A changing financial industry is transforming the relationship between traditional banks and FinTechs. In the past, banks largely regarded FinTechs as formidable competitors, if not existential adversaries, due to the latter’s technological prowess, agility and superior customer experiences. This dynamic, however, has begun to swing toward collaboration as both sides adjust to economic pressures, regulatory concerns and evolving customer preferences.

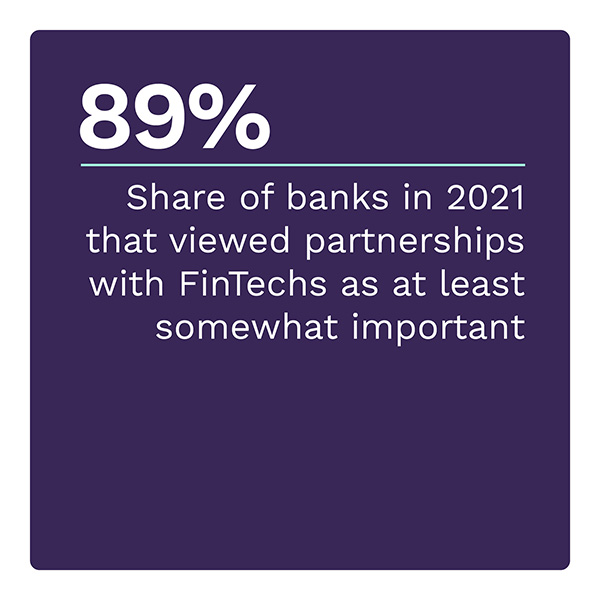

Major financial institutions (FIs), including JPMorgan and American Express, have moved to acquire FinTechs, and banks’ general interest in FinTech acquisitions has increased markedly. Partnerships have become even more popular: The share of banks viewing bank-FinTech partnerships as at least somewhat important rose to 89%, up from 49% in 2019. Driving this change is both parties’ realization that against the backdrop of a shifting landscape, a more collaborative relationship can be mutually beneficial.

Major financial institutions (FIs), including JPMorgan and American Express, have moved to acquire FinTechs, and banks’ general interest in FinTech acquisitions has increased markedly. Partnerships have become even more popular: The share of banks viewing bank-FinTech partnerships as at least somewhat important rose to 89%, up from 49% in 2019. Driving this change is both parties’ realization that against the backdrop of a shifting landscape, a more collaborative relationship can be mutually beneficial.

The “FinTech Tracker®” explores how FinTechs and banks can benefit from working with each other and why the dynamic has recently swung in favor of collaboration.

Around the FinTech Space

As part of its effort to work closer with FinTechs, Grasshopper Bank penned deals in 2022 with Treasury Prime, FIS, Visa, Autobooks and more, with the objective of modernizing and bolstering its existing capabilities. These efforts appear to be successful so far, and Grasshopper has reported a 262% year-over-year increase in loans.

Lloyds Banking Group is also looking to deepen its relationship with FinTechs. The bank unveiled a 12-week program in which select FinTechs will be invited to compete for a chance to partner with the FI and become eligible for Series B funding. The program builds off a similar effort last year, which saw FinTech Caura receive a £4 million investment at the program’s conclusion.

The program builds off a similar effort last year, which saw FinTech Caura receive a £4 million investment at the program’s conclusion.

For more on these and other stories, visit the Tracker’s News and Trends section.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

An Industry Insider on the Growing Importance of Compliance in Bank-FinTech Relationships

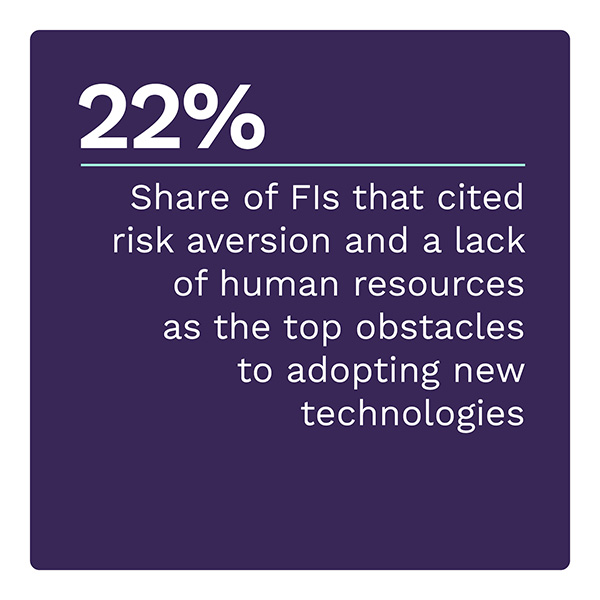

Regulators are ratcheting their scrutiny of FIs, including banks and FinTechs, following an uptick in fraud in 2022. This scrutiny comes in response to rising levels of external fraud and high-profile internal fraud incidents such as the FTX scandal, which sent shock waves through the crypto industry.

To get the Insider POV, PYMNTS spoke with Kiran Hebbar, CFO at identity decisioning platform Alloy, about why compliance is more important than ever.

Impending Open Banking Rules Make Bank-FinTech Collaboration a Must

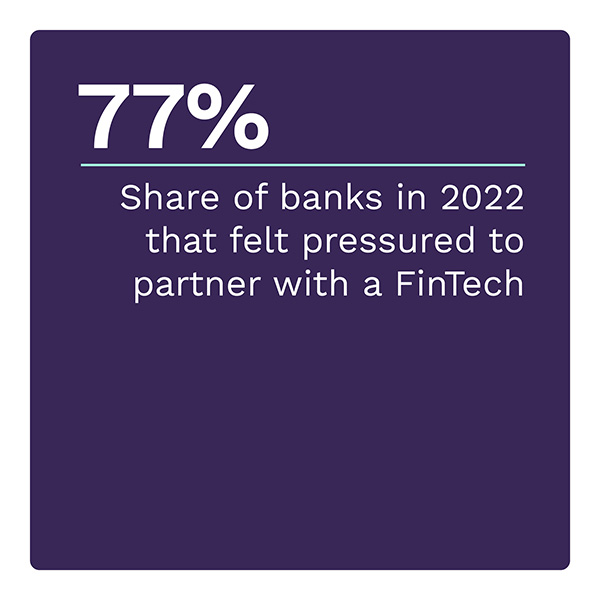

It is a good thing that banks and FinTechs have been making overtures toward collaboration in recent years because a closer relationship might soon become necessary.  Last October, the Consumer Financial Protection Bureau (CFPB) unveiled an open banking framework that will have profound consequences for FinTechs and banks when it eventually goes into effect, potentially in 2024.

Last October, the Consumer Financial Protection Bureau (CFPB) unveiled an open banking framework that will have profound consequences for FinTechs and banks when it eventually goes into effect, potentially in 2024.

The framework requires banks to provide qualified third parties access to consumer financial data, such as settled and unsettled transaction and deposit data and consumers’ personal information, through application programming interfaces (APIs). Although the specifics may change, banks and FinTechs must rely on each other to ensure compliance. Banks, for example, have long had problems with APIs: 81% of surveyed banks cited a lack of API experience as a challenge when partnering with FinTechs, according to a study.

To learn more about why bank-FinTech partnerships might become necessary, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “FinTech Tracker®,” a collaboration with Sezzle, explores how the FinTech-bank relationship is moving from a competitive to a collaborative dynamic as each side adjusts to a financial landscape in flux.