Personal information is, well, personal and consumers want their financial institutions to protect it better.

That’s according to the latest research in PYMNTS’ January 2023 report, “Consumer Authentication Preferences For Online Banking And Transactions,” which finds that while most banks tend to meet the basic online security expectations of their customers, they still fall short of delivering the security options and features customers prefer.

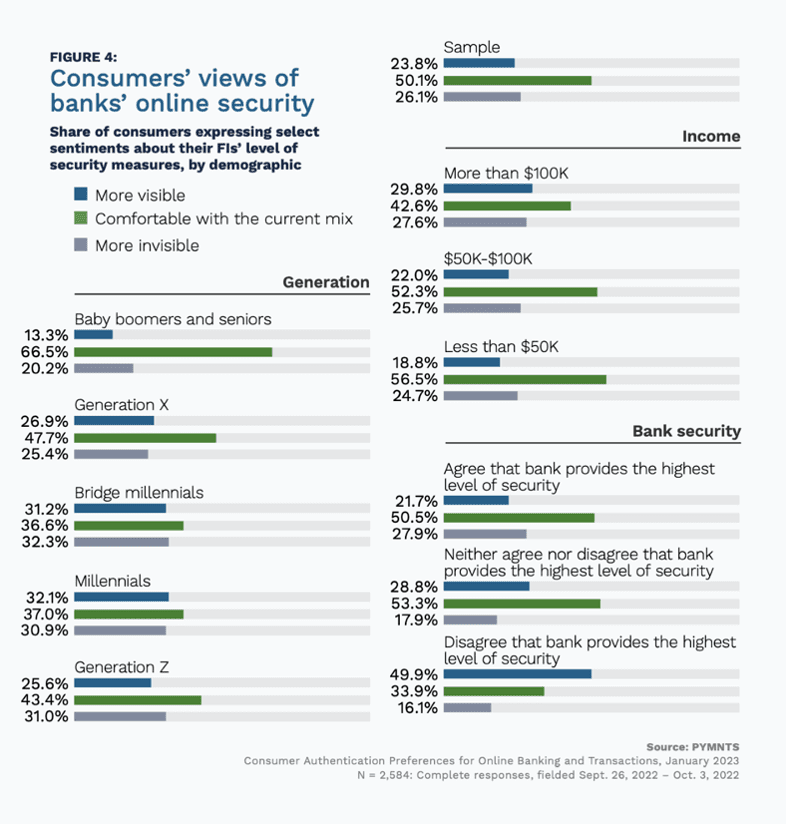

Just don’t tell the baby boomer cohort. Two in three baby boomers and seniors (66.5%) surveyed by PYMNTS report that they are comfortable with the current mix of online security features and tools their financial institutions already provide.

That’s compared to under half (47.7%) for Generation X and Generation Z (43.4%) who say they don’t need any more protections in place, and just over a third for both bridge millennials (36.6%) and millennials (37%), who represent the generational groups least comfortable with the measures in place to protect their financial information.

Consumers in lower income brackets also self-report as being more comfortable (56.5%) with their financial institution’s existing level of security than do those in higher income brackets making more than $100,000 per year (42.5%).

Still, more than 8 in 10 consumers (83%) are confident in their banks’ security measures as being able to adequately protect them from security threats while making online transactions and preventing unauthorized access to their accounts.

That said, PYMNTS research found that consumers do want financial institutions to provide them either with visible security measures that require a user to act, such as entering a password or using biometric authentication, or invisible ones that work behind the scenes.

Consumers report that they are most concerned about security measures when using new devices to access their bank accounts (38%), completing their first online transaction with a new eTailer (35%) and updating their personal information in their bank accounts (35%).

For more information on how evolving consumer security needs might impact your business, download the free PYMNTS report, “Consumer Authentication Preferences For Online Banking And Transactions.”