Only one pillar lost ground — the Work segment, which sank 1.5% through the week.

Bankrupt WeWork plunged 27.8%. As reported, WeWork said it had commitments in place for up to $682.5 million in debtor-in-possession financing from several lenders. The financing, as part of Chapter 11 proceedings, includes banks such as Goldman Sachs and JPMorgan Chase, as noted in a SEC filing.

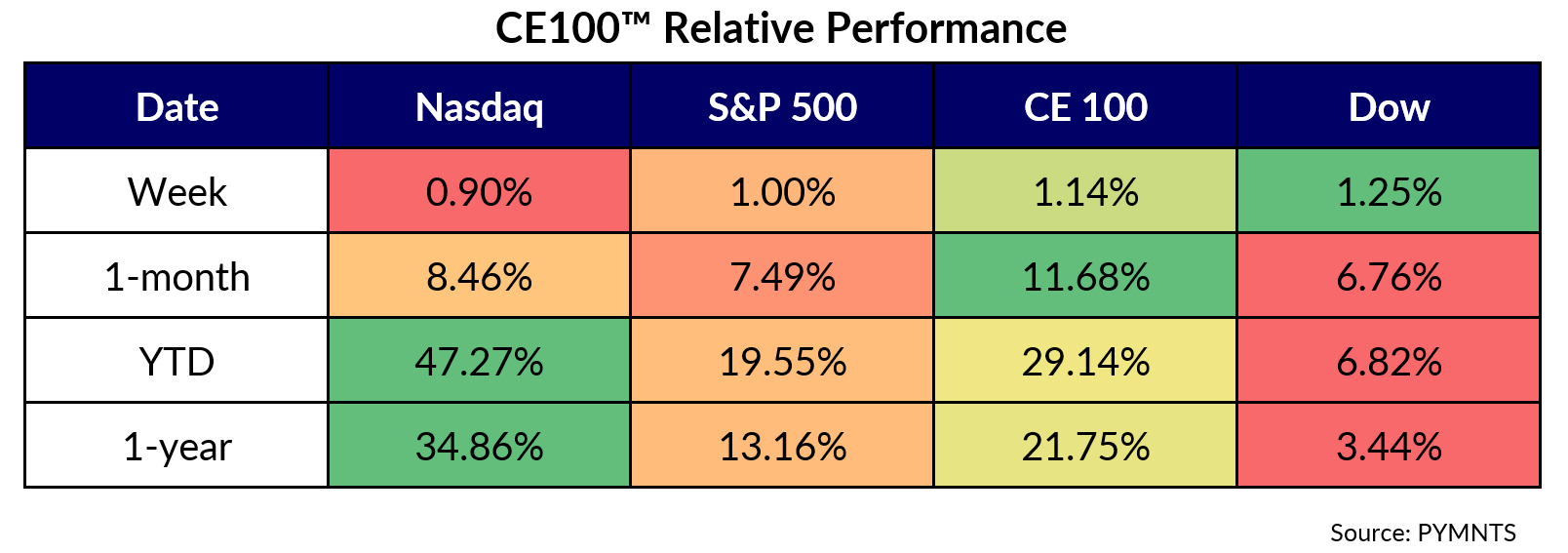

Elsewhere, the lingering impact of earnings announcements and partnership announcements from the past few weeks helped sustain some momentum. As of this writing, there’s a bit more than a month’s worth of trading days left in the year, as the CE 100 Index has posted a year-to-date gain of a bit more than 29% — impressive, to be sure, but still trailing the tech-heavy NASDAQ, which is up more than 47% over the same timeframe.

iRobot Soars on EU News

The Live pillar gained 6.3%.

iRobot led that segment higher, finishing the week up 36%, far and away the most impressive showing among names in our Index that posted positive returns for the week. Friday’s trading was responsible for most of the gains.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Advertisement: Scroll to Continue

As had been reported by Reuters, the European Union is on the verge of approving Amazon’s $1.7 billion to buy the company. The Reuters report noted that the EU’s approval will be unconditional — though it is still being reviewed by regulators here in the United States.

Porch Group’s 12% rally this past week also helped augment the Live pillar’s gains, where, as we noted amid the company’s earnings report earlier in the month, a 67% revenue gain was bolstered by 195% year-over-year growth in the insurance segment.

MercadoLibre’s 6% boost was at the top of the Shop pillar’s 0.8% bump. The company’s shares continued an upward trend seen since the early November announcement of results, where third-quarter earnings surpassed expectations. The company’s income from operations reached a record high of $685 million in the quarter, up 131% year over year.

During the earnings call, CFO Martin de los Santos attributed the strong showing to an uptick in revenue from Brazil and Mexico.

Vroom’s 9.5% decline offset these gains within the shopping segment, as the company announced that the Compensation Committee of Vroom’s Board of Directors approved the grant of inducement-restricted stock unit awards covering 96,925 shares of Vroom’s common stock to 11 individuals and employees “to induce them to join … Vroom and its affiliates.” Earlier in the month, the company’s own earnings results spotlighted that it had reduced its titling, registration and support costs by 15%, its marketing costs by 13% and its fixed costs by 15%.

In addition, CEO Tom Shortt said that Vroom’s automotive finance subsidiary, United Auto Credit Corp. (UACC), has changed its underwriting criteria to improve delinquency trends.

Sezzle shares slipped 6.3% blunting gains from Affirm, which gathered 5.8% and holding the Pay and be Paid segment to a 1.4% increase for the week. Sezzle company said mid-month that Sezzle has entered into partnerships to bring its buy now, pay later (BNPL) services to a sporting goods retailer and to hundreds of Software-as-a-Service (SaaS) platforms. This collaboration allows the retailer’s customers to make instant purchases, with the total being broken down into four interest-free payments.