Amazon, Walmart Dangle Free Subscriptions to Boost July Savings Days Sales

Hooking consumers with the privileges of subscription membership is worth offering trial giveaways for Amazon and Walmart.

Ahead of July’s savings extravaganza, Amazon and Walmart are increasing free subscriptions or trial offers for their membership programs, Amazon Prime and Walmart+. With the intent of luring and keeping consumers within their shopping ecosystems, these megaretailers are piling on program benefits.

For the world’s top two retailers, the prevailing strategy seems to be that the potential increase in revenue of subscription fees and sales from members far outweighs the cost of offerings such as free shipping and exclusive streaming. For consumers, getting these deals cheap or free may seem too good to pass up. Proprietary research prepared for PYMNTS’ “Consumer Inflation Sentiment” report series notes the share of subscribers using a free trial.

As the data depicts, Walmart has long tapped into the power of giving away Walmart+ memberships. The share of free subscribers within the program is more than double that of Amazon’s Prime giveaways and deals for two of the past four months. The well-publicized Walmart+ subscription program starts with a 30-day free trial as a method of hooking customers with a “try before you buy” strategy.

Introduced in 2020 as a competitor to Prime, Walmart’s previous membership giveaways included one-year memberships for 20,000 new moms for Mother’s Day. These offerings are amid a more focused push to retain customers at the expense of absorbing costs.

It is difficult to assign Walmart’s rate of free subscriptions or trials solely to variability in otherwise fully paid membership rates, as other factors may include the existing customer base and seasonality.

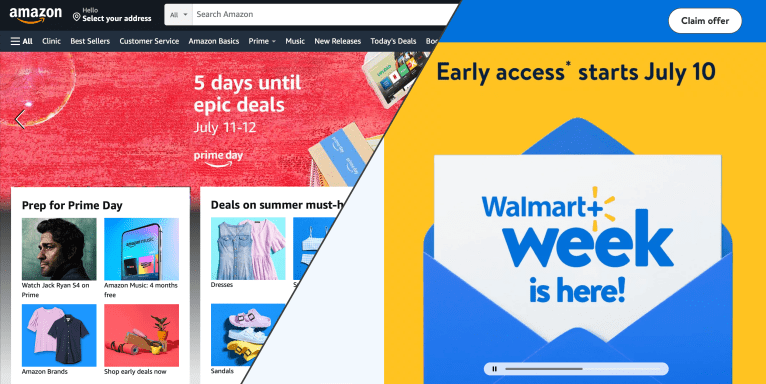

Walmart’s 30-day free trial may be why the Arkansas-based retailer isn’t publicizing new promotions ahead of its Walmart+ savings week. Starting July 10 and planned in direct competition with Amazon’s Prime Days, Walmart’s event gives early access — and the retailer is not limited this to Walmart+ members.

Amazon also has a 30-day free trial for new and returning customers who haven’t had Prime in more than 12 months, though perhaps less splashily advertised on sign-up as Walmart. However, the retailer has taken a slightly different approach to Prime Days.

It is limiting deal access to just subscribers. However, it has also extended membership deals to $2 during its sale days to lure customers who have canceled Prime within the past year. The price will return to $15 per month after the trial period.

Taking over as company CEO, Andy Jassy has focused on strengthening loyalty by offering consumers increased value for their subscriptions instead of leaning on membership giveaways. This value add includes rumored talks of offering Prime subscribers low-cost phone plans. Presumably, any consumer signing up for this potential benefit may be less inclined to cancel Prime. These consumers would then have to deal with the hassle of finding a new carrier and paying rates that may surpass Prime’s current $139 annual fee.

As self-paid subscriptions for both Amazon and Walmart decline, led by younger consumers, it makes sense for the retailers to be sweetening the proverbial pot. This push for savings may be especially important with student loan payments resuming soon, causing reduced purchasing power for these demographics.

Walmart is rushing to catch up to Amazon in sales share with a strategy that includes bolstered membership discounts and giveaways. While these promotions could have a noticeable effect on increased Walmart+ sales during the retailer’s savings week, it may take much more to pull away from still being one step behind.