…and the pinch to retailers’ top lines — and profits — may be unforgiving.

Friday (June 30th), the Supreme Court struck down the Biden administration’s student loan forgiveness program. And so, the stage looks set for roughly $400 billion of student debt to remain on the books, so to speak.

The Court’s actions come against a backdrop where as many as 26 million people applied for student loan forgiveness; 16 million had been approved. In terms of the household spending impact — see here for a generational, GenX impact — the plan would have wiped out as much as $10,000 in federal student loans for individuals making less than $125,000 annually, and households earning less than $250,000. Up to $20,000 in Pell grants would have been forgiven.

The stats from the government indicate that 17.6% of the population holds student loans, for a cumulative debt load of $1.7 trillion. And the Biden administration has offered up profiles of typical borrowers that indicate the program would have saved individuals thousands of dollars a year.

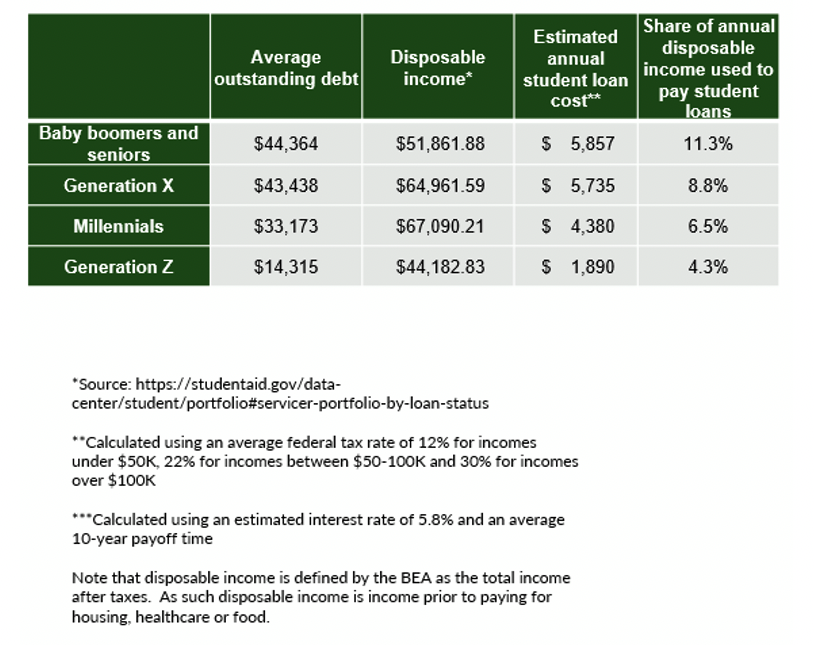

And separately, PYMNTS’ own data show that as student loan payments resume — and may be destined to stay stubbornly entrenched as a monthly obligation – depending on where you look, a mid-single-digit to low-double-digit percentage of disposable income would be lost.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Baby Boomers and seniors average a debt of $44,000 per borrower, so more than 11% of their disposable income will now be used for student loan payments. Millennials and Generation X will lose 6.5% to 8.8% of disposable income to the same monthly obligation.

Big Retail

The retailers that would be hardest hit would be the ones that have been able to capture the most share of wallet in the midst of the repayment pause. Amazon stands out here, of course, because — well — it’s Amazon. The fact remains that, as we estimate, 65% of U.S. consumers have Amazon Prime memberships, and that massive reach covers all manner of demographics and income levels, and by extension, the holders of these student loans. Amazon’s got roughly half of eCommerce retail spend. And eCommerce growth is already slowing, as detailed in the company’s most recent earnings report; the student loan burden seems poised to represent an additional headwind to that growth.

Target’s already been noted in the financial press and on Wall Street for a significant exposure to millennials and to the resumption of student loan payments. Earlier this month the company was downgraded from “overweight” to “neutral” by J.P. Morgan.

Walmart, similarly, may feel a pinch, jousting as it is for subscriptions and for share across key categories vs. Amazon. But there may be some insulation, given the facts we reported during last month’s earnings coverage: grocery comparable sales grew by “low double-digit” percentage points, and it has seen more spending from higher-income households. The shift towards private label goods has become an entrenched pivot.

Discounters to Benefit?

But in an environment where almost a quarter of disposable income already goes to food, clothing and shelter, there will be some pivoting. And it may be the case that consumers gravitate toward discounters to get what they need.

The appeal of private label goods, as noted with Walmart — in the grocery aisles, yes, but across other categories — could bolster resilience in Dollar Tree, Dollar General and BJ’s results. As reported here, higher-income consumers are spending more of their own funds at stores like Dollar General and Five Below, behaviors that took root amid rising inflation and which have proven sticky.