American workers are ditching the traditional waiting game and opting to receive their income and earnings in real time.

It’s not just a preference; it’s a widespread shift shaping the way consumers handle their finances.

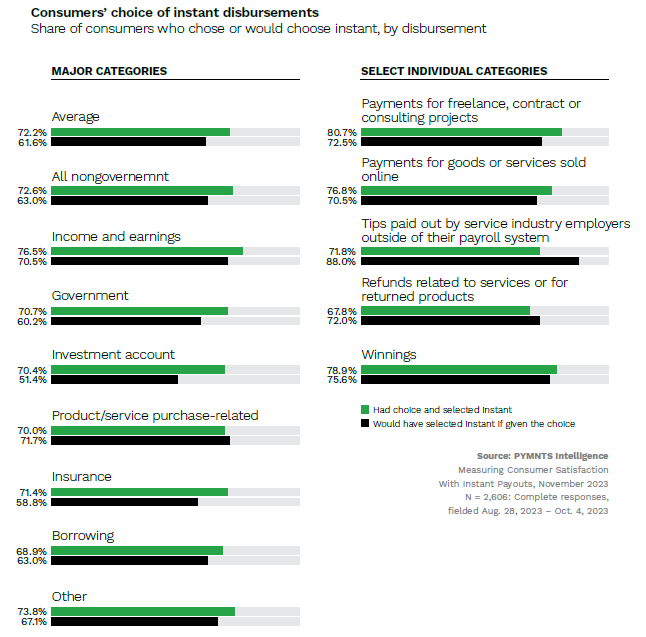

According to findings detailed in the “Measuring Consumer Satisfaction With Instant Payouts” report by PYMNTS Intelligence, U.S. consumers are increasingly choosing instant payments for various types of disbursements, with 72% expressing a preference for this method when given the choice.

Data analysis showed that consumers receiving income and earnings payouts are the most likely to opt for instant transactions. The trend holds true across all disbursement categories, from government and nongovernment entities to insurance claim payments and loan disbursements. Notably, consumers receiving payouts for income and earnings surpassed the average, choosing instant transactions 77% of the time.

Read also: The Rise of Instant Payroll Payments in 2023

Zooming in on specific individual categories shows that those receiving income and earnings disbursements for freelance, contract or consulting work have the highest preference for instant transactions, at 81%. Among this group of independent professionals, there is a demonstrated willingness to incur fees for the convenience of receiving disbursements through instant payment rails, surpassing other individual categories in terms of enthusiasm for this option.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Advertisement: Scroll to Continue

Among employed individuals who did not have the option for instant payouts, 62% expressed a desire for it, particularly those receiving tips disbursed by their employers. Nearly 90% of consumers in the service industry, receiving tips from their employers, expressed a strong inclination for instant tip payouts if given the option.

Real-Time Earned Wage Access Gains Traction

The strong interest in instant income and earnings payouts aligns with the rising popularity of early-access compensation among workers who are keen to break away from the traditional biweekly salary payouts and access their earned wages whenever needed.

Consequently, employers are acknowledging these changing preferences of employees and integrating new payroll systems to meet this need. The strategic move not only increases employee satisfaction but gives employers a competitive edge in today’s tight labor market.

For instance, BMO Financial Group partnered in September with DailyPay, a provider of on-demand pay solutions, to enable BMO’s commercial clients to offer earned wage access to their employees. The deal will enable real-time access to wages as they are earned, allowing employees to access their earned but unpaid income at any time, reducing financial stress and fostering longer tenures with employers.

In July, workforce payments platform Branch unveiled Branch Direct, an online instant payment solution enabling companies — including its business clients in retail, restaurant, manufacturing and healthcare — to pay workers directly into an existing bank account.

The overall picture painted by the data is one of growing demand for instant payments among consumers. With the potential for increased customer satisfaction and retention, issuers should consider incorporating instant payout options into their offerings, especially for income and earnings disbursements. By doing so, they can stay ahead of the curve and meet the evolving needs of their customers in the fast-paced digital age.