For merchants looking to enhance customer engagement and maintain a competitive edge in a highly competitive market, loyalty programs are a vital asset.

In fact, these programs, many tied to store or co-branded credit cards, can be used as a strategic tool to keep cardholders returning to their stores, as noted in a recent PYMNTS Intelligence study on “Leveraging Item-Level Receipt Data: How Personalized Card-Linked Offers Drive Store Card Usage.”

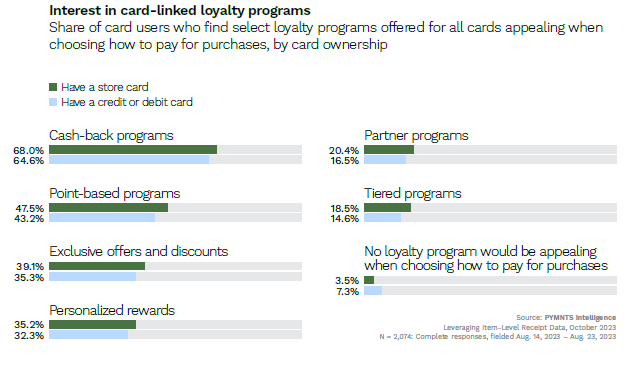

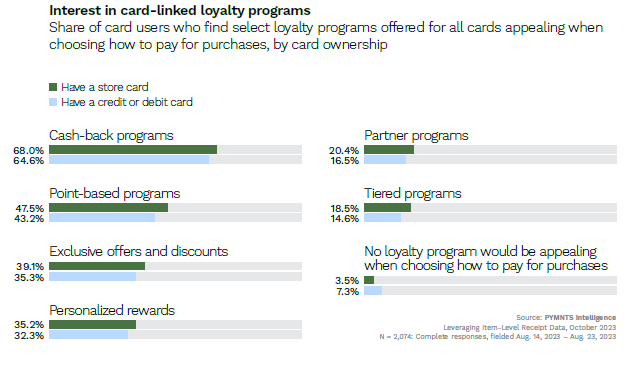

The report, produced in collaboration with Banyan, shows that cash-back programs are the most appealing type of loyalty programs for cardholders, with nearly 65% of all cardholders finding these programs attractive when deciding how to pay for their purchases. For store or co-branded card holders, the appeal of cash-back programs is even stronger, with 68% of them expressing a similar interest.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Examining the data further shows card-linked offers that provide personalized rewards have the best chance of increasing consumer usage of these programs. Overall, 73% of consumers expressed a strong interest in using cash-back offers tied to specific products in the next three months, highlighting the significant opportunity for merchants and brands to harness these incentives as a means to encourage greater usage of store cards.

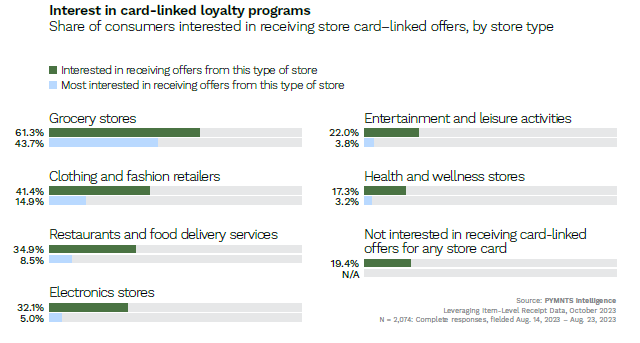

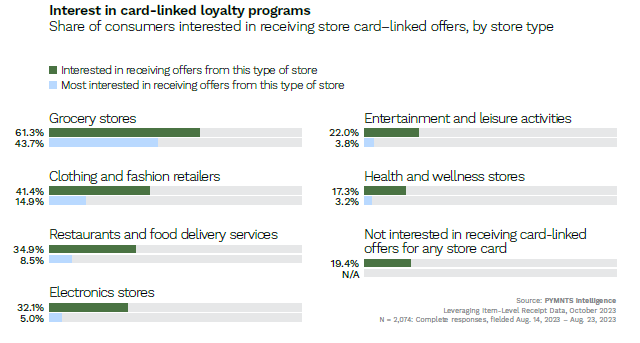

When it comes to store type, the data reveals that consumers are most interested in receiving personalized card-linked offers from grocery stores. Sixty-one percent of cardholders are interested in receiving relevant offers from grocery store cards, making it the top choice among consumers. This is followed by clothing and fashion retail stores and restaurant and food delivery services, which garnered interest from 41% and 35% of cardholders, respectively.

In addition to merchants offering personalized cash-back offers based on consumers’ purchase history, offering discounts, bundle deals, and coupons are also of interest to consumers and can be effective in encouraging store card usage, the report notes.

Advertisement: Scroll to Continue

In conclusion, personalized card-linked offers enable merchants and brands to not only tailor their store and co-branded credit card offerings but also enhance their appeal and effectiveness in a highly competitive market.

This is even more critical to sway the nearly 80% of cardholders who own a store and/or co-branded credit card but have not used it to make a purchase in the last 30 days, while boosting consumer engagement and driving business growth.

Add as Preferred Source

Add as Preferred Source