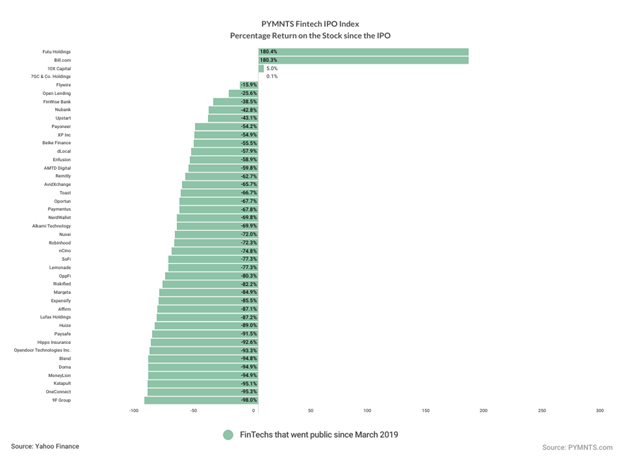

Earnings, earnings, everywhere — and for the FinTech IPO Index, a notable rally marked the past five sessions.

The overall index was up 9.3%.

Blend Labs led the charge, where shares soared more than 84%.

In the company’s results, Blend noted its mortgage banking software processed 23.2% of the total market originations as measured by the Mortgage Bankers Association in the second half of 2022, up from 14.5% in the second half of 2021. Supplemental earnings materials show that its consumer banking suite revenues were up 34% to $5.2 million, and the declines in its mortgage suite revenues, at 33% year over year (YoY), to $17.8 million, were better than the 58% decline seen in industrywide mortgage loan origination volumes.

Open Lending saw its stock jump more than 55%. The company’s most recent earnings announcement shows that the company facilitated 32,408 certified loans during the first quarter of 2023, compared to 43,944 certified loans in the first quarter of 2022. Total revenue was $38.4 million during the first quarter of 2023, lower than the $50.1 million logged in the first quarter of 2022. New vehicle certifications as a percent of the total were 14.7%, compared to 5.6% last year. Used vehicle certifications were 85.3%, down from 94.4%.

Oportun earnings this past week drove the shares up 41%. In the earnings release, management noted that the membership roster grew by 14% to 1.9 million. The company also said that products were up 17% to 1.9 million.

During the most recent quarter, the company said that revenues surged 21% to $260 million. Aggregate originations were $408 million, down 49% YoY. The filings detail the annualized net charge-off rate of 12.1% as compared to 8.6% for the prior-year period. The 30-plus-day delinquency rate of 5.5% was higher than the 4.5% for the prior-year period.

Our coverage of Affirm’s quarterly report noted that the company’s quarterly results showed double-digit gains in gross merchandise value (GMV). But consumers are pulling back on at least some categories of spending.

Shares in Affirm were up 36.6%.

The consumer electronics category declined 8% YoY. The home/lifestyle category also declined 10% YoY, whereas it had grown 2% YoY in the fiscal second quarter.

Revenue was up 7% YoY, or up 15%, excluding Peloton, to $381 million.

Active merchant count grew 19% YoY to 246,000 merchants overall, and merchants with greater than $1,000 in trailing 12-month GMV grew 29% YoY to 92,000.

Management said the banking sector in the last several months had pushed funding costs higher — an environment that will remain in place in the current fiscal fourth quarter.

CFO Michael Linford noted, “as you get to Q3 of next fiscal year, when we get to about nine months from now, you will begin to lap easier comps. And so we’re optimistic that by the time we get there, some of those businesses will return to some solid growth. But for now, the headwinds there continue.”

Upstart’s shares rallied 34.6%. The company, which uses AI to help power the platform’s lending efforts, posted a narrower loss than the Street had expected. In the most recent quarter, the company said its revenues slipped more than 50% to $147 million. The company’s lending partners, per the earnings release, originated 154,478 loans in the quarter, totaling $1.5 billion. Those figures were off by more than 60% from the year-ago period. The company also said it had secured about $2 billion in additional funding.

Toast’s first quarter results illustrated that during the quarter, the company added over 5,500 net new locations. Gross payment volume (GPV) increased 50% YoY to $26.7 billion.

Revenues from subscription services in the most recent quarter stood at $107 million, compared to $63 million last year. The stock rocketed up 18.2%.

“In the small SMB space, we’re optimizing pricing and packaging to meet the needs of that customer segment and leveraging an eCommerce sales motion and self-service onboarding to efficiently grow in this segment,” Toast Chairman and CEO Chris Comparato said.

In the quarter, the technology company also announced that it was integrating Order With Google into its platform, allowing restaurants to unlock a new channel for orders. The company also shared that it has acquired digital drive-thru signage company Delphi Display Systems in an effort to boost its QSR offerings.