Navigating the current economic turbulence is a key task for seemingly all consumers now, but members of Generation Z are doing so with their style. Perhaps more so than other generations, Gen Z consumers’ habits and preferences seem to strive for greater personal balance, and this cohort values wellness as much as professional ambitions. In short, the generation overall seeks to find success — sanely. Remarkably, this mindset is being maintained as the age cohort experiences a steady yet dramatic rise in financial challenges, illustrated in the April installment of PYMNTS’ collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report.”

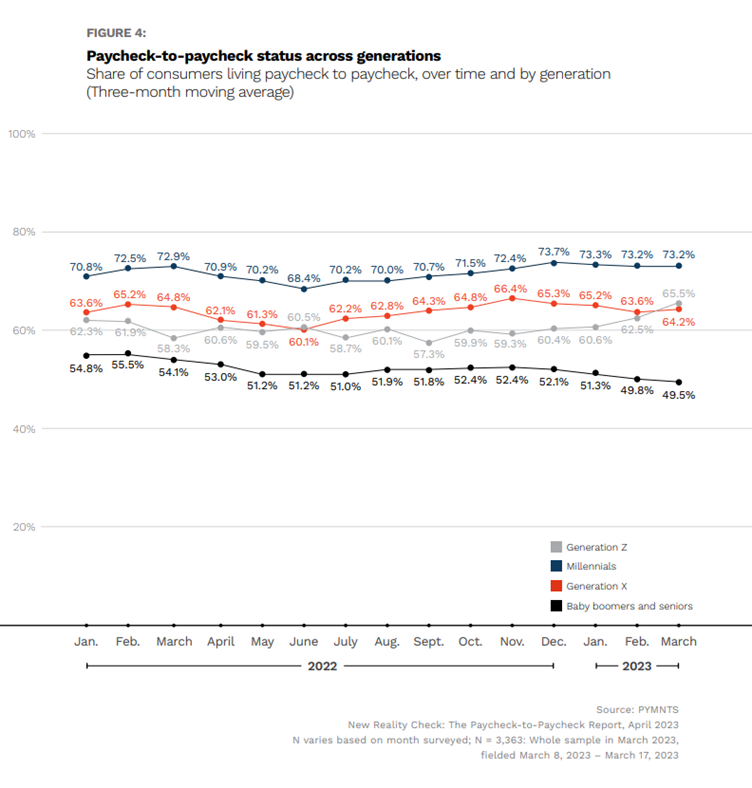

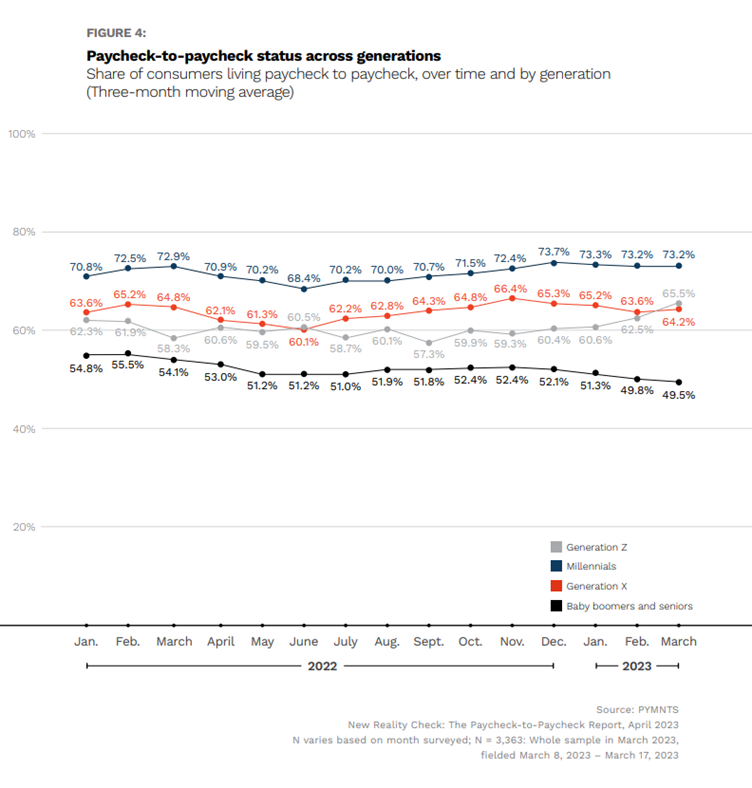

The three-month moving average of Gen Z consumers who live paycheck-to-paycheck rose from a September 2022 low of 57.3% to 65.5% in March, meaning this generation has the dubious honor of exhibiting the fastest paycheck-to-paycheck growth of any age cohort. Given this, it’s no wonder that more than one-third have a side hustle to bolster their financial security, or that 70% believe homeownership is out of reach.

The goal of striking a balance between financial and personal wellness may be driving Gen Z toward some of their nearly generation-wide habits — habits that could seem contradictory at first glance. For example, they have adopted time-saving incentives such as restaurant aggregators, even though those platforms raise expenses through surcharges and tips. Despite overall economic challenges, an average of 69% of Gen Z’ers have used a restaurant aggregator over the six months before being surveyed. Time-saving yet budget-friendly habits could also be behind Gen Z’s use of eGrocery platforms, which outpaces baby boomers and senior use by over four to one. (These platforms also provide increased convenience, often at the cost of delivery fees.)

Personal wellness could be driving some other trends in which Gen Z leads. These include the uptake of healthcare-related wearables for daily monitoring, with 30% of the generation use these daily. It also may be behind their increased use of “dumb phones” as Gen Z tries to blunt the possible negative effects of social media and too much time on digital devices overall.

Despite a gloomy rising share of those living paycheck-to-paycheck, Gen Z seems committed to keeping their financial and personal wellness priorities balanced through time-saving “hacks.” Merchants, restaurants and others seeking to appeal to this generation may consider these habits in their strategic efforts, as appealing to price alone may miss the mark.