Japan is a veteran in the real-time payments space, launching its Zengin System in 1973. The system enables individuals and businesses to make instant payments using a mobile phone, computer or tablet.

Kenya’s M-Pesa system was launched in 2007 by mobile network operator Safaricom. The system allows users to send and receive money using their mobile phones, and it has become very popular as most Kenyan consumers do not have access to traditional banking services.

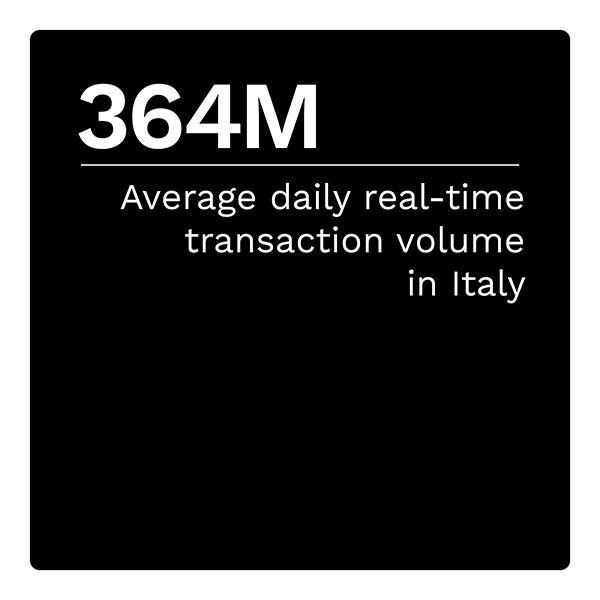

Italy joined the SEPA Instant Credit Transfer (SCT INST) scheme when it launched in 2017. This system allows individuals and businesses to make instant payments across the entire European Union up to a limit of €15,000 ($16,542).

Malaysia’s real-time payment system is called DuitNow and was launched in 2018. It enables individuals and businesses to make instant payments using their mobile phones or online banking platforms with a maximum transaction value of 100,000 Malaysian ringgits ($22,406).

Mexico’s real-time payment system CoDi was launched in 2019, meanwhile, and processes a maximum amount of 8,000 Mexican pesos ($445).

While the maximum transaction limits and the types of devices used may differ, they all operate 24/7 and have become popular in their respective countries. These systems have helped to increase financial inclusion, reduce transaction costs, and promote economic growth.

“The Real-Time Payments World Map,” a collaboration with The Clearing House, examines the state of these real-time payments across countries around the globe, and examines how they compare to their counterparts as well as total payments volume in recent years.

Real-time payment systems have become increasingly popular around the world due to the rise of digital payments and the need for faster and more efficient financial transactions.

Real-time payment systems have become increasingly popular around the world due to the rise of digital payments and the need for faster and more efficient financial transactions.  Some of the most exciting and interesting use cases have been in Japan, Kenya, Italy, Malaysia, and Mexico — all of which are on different points their real-time payments journey.

Some of the most exciting and interesting use cases have been in Japan, Kenya, Italy, Malaysia, and Mexico — all of which are on different points their real-time payments journey. Add as Preferred Source

Add as Preferred Source