With inflation still at high levels, Americans continue to rely on their regular paychecks to meet their expenses and financial obligations, with little or no savings left over for unbudgeted costs or emergencies.

Over 60% of U.S. consumers lived paycheck to paycheck as of June this year — unchanged from June 2022 — with 21% struggling to pay their monthly bills, according to findings from “New Reality Check: The Paycheck-to-Paycheck Report,” a PYMNTS and LendingClub collaboration.

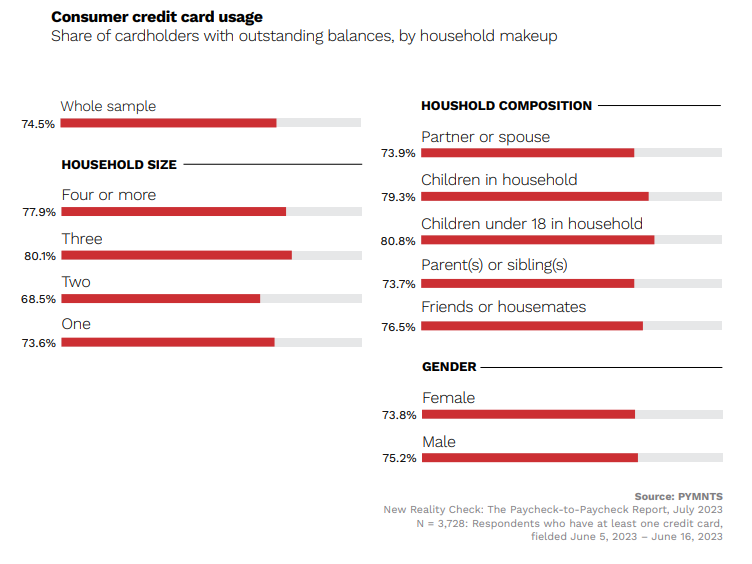

Without the necessary financial resources for their upkeep, households have resorted to borrowing money to weather financial setbacks and to pay for additional expenses. But among those turning to credit in this challenging economic environment, consumers who live alone seem to be better positioned to avoid drowning in debt than couples and families with children.

As PYMNTS’ research showed, 74% of consumers living with a partner or spouse have outstanding credit card balances, compared to 80% of those living with children younger than 18.

Moreover, families with younger children maintain outstanding credit card balances that are significantly higher, on average, than those of consumers living with a spouse or partner, further underlining the advantage smaller households have over larger ones.

“Consumers living with children under 18 average outstanding credit card balances that are 50% above those of consumers who live alone,” the study found. “Consumers living with a partner or spouse are also the least likely to have pending installment repayments.”

Data from the report further revealed that while 16% of those living with just one other person recently used installments, 35% of consumers living in households of four or more people did the same.

“This suggests that while both couples and families use credit cards to cover essential and discretionary spending, consumers living with a partner or spouse have access to shared resources and so are better able to meet their financial responsibilities,” the report stated.

The study also found that in addition to larger credit card debt, consumers living with a partner or children are more likely to have an auto loan or mortgage than those who live alone.

As the report noted, “more than 40% of consumers living with a partner or children have made auto loan or mortgage payments, compared to 24% and 20%, respectively, of consumers living alone.”