Seven months of spending at the register… and now comes an interruption.

October’s retail sales decline may prove to be a mere blip.

Or maybe not.

The latest data from the Commerce Department’s breakdown of where consumers are spending their time and money — and where they are not — hints at gathering clouds for brick-and-mortar operators.

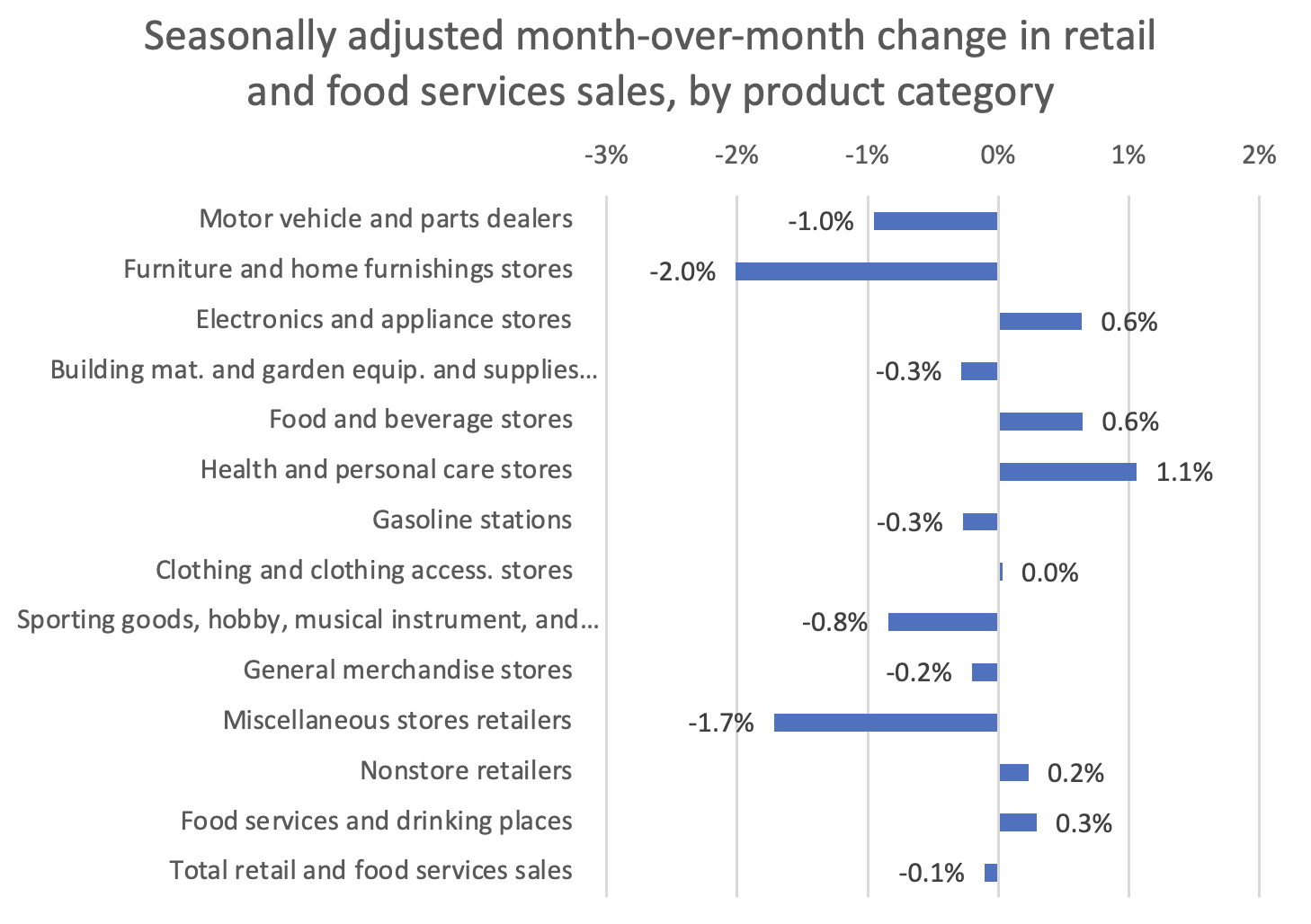

As disclosed Wednesday (Nov. 15), on a seasonally adjusted basis, total retail and food services sales were 0.1% lower in October as measured month on month.

Spending at department stores slipped 1.2%, spending at home furnishing and furniture store slipped 2% and miscellaneous store retailers saw sales slide by 1.7%. eCommerce may not have offset things all that much: Non-store retail sales, generally taken as a proxy for online commerce, were up only 0.2%.

Where consumers did spend their money can be boiled down to a few key categories, namely food and beverage stores, up 0.6%, and health and personal care establishments, where spending was up 1.1%. Apparel sales were flat.

The October report comes right as goods have been piling up on shelves, and might be more than merchants need. Markdowns, we note, might in the offing, well into the holiday season and beyond.

As noted here, analyses by financial news/data platform LSEG Workspace of 30 major American retailers estimated that two-thirds of the 30 retailers surveyed, including Foot Locker and Ulta, marked inventory turnover below their peers, a sign of either slow sales or excess stock.

“I am relatively pessimistic about the holiday season,” said Gerald Storch, retail consultant and former Target vice chairman and ex-CEO of Hudson’s Bay said, as reported by Reuters. “It’s possible that some retailers could be overly optimistic and make that mistake of buying too much yet again.”

The pullback in October might mean that consumers are taking a pause, surveying the deals that will come beginning with the Thanksgiving season and into the end of the year.

They might be re-assessing the state of their own finances.

But even September’s data present evidence that the pressures might be long-standing.

As we reported, when the September data was made official, retail sales, overall, were up 0.7% as measured from August levels, which were in turn up 0.8% from the prior month. Electronics and appliance stores’ sales were 0.8% lower than August’s levels, and clothing and accessories retail sales were down a commensurate amount, also month over month.

But as PYMNTS Intelligence found, trailing 12-month data from September indicates that sales gained 2.9%, an unadjusted number. Adjust for price gains, and the boost is a bit smaller — at 0.8%. When adjusted for inflation, the trailing 12-month sales are 3% less than sales in the corresponding 2021 period.

Essentially we are spending more to buy less.

And so the pause that refreshes may wind up being a prolonged pause.

PYMNTS Intelligence data noted in September that two-thirds of consumers see the holidays as a time of financial stress, exacerbated by gift-giving, events and celebrations. But through it all, the monthly bills still loom, which puts a strain on what consumers might be able to spend on themselves, and others, during the waning months of 2023. More than a third of consumers use credit cards to help make those purchases.

But with credit card debt well over the $1 trillion mark, with inventory accumulating at merchants, and with October signaling at least some closing of wallets, the holidays may not be all that merry for retail.