Government data confirms what consumers already know: Market and Main Street stabilization may be further off than previously thought.

The Bureau of Economic Analysis (BEA) released its Q1 2023 GDP advance estimate report Thursday (April 27), and the numbers indicate a tumultuous economic landscape may be ahead for a while longer. U.S. economic growth has slipped for the third consecutive quarter, from 3.2% in Q3 2022 to 1.1% in Q1 2023. Consumer spending, a major GDP factor, has contracted in recent months as many shoppers continue to cut back to essentials.

This consumer spending pullback has been steadily growing, starting with the pandemic and ratcheting up as inflation tightens most shoppers’ belts and SNAP cuts affect major retailers’ bottom lines. The GDP release simply confirms consumers’ suspicions that have been cited in PYMNTS’ “Consumer Inflation Sentiment” series.

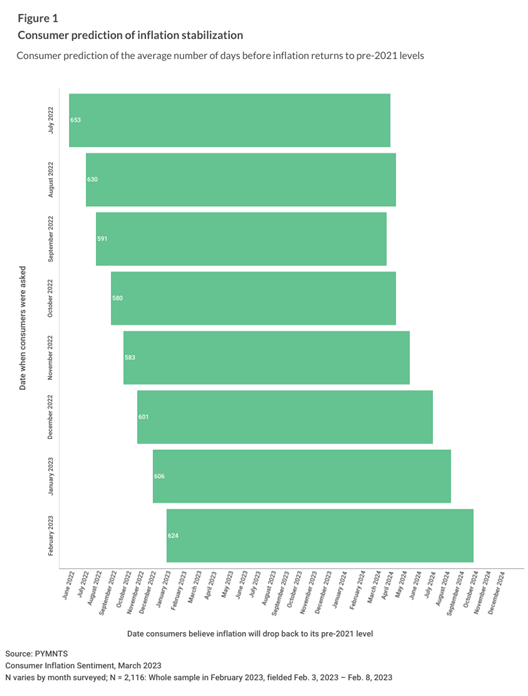

When asked in November 2022 when inflation might return to pre-2021 levels, surveyed consumers on average predicted around July 2024. By February, that average date had moved out to October 2024, meaning consumers expect inflation to linger at least another year and a half. The GDP growth slowdown further quantifies these expectations for prolonged economic uncertainty as consumers continue to cut back.

When combined with GDP data, consumer sentiment may signal more serious economic challenges on the horizon. As PYMNTS noted last year, two consecutive quarters of GDP contraction is historically a signal of a recession underway. While economists currently disagree on what defines a full-on slump and so no official proclamations may be forthcoming, both Main Street and the Fed have voiced recession concerns.

Further hinting at continued uncertainty, analysts predict S&P 500 companies to see a 6.8% year-over-year decline in Q1 2023 earnings. If correct, the decrease would represent the steepest drop since Q2 2020, when pandemic shutdowns were put in place. Driven by inflation constraints, rising interest rates and recession fears, reduced margins and demand across a range of industries are fueling analysts’ lowered expectations.

Combined, these indicators may signal a bumpy time ahead.

Spending is influenced by sentiment and how secure consumers feel about what’s on the economic horizon. Consumers’ concerns surrounding inflation and financial stabilization have been steadily growing louder, first during the pandemic and again now amid the one-two punch of inflation and higher interest rates. GDP is a fundamental part of the greater economy, yet consumer predictions are once again ahead of the curve.