As noted earlier this month (May 14) by The Wall Street Journal, glitzy jewelry and fast cars are no longer clearly fashionable and are instead relatively polarizing. With many consumers continuing to cut back and shunning all but the essentials, showing items off has the risk of coming off as tasteless. This sentiment may be impacting some consumers’ planned purchases in 2023, per the January PYMNTS collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report.”

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

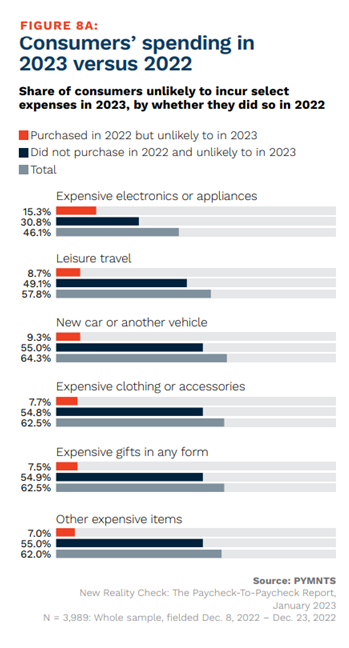

The data shows that consumers are planning to not purchase a wide array of items in 2023, with 64% of consumers skipping a vehicle purchase and 63% unlikely to purchase expensive clothes or accessories. However, it is perhaps telling that the share of those planning to continue their previous spend this year is significant as well, with more than one-third of surveyed consumers expecting to make these selected purchases.

It could also provide a clue as to how certain more-expensive brands are thriving even as they raise their prices. This includes the Swiss watch industry, which is raising prices to fend off smartwatch competition and offset volume decline, resulting in an expected compound annual growth rate of 7%. While there is a core consumer group who have so far not seen their spending affected by inflation, these numbers suggest that it is more than just the ultra-wealthy making these purchases.

This spending also extends to the luxury fashion market. Retailers such as Saks and Gucci are shifting their focus towards exclusivity with appointment-only storefronts and providing clients with high-end experiences. So far this strategy has paid off, with the Saks Limitless program now claiming thousands of top-spending customers and Gucci’s Melrose Place Salon reserved for the brand’s VIP clientele. As well, Italian luxury group Brunello Cucinelli, famous for its cashmere apparel, saw 33% sales growth in Q1 2023. Mainly attributed to performance in the Americas and Asia, the increase may also hint at the emergence of the “quiet luxury” trend, also viewed as a backlash against flashy consumption.

As attitudes shift in the current economic climate about what may or may not be appropriate to display, consumers still feel the need to show off in their own way. And with flashy branding out of sync with the economic landscape, perhaps not worrying about the price is the new status symbol.

Advertisement: Scroll to Continue