That study, “Corporate Changes in Payment Practices: The Challenge for Small Insurance Companies,” drew on a survey of 125 executives from insurance firms across the United States to learn more about their interest in adopting, using and expanding their use of real-time payments and how this interest impacts the partners — FinTechs, digital giants, card networks, banks, credit unions and third-party processors — they are likely to rely on.

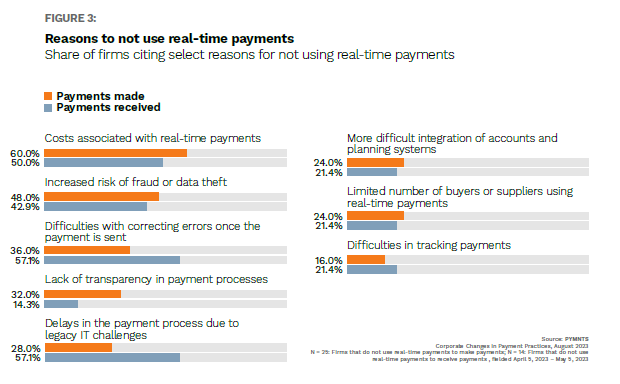

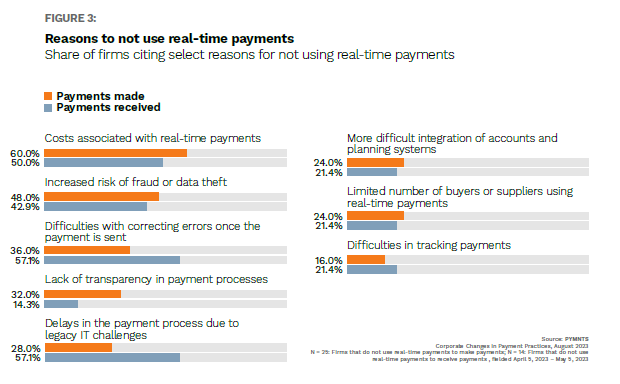

Despite the optimistic growth forecast across the sector, findings captured in the joint PYMNTS-The Clearing House study show that several concerns are slowing down real-time payments adoption or expansion, especially for smaller firms.

The primary concern revolve around the costs associated with real-time payments, cited by 60% of firms as a reason they do not use instant payments when making payments.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

When it comes to smaller firms, a staggering 82% cite higher costs associated with implementation as a key factor holding them back. In contrast, only 25% of larger firms share this concern.

Another reason holding nearly half of small firms back is concerns around the increased risk of fraud or data theft, while 32% of firms raised concerns about the lack of transparency in payment processes.

Advertisement: Scroll to Continue

When it comes to receiving real-time payments, concerns vary slightly. Fifty-seven percent of insurers mention difficulties with correcting errors once the payment is sent, while only 36% mention this concern when making payments. The same percentage of insurers (57%) also worry about delays in the payment process due to legacy IT challenges.

Although smaller firms have been slower in adopting real-time payments, 87% of them plan to catch up by incorporating more real-time payment features in the next year. These firms expect to rely heavily on FinTechs and digital giants to provide the necessary solutions. Conversely, larger firms are more inclined to turn to FinTechs, card networks and banks for their real-time payment needs.

Overall, real-time payments offer substantial benefits to the insurance industry, including faster and more efficient payment processes. And although smaller firms encounter obstacles that have slowed adoption, FinTech partnerships can help bridge the gap, enabling these firms to overcome these challenges and unlock the full potential of real-time payments across the industry.

Add as Preferred Source

Add as Preferred Source