A recurring theme has also been that profits are elusive — and sometimes the pressures on the business itself prove insurmountable.

As a result, entire verticals have been refashioned — for example, the meal kit space — and in some cases, other companies have had to face the specter of shutting down entirely.

There are two recent examples here, though several others suffice.

As reported by sites such as Bloomberg this week, SmileDirectClub faces liquidation if it cannot find a buyer in the next few months, having filed last week for Chapter 11 bankruptcy. The company, which focuses on dental treatments where consumers buy teeth aligners and finance them over several months, has received loans from its founders in the tens of millions of dollars while it looks for a buyer.

But for a company with more than $900 million of debt on its books, and where the latest financial results have shown a 19% decline in revenues year over year, dwindling cash on the books and negative adjusted EBITDA (a rough measure of cash flow), macro pressures have left a significant mark on the company.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

A Steep Descent on Wall Street

The company’s shares once traded for more than $20; they’ve closed most recently at about 9 cents.

The buy-or-go bust strategy has had an impact, too, on other companies. As noted here, Blue Apron is being bought by Wonder. That announcement came last week, and the deal price is $103 million. The stock’s market cap is now $81 million. When the firm went public in 2017, the market cap was more than $1.9 billion.

In the company’s most recent earnings report, Blue Apron showed a roughly 15% decline in year-over-year top line to $106 million. Customers declined during that same time frame from around 349,000 to 267,000, even though orders increased and average revenue per customer gained ground. Adjusted EBITDA has been negative, too.

Other companies stand out as examples of re-invention and consolidation. Birchbox found a buyer back in 2018, while BarkBox has spent time positioning its model to extend beyond subscriptions.

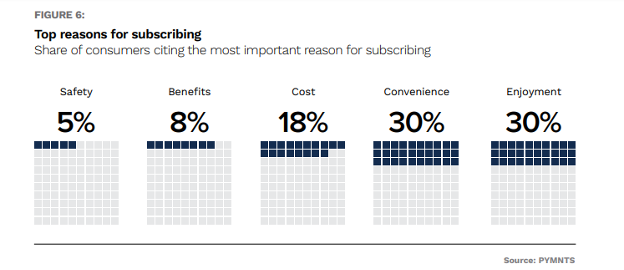

For many of these merchants focused on repeat business, there’s a bit of a conundrum: Loyalty matters, and as PYMNTS Intelligence data has found, loyal customers are 30% of a firm’s installed base and make up 80% of the top line. The chart below details the key reasons why consumers opt for a given subscription: enjoyment and convenience top the list, followed by cost.

For the companies that get it right, the rewards can be significant. Our latest subscription report shows that of the loyalist group — the stickiest segment — high-income consumers, who earn more than $100,000 annually, account for half of this cohort.

And there are signs as to what moves these subscribers to stay or go. As many as 37% of the most loyal subscribers would cancel their subscriptions if free shipping were not part of the equations; 28% would do so due to “excessive” promotional materials.

Marketing and shipping are key line items for the subscription companies, and prudent management helps improve the operating line.

Elsewhere, we’ve found that payments themselves can be a critical determinant. As detailed here, 70% of companies say failed payments negatively impacted their customer churn rates in the last 12 months, and roughly 25% of subscription firms see failed payments as the most important contributor to customer churn.