Consumers are less sanguine about their financial situations — especially when it comes to obtaining credit.

And those reservations may be incentivizing them to shift their spending, at least a bit. At the moment, as PYMNTS Intelligence shows, perhaps call it a case of spending now, when things may be uncertain later.

The Federal Reserve Bank of New York’s Center for Microeconomic Data said Monday (Sept. 11) in its latest reading of its Survey on Consumer Expectations that in August, consumers think that inflation is set to rise over the next year and for the long haul.

And in the meantime, per the data, expected household income growth stood at 2.9%, within the band of 2.8% to 3% that has been seen in the past year.

“Perceptions of credit access compared to a year ago deteriorated in August, with the share of households reporting it is harder to obtain credit than one year ago hitting a new series high. Expectations for future credit availability also deteriorated in August, with the share of respondents expecting it will be harder to obtain credit in the year ahead increasing,” noted the Fed. The data show that roughly 53% of consumers think credit access will be at least “somewhat harder” than had been seen a year ago.

Median household spending growth expectations fell by 0.1% to 5.3%.

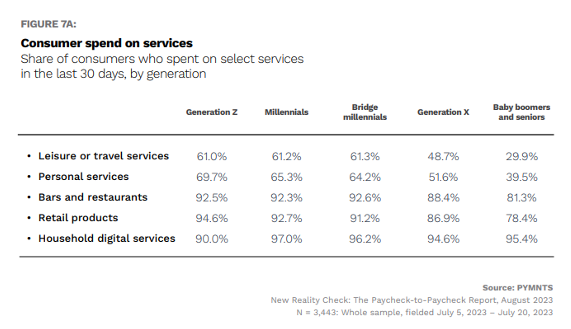

Recent PYMNTS research delving into the continued day-to-day spending habits in the paycheck-to-paycheck economy show that there’s a willingness to move away from the essentials, which had been top of mind earlier in the year, toward non-essential items, including all manner of services — and, especially, travel, as seen in the accompanying chart. Overall, 21% of paycheck-to-paycheck consumers cite nonessential spending as a reason for their financial lifestyle. And 36% of Gen Z consumers say that have been “indulgent” for at least three product or service categories — while almost a third of them live paycheck to paycheck.

The chart shows that this demographic has been among the most inclined to buy retail goods. Other research shows that middle-income consumers are grappling with pressures by switching merchants, and PYMNTS research finds that 16% of this demographic say this change is the most important change they have made as a result of increased prices.

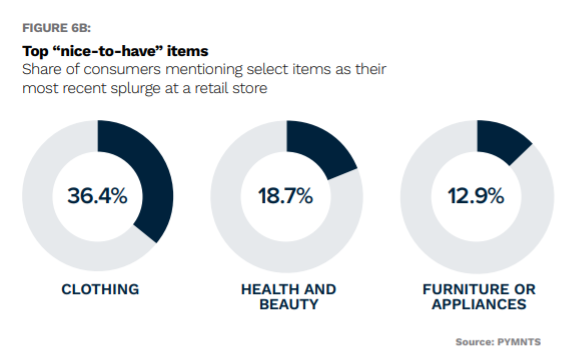

But at least some of the spending on services, and some of the non-essential spending, indulgent as it might be, is coming at the expense of paying for retail items, such as clothing or accessories. As reported here, Nearly 60% of consumers have cut spending on clothing and accessories, with 4 in 10 trading to less expensive brands. In fact, consumers are 21% more likely to report making retail cutbacks than grocery cutbacks. There’s a hierarchy of items that our surveyed consumers see as splurge-worthy: A third say clothing is on that list, while only about 13% say the same about furniture or appliances.