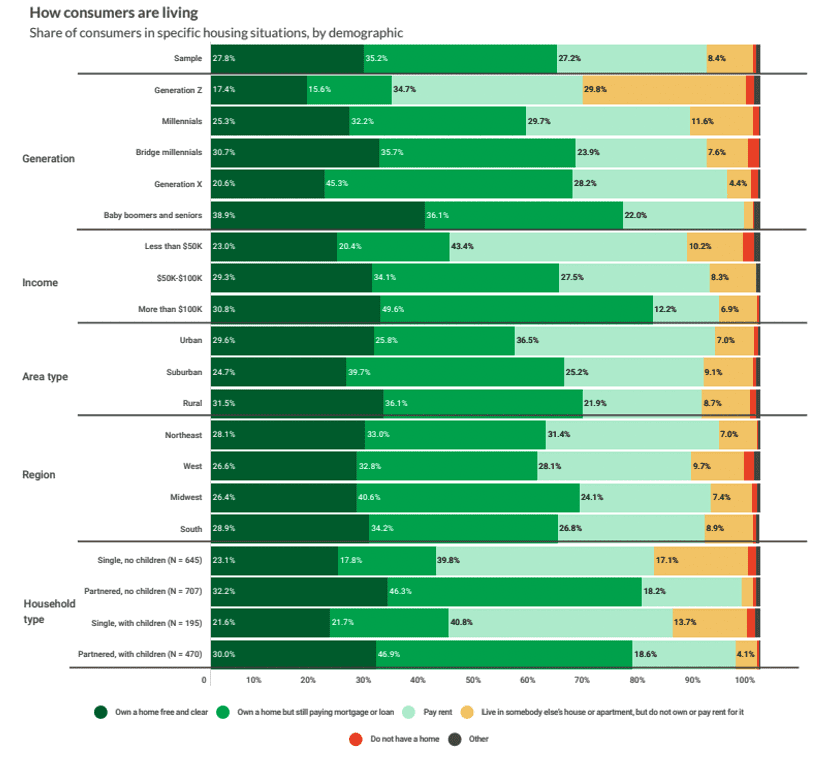

Looking at generational breakdowns, less than one-third (27.8%) of Americans own a home free and clear, with baby boomers and seniors dominating at 38.9% of those living in — or at least owning — a home outright. Generation Z and Generation X rank as the least likely to own a home outright at 17.4% and 20.6%, respectively.

Just over one-third (35.2%) of consumers own a home but are still making mortgage payments, 27.2% are renters, and 8.4% live in somebody else’s house or apartment, but don’t own and don’t pay rent to do so. That’s another artifact of the housing market crash of 2008 when moving back in with parents or other family members became a national phenomenon.

This situation is having profound psychological impacts on portions of the population for whom housing — or the inability to afford it — is eliciting an emotional reaction in their sense of financial well-being.

“Renters are twice as likely to say housing costs are very or extremely detrimental to their financial lifestyle than homeowners who pay mortgages,” the study found. “Sixty percent of renters say these payments negatively influence their financial health, with 29% of renters saying this influence is very or extremely negative. Lower-income consumers are the most likely to report that housing costs are making very or extremely negative impacts on their financial health, with 34% of these consumers saying this has been the case.”