The striking down of Biden’s forgiveness plan may give the “Forgotten Generation” less opportunity to repay their outsized debt.

With many members of Gen X paying for nearly adult children and/or aging parents, the generation has been particularly hamstrung financially since inflation began taking its toll on consumer wallets. Student loans are particularly taxing for some, who may make payments towards their own student loans as well as their children’s — and possibly even their parents’. As a result, the Supreme Court’s dual decisions in Biden v. Nebraska and Department of Education v. Brown could have a direct detrimental effect on the generation’s ability to repay debts while retaining some amount of purchasing power.

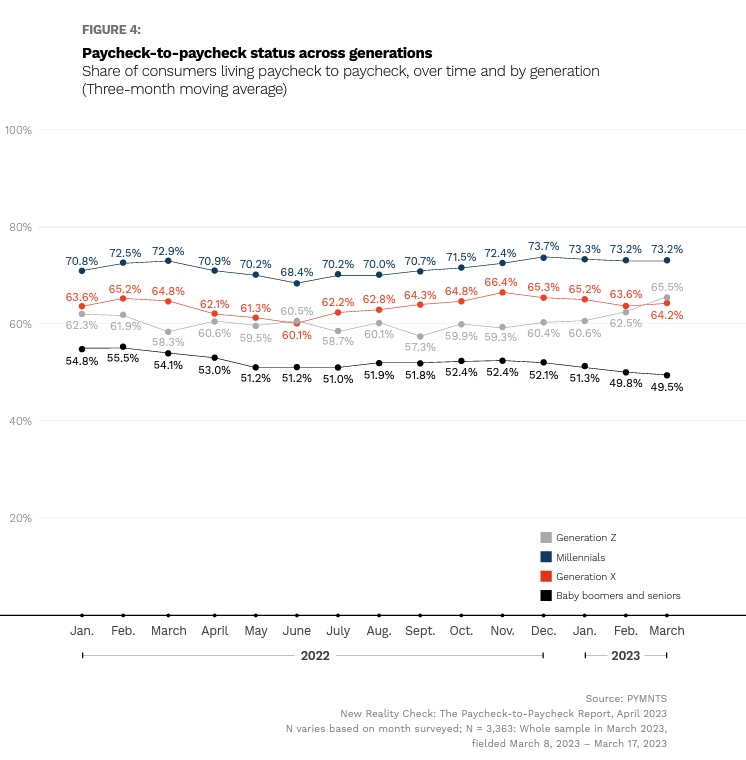

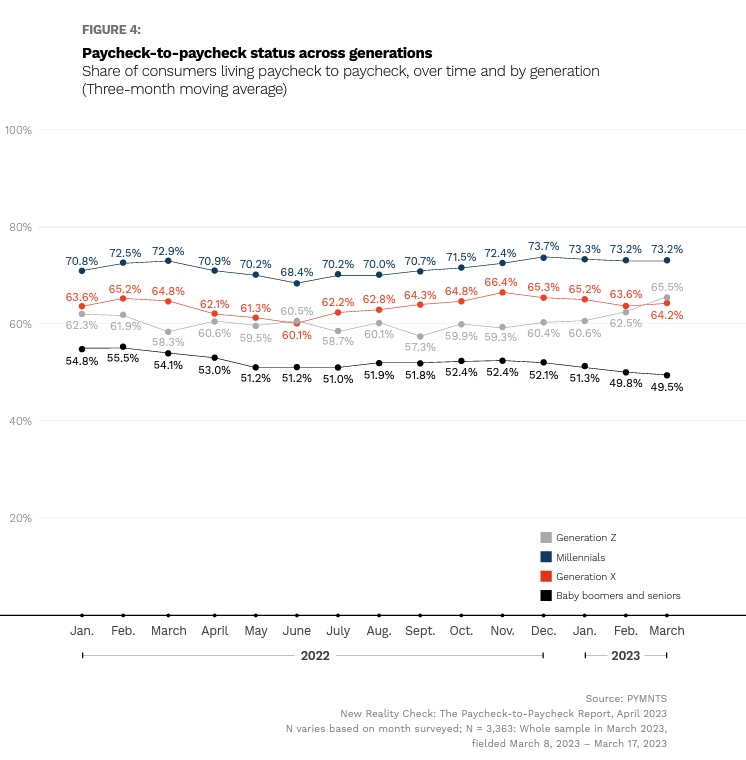

Aged between 43 and 58 in 2023, the demographic’s additional debt duty has taken its toll on their financial lifestyle. As illustrated in the April PYMNTS collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report,” Gen X’s paycheck-to-paycheck status more resembles their Gen Z children’s than the stability of their baby boomer and senior parents.

Although one expects at Gen X’s age to be hitting a professional stride and feel relatively financially secure, 64% report living paycheck to paycheck. The increased intergenerational debt burdens are likely a main driver for the generation’s financial instability, surpassing all but millennials’ paycheck-to-paycheck lifestyle since the start of 2022.

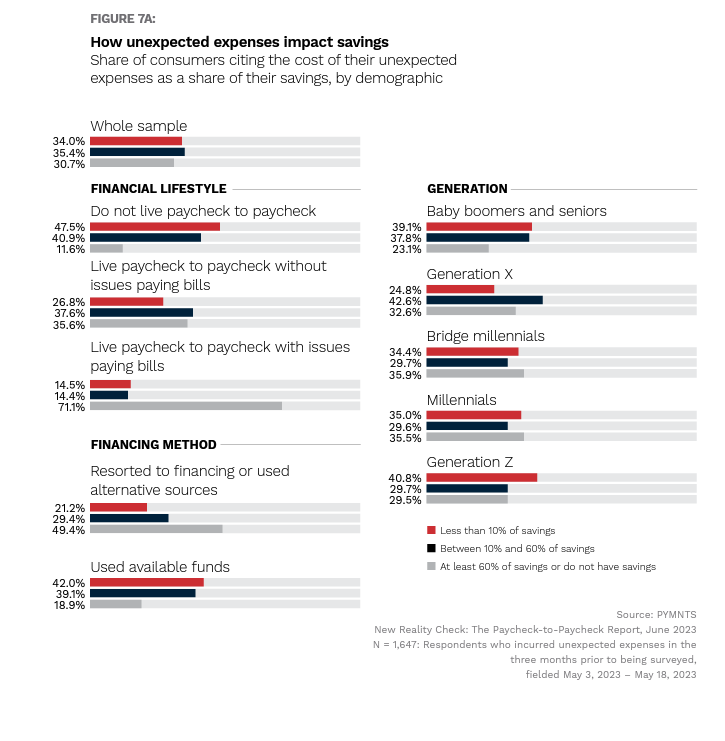

In addition to their paycheck-to-paycheck lifestyle, Gen X’s savings may be most impacted by unexpected expenses, noted in the June PYMNTS “Paycheck-to-Paycheck” collaborative report with LendingClub.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Advertisement: Scroll to Continue

Unexpected expenses in the three months prior to being surveyed cost 42% of Gen Xers between 10% and 60% of their savings. Another third said unexpected expenses cost 60% or more of their savings, if they have savings at all. Those counting on the program’s forgiveness are now going to need to find the money to face those debts from somewhere, and this generation is by far the most likely to significantly deplete or wipe out their savings for an unexpected expense. Just one-quarter expect to only lose less than 10% of their savings, whereas at least one-third of every other generation would expect to retain the grand majority of their savings.

Possibly due to taking on additional family members’ loans, Gen X’s student loan debt is more pronounced than other generations. Per the Education Data Initiative, their average $43,438 in outstanding loans represents 39% of the country’s total student loan debt. This pronounced burden means that the Supreme Court decision could also unevenly affect them.

With the generation already shouldering disproportionate debt, the Supreme Court decision and overall restart of student loan repayments set to resume in the fall could leave Gen X staggering. Should that happen, their worsened financial picture is likely to cause ripple effects on businesses and organizations reliant on their spending power.

Add as Preferred Source

Add as Preferred Source