It once seemed like FinTechs going public had limitless funding if investors saw potential. That mindset may be becoming a thing of the past.

If only FinTechs could turn back the clock a few years, when worldwide venture capital (VC) investments were through the roof, with much of those freewheeling funds going to FinTech startups, leading to sky-high valuations. The hard landing started last year, with 2022 ushering in the rising inflation that led to increased market volatility and broad economic uncertainty. In response, VC firms became less adventurous and began considering FinTech profitability along with growth potential — something even those considered successful, such as Klarna, continue to struggle with.

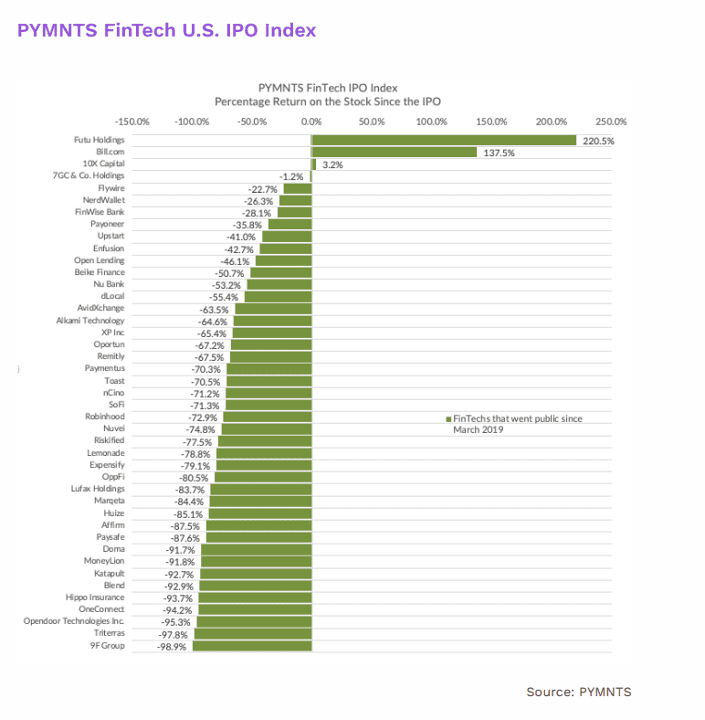

As illustrated in the new PYMNTS collaboration with Sezzle, the “FinTech Tracker®,” when VC FinTech funding began drying up, so did valuations.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

PYMNTS’ FinTech U.S. IPO Index, tracking FinTech return percentages since going public, starkly demonstrates FinTechs’ recent rough ride. The initial public offering (IPO) index saw a 51% loss over 2022, roughly comparable with the Global X FinTech ETF 52% decline, as IPO funding fell 68% in the same time period. Of course, now with the SVB meltdown and general jitters of banks becoming more risk-averse in its wake, funding now may be even more difficult to obtain for FinTechs.

Proof of post-SVB investor anxiety is already taking shape, as FinTechs going public since 2020 are now trading at 54% below offer price. Lending platforms have especially driven this recent rout, driving the IPO Index nearly 5% south in March. However, FinTechs focused on other suffering sectors are also seeing trouble, as mortgage facilitation platform Blend announced its stock had fallen 40% over the past five sessions.

Operating under an IPO’s regulatory constraints that include SEC scrutiny, disclosures and financial auditing, FinTechs going public now must reevaluate their profit strategies to appeal to the post-SVB investor. Present revenue is being prioritized over potential growth, and so FinTechs seeking further funds may need to pivot to a more steady, sustainable model. This may be more difficult than in past years, as inflation and continued raised Fed rates place extra pressure on FinTech profitability.

Advertisement: Scroll to Continue

There is no one answer for how FinTechs may hit the milestone of going from in the red to the black. Firms should clearly cut out excess costs and spending, including possibly painful layoff rounds as well as scaling back.

However, the sad reality is that not all FinTechs may survive what’s already turning out to be a turbulent 2023. The ones that do, however, could come through stronger than ever as this year further tests everyone’s resiliency.