Use of Working Capital Solutions Set to Rise 26% Among North American Growth Corporates

North America ranks second, behind Latin America and the Caribbean (LAC), among the five regions analyzed in the “Growth Corporates Working Capital Index.” In the past 12 months, 71% of North American Growth Corporates accessed working capital solutions — the third-highest rate of utilization across all five regions in this study, behind LAC and Europe. Nearly 9 in 10 CFOs from the region state that these solutions have helped their companies obtain favorable payment terms for new business ventures. North America’s Growth Corporates appear to experience operational efficiency advantages by using external working capital solutions for strategic purposes rather than tactical ones.

Growth Corporates in North America are poised to continue their growth in operational efficiency though the expansion of using working capital solutions. Ninety percent of companies in the region plan to use some type of external working capital solutions next year, a 26% increase from the last 12 months, which represents the third-highest increase.

Growth Corporates in North America are poised to continue their growth in operational efficiency though the expansion of using working capital solutions. Ninety percent of companies in the region plan to use some type of external working capital solutions next year, a 26% increase from the last 12 months, which represents the third-highest increase.

These are just some of the findings detailed in “The 2023–2024 Growth Corporates Working Capital Index: North America Edition,” a PYMNTS Intelligence and Visa collaboration. This edition is based on a survey of corporate CFOs or treasurers at companies which Visa calls Growth Corporates — those generating revenues between $50 million and $1 billion. The report examines the working capital solutions available to Growth Corporates to raise short-term cash or credit, the preferred use of these proceeds and the impact these solutions can have on their operational efficiency and business performance.

Other findings from the report include:

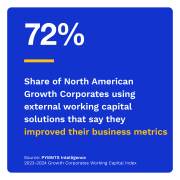

Seventy-two percent of North American Growth Corporates that tapped into external working capital say it improved their business metrics. Nearly 9 in 10 achieved favorable payment terms for new business initiatives.

Achieving favorable payment terms when venturing into new business initiatives was the most-cited reason that North American Growth Corporates use working capital solutions, with 87% of respondents giving this reason.

Except for those in the fleet and mobility sector, North American Growth Corporates tend to use working capital solutions to manage cash flow more than average.

Cash flow management allows companies to forecast spending and strategize investments, among other key operations, and external working capital solutions are pivotal in this endeavor. North American Growth Corporates in commercial travel, for instance, exhibited high rates of use of these solutions for expected cash flow gaps, at 48%, compared to the global average for this industry, of 28%. North American Growth Corporates in the agriculture sector had the highest utilization of working capital solutions for seasonal cash management.

Cash flow management allows companies to forecast spending and strategize investments, among other key operations, and external working capital solutions are pivotal in this endeavor. North American Growth Corporates in commercial travel, for instance, exhibited high rates of use of these solutions for expected cash flow gaps, at 48%, compared to the global average for this industry, of 28%. North American Growth Corporates in the agriculture sector had the highest utilization of working capital solutions for seasonal cash management.

Within our study, all top-performing North American Growth Corporates in the fleet and mobility sector and 7 in 10 healthcare top performers tapped external working capital strategically to grow and develop their businesses.

One-quarter of top-performing Growth Corporates in North America use working capital to cover expected cash flow shortfalls; however, North American agriculture and commercial travel Growth Corporates use working capital for cash flow continuity reasons at higher rates than average.

Growth Corporates in North America have been able to meet the challenges posed by economic and financial headwinds, showing market resilience through their use of working capital solutions. Download the report to learn more about how North American Growth Corporates leverage working capital solutions.