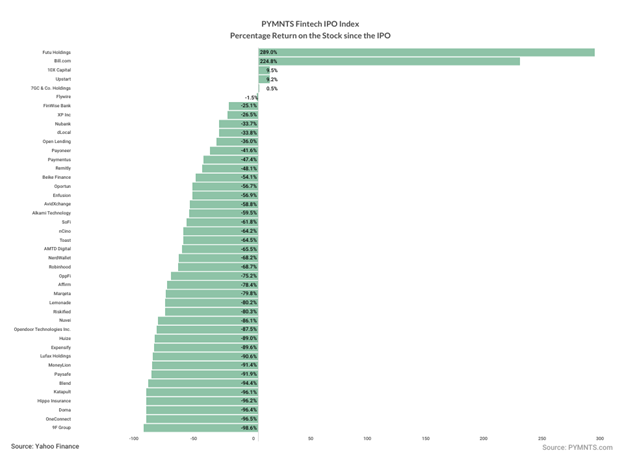

But two were enough to mark some outsized gains — double-digit rallies — that wound up propelling the FinTech IPO Index 6.4% higher through the past five trading days.

The year-to-date positive return is 37.5%.

Shares of Futu Holdings were 20.1% higher through those five days.

The company said in its most recent earnings results that in the quarter that ended in June, the total number of paying clients by increased 14.3% year over year (YoY) to 1.6 million. The user count was up by more than 10% to 20.5 million. And client assets, the company noted, gained 7.5% YoY to 466.2 billion Hong Kong dollars (HK$) as of the end of the most recent quarter. Total trading volume declined 28.7% YoY to HK$1 trillion.

Affirm Leads the Rally

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Affirm shares were the standout this past week, roaring ahead by more than 50%.

Advertisement: Scroll to Continue

As we noted in our own coverage of the company’s earnings, Affirm’s report detailed growth in repeat transactions per active customer. Overall there was a 25% rise in gross merchandise volume to $5.5 billion. The company said that 17% of its transactions were Pay in 4. One-time virtual card and Affirm Card general merchandise volume (GMV) accelerated sequentially to 37% YoY. The active consumer count was up 18%, Affirm said, to 16.5 million. Transactions per active consumer in the most recent quarter stood at 3.9, up from 3 at the end of the 2022 fiscal year. Active merchant count was more than 254,000, and during the quarter, the tally of merchants with more than $1,000 in trailing 12 months GMV was up 16%.

The company’s earnings supplementals showed that there are a number of categories underpinned by resilient consumer demand. GMV growth was up 61% YoY, fashion/beauty gained 14%.

Beyond individual companies’ earnings reports, Marqeta stock gained 12%. The company said this past week that it has added new embedded finance customers Giftbit, Vivian and Whistle, adding to the roster of non-financial services customers to integrate embedded banking and payment solutions into their products. Embedded finance customers, Marqeta has said, accounted for more than half Marqeta’s bookings in the first half of 2023.

Nuvei shares gathered 10.8%. The company said it has teamed with Mastercard to enable traders and investors to have “near instantaneous payout capabilities” using Mastercard Send. Send, which as reported already is offered to Nuvei customers in Singapore, powers rapid payments for merchants, acquirers, governments and consumers. The tool will now also be available in Australia and Hong Kong SAR, beginning later this year, Nuvei said in the release.

“Nuvei customers will then be able to process payouts, including business to consumer disbursements, and funding transactions between over 1.5 billion debit, credit and prepaid Mastercard cards,” Nuvei said.

Robinhood shares powered ahead by 5%. As reported by Bloomberg this past week, Robinhood has ended its relationship with crypto market maker Jump Trading, As had been reported, Jump Crypto, the digital-assets unit of Jump Trading, had been in the process of scaling back its U.S. presence in the wake of continued industry-wide regulatory scrutiny of the crypto arena.