Banks in the U.S. report a rapid increase in fraud and fraud losses, highlighting the urgent need for newer and better anti-fraud technologies. The rise of digital banking and faster digital payment methods have made financial institutions (FIs) more vulnerable to increasingly sophisticated fraud and financial crime.

According to a study of U.S. FIs, “Increasing Fraud Heightens Need for Newer, Better Technologies,” a collaboration between PYMNTS Intelligence and Hawk AI, the average cost of combatting fraud for FIs with assets of $5 billion or more amounts to $7.2 million, including staffing, adapted technologies and outsourcing services. However, these resources have proven to be insufficient, as average losses from fraud operations reached $3.8 million this year, representing a 65% increase compared to 2022.

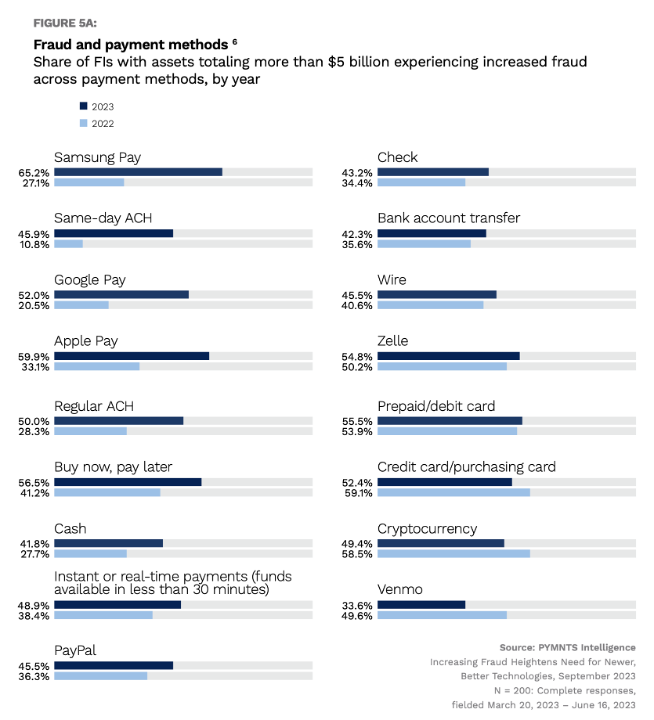

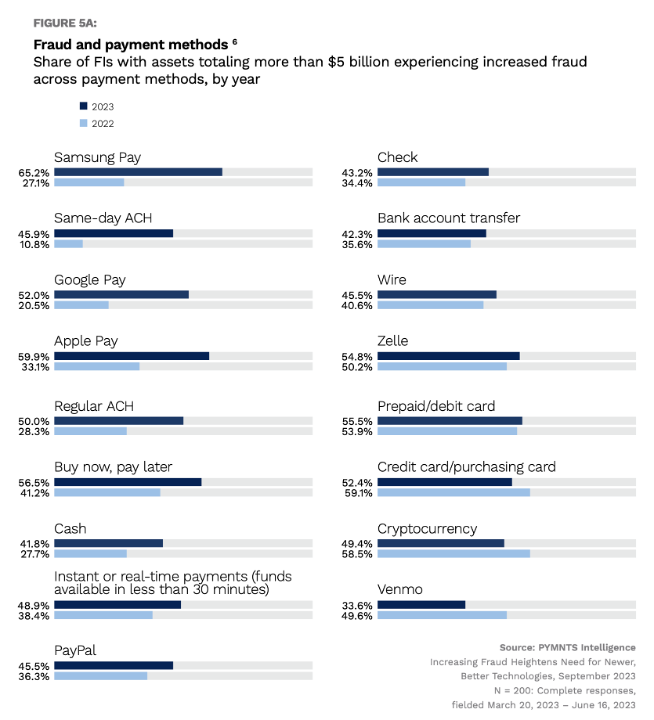

Forty-three percent of FIs say they have experienced a growth in fraud compared to 2022. This growth applies to most of the payment methods used, and digital wallets such as Samsung Pay, Apple Pay or Google Pay showed among the highest increases. According to the survey, around 65% of FIs that accept Samsung Pay experienced increased fraud relative to 2022. Both Apple Pay and Google Pay are not far behind, with 60% and 52%, respectively, of FIs that accept them experiencing increased fraud.

In relative terms, the growth in fraud related to digital wallets is incredibly high: Google Pay saw an increase of 153%, Samsung Pay saw an increase of 140% and Apple Pay saw an increase of 81%.

The sophistication of fraud calls for FIs to adopt newer and better technologies to combat fraudulent transactions and reduce financial losses. FIs are ramping up their investments in and deployments of machine learning (ML) and artificial intelligence (AI) technologies. These advanced technologies are recognized as powerful tools in stemming fraudulent transactions. In fact, FIs that currently use ML and AI technologies experienced 30% fewer transactions resulting in fraud losses compared to those that do not.

Investing in these advanced technologies is crucial to stay ahead of the evolving tactics used by fraudsters and must be a priority for FIs if they want to effectively combat fraud. This view is shared by Dean M. Leavitt, CEO of Boost Payment Solutions. “Even if there are other important projects that presumably have higher priorities for your core business,” Leavitt said in an interview with PYMNTS, “you may have to sacrifice those projects or push them out to instead make those investments in securing your platforms.”

Advertisement: Scroll to Continue

Add as Preferred Source

Add as Preferred Source