The past week’s been dominated by bank runs, by lifelines thrown to banks, by bank rescues.

And yet, in the midst of a whipsaw week for tech stocks, there was other news.

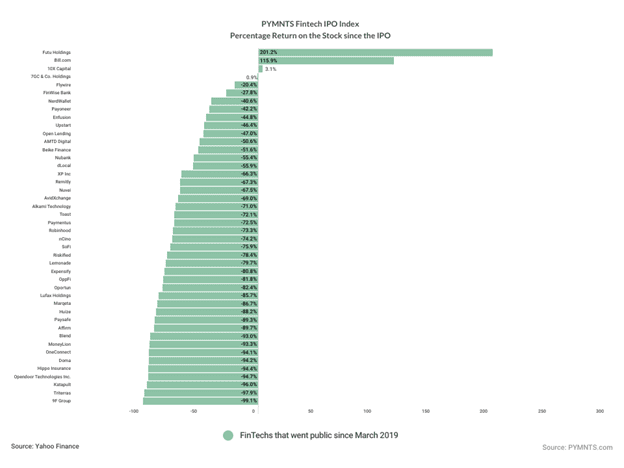

Earnings continued to trickle in, helping to send the FinTech IPO Stock Index 4.1% lower for the week, as several names declined by double-digit percentage points.

At the vanguard of those declines were Oportun and Katapult.

Earnings Reports Send Investors to the Exits

Oportun sank 43% through the past five sessions. The company reported earnings this week that showed that revenues were up 35% in the December quarter to $262 million. The company’s financial presentation revealed that members in the quarter were 1.9 million, up about 27% year on year, while aggregate organizations were down 29% in the same period to $610 million. Management said on the conference call with analysts that loan originations were lower year over year and below prior guidance of between $650 to $700 million due to further credit tightening actions the company November and December.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

The company’s 30-day delinquency rate grew to 5.6%, from 5.4% in the third quarter and up from 3.9% last year. The materials show that the annualized net charge-off rate was 12.8%, where that metric had been 6.8% last year. And per commentary from CEO Raul Vazquez, the company does not anticipate returning to a 7% to 9% charge-off rate in the second half of the year.

Katapult lost 31.2% through the week.

The company said in its own earnings report that gross originations of $59.8 million increased by $0.9 million, or 1.5% year-over-year in the December quarter. At the same time, total revenues slipped by 33.4%, to $48.8 million. And while there’s been evidence that year-over-year gross originations should continue to increase into 2023, there still are headwinds to consumer spending. The presentation materials from the company note that impairment charges as a percentage of gross originations have declined from around 10% earlier in 2022 to a more recent 9% level.

Paysafe lost more than 20% through the past five sessions. As reported here, Binance is halting cryptocurrency withdrawals and deposits for its British customers.

“Paysafe, our fiat partner that provides GBP deposit and withdrawal services via bank transfers (Faster Payments) and via card (card deposit) to Binance users, has advised us that they will no longer be able to provide these services from May 22nd, 2023,” the company said in a statement provided to PYMNTS.

Paysafe’s stock slide came in the wake of its own earnings report that showed that total payments volumes were up 5% to $33.1 billion, while revenues grew 3% to $383.6 million. Merchant solutions revenues gained 10%, while digital wallet revenues were 4% on an as-reported basis.

Alkami lost 15.2%, having reported this past week that Maine-based Kennebec Savings Bank has launched the Alkami Digital Banking Platform. The release noted that the platform will provide customers with self-service banking capabilities.

Bill.com gave up 4.6%, and the company announced a partnership with BMO to digitize and streamline business payments. BMO Bill Connect, powered by BILL, per the announcement, operates as a bill pay and invoicing platform that helps customers pay and get paid in a simpler, faster and more secure way, the companies said.

There were some companies that managed to post gains. Opendoor Technologies was up 23.2%, having rebounded a bit from results late last month that showed a narrower loss than expected, but where there was a 25% drop in sales, quarter over quarter. Hippo Insurance was up 12.3% on the week. The company said it had instituted a $50 million stock repurchase program.