With extensive financial resources, widespread branch networks, and robust financial infrastructure, national banks wield considerable influence and dominance, particularly in the credit card industry.

However, credit unions and community banks are growing in popularity. An increasing segment of consumers now favors these smaller financial institutions when selecting their next credit card, a trend that extends to a portion of those presently without a designated primary card.

The PYMNTS Intelligence study “Credit Unions and Community Banks Gain Credit Card Issuing Momentum,” which drew from a survey of over 2,000 U.S. consumers, examined the dynamics of consumer credit cards and the evolving preferences regarding card issuers.

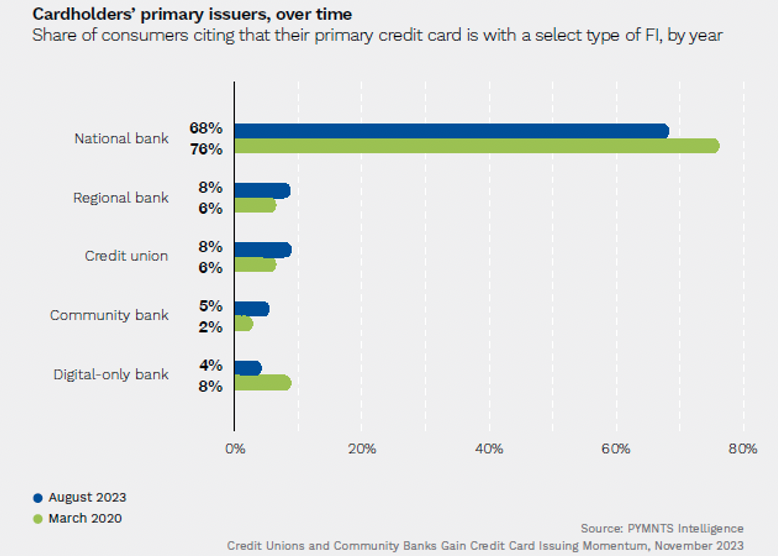

According to the study, national banks issue 68% of primary consumer credit cards and have a strong lead among consumers who also bank with them. Their massive scale and the cross-selling opportunities they have with their existing customers give them an advantage, making it challenging for smaller FIs to compete.

Despite this stronghold, the survey revealed that CUs and community banks have made progress in the consumer credit card space in recent years. Almost a quarter of consumers surveyed indicated a likelihood of selecting one of these smaller FIs for their next credit card, signaling a shift in preferences.

Additionally, CUs saw an increase in their primary credit card share from 6% to 8.3% between 2020 and 2023. In the same time frame, community banks increased their stake from 2.3% to 5.1%, a more than twofold increase.

Although modest in absolute terms, these relative gains for CUs and community banks represent a change in the market landscape. This is especially noteworthy given the decline in primary cardholders for national banks, decreasing from 76% in 2020 to 68% in 2023.

However, although CUs and community banks have gained momentum, they face specific challenges in appealing to certain consumer segments. High-spending non-revolvers — individuals who settle their credit card balances in full each month — pose a challenge, as only 14% of this lucrative consumer segment stated they would likely opt for a new card from one of these FIs.

This highlights the need for CUs and community banks to reassess and tailor their marketing strategies effectively to attract a greater share of this demographic. To do this effectively, they must prioritize providing essential features valued by current cardholders.

Top of the list are rewards and cash-back programs, deemed important by over 80% of national bank cardholders. Additional valuable benefits include account alerts, autopay options, and the provision of user-friendly websites and apps for seamless balance monitoring and payment processing.

While national banks continue to dominate the consumer credit card industry, CUs and community banks are making strides in gaining market share. To sustain this growth and compete effectively with national banks moving forward, these smaller FIs should focus on delivering key features and addressing cardholder preferences.