The Consumer Financial Protection Bureau finalized a rule this week slashing what it labeled “excessive credit card late fees,” reducing the penalty card issuers can charge from the typical $32 to $8.

Once the new rule goes into effect, the CFPB estimated the fee cap will save American families “more than $10 billion in late fees annually,” or an average of $220 each year for the 45 million U.S. cardholders now impacted by the fees.

While the new rule could prove beneficial to those millions of consumers and business owners who rely on credit cards to manage their day-to-day expenses, there may also be unintended consequences.

For starters, the “more than $10 billion” that cardholders are supposed to save could be equally framed as a more than $10 billion loss for card issuers, and — because the new rule enables these firms to take other actions, like increasing interest rates or reducing credit limits — it’s conceivable they will explore other options to make that money back.

After all, the Federal Reserve estimated card “fees — in particular late fees — comprise approximately 15% of credit card profitability.” This is a significant share of revenue, and if card issuers or banks are allowed to make credit access more onerous for consumers and businesses, both entities might encounter other troubles ahead.

A portion of financially challenged consumers already count on credit cards to stay afloat. As PYMNTS Intelligence found in compiling the latest The Credit Card Use Deep Dive Edition of the “New Reality Check: The Paycheck-to-Paycheck Report,” nearly 60% of credit cards are now in the hands of U.S. consumers who live paycheck to paycheck, a financial status that intensifies the prospect of incurring late fees.

One-third of U.S. consumers said they hit their credit card limit ($9,200 on average) at least once in the last year. But, for those living paycheck to paycheck — who said they were already having trouble keeping pace with their monthly expenses — the percentage more than doubled. Sixty-four percent of struggling consumers hit their credit card limits ($5,900 on average) “occasionally” in the last 12 months.

If issuers pull back credit limits, a reaction that is a possibility according to trade organizations such as the American Bankers Association, the share of consumers running out of credit could skyrocket.

Lower credit limits do not only impact consumers. For many business owners and firms in growth mode, credit cards can be an important source of short-term capital to cover emergency expenses or planned growth.

In the “2023-2024 Growth Corporates Working Capital Index: North America Edition,” PYMNTS Intelligence found that 70% of North American middle-market firms used a variety of external capital solutions last year to offset economic headwinds, and that percentage could hit 90% this year.

The report, which was based on surveys with 124 corporate chief financial officers or treasurers at mid-market companies generating between $50 million and $1 billion in revenue, determined almost one-third of respondents anticipated accessing virtual cards in the year ahead to cover costs. And — for 5% — those cards would serve as the “primary working capital solution.”

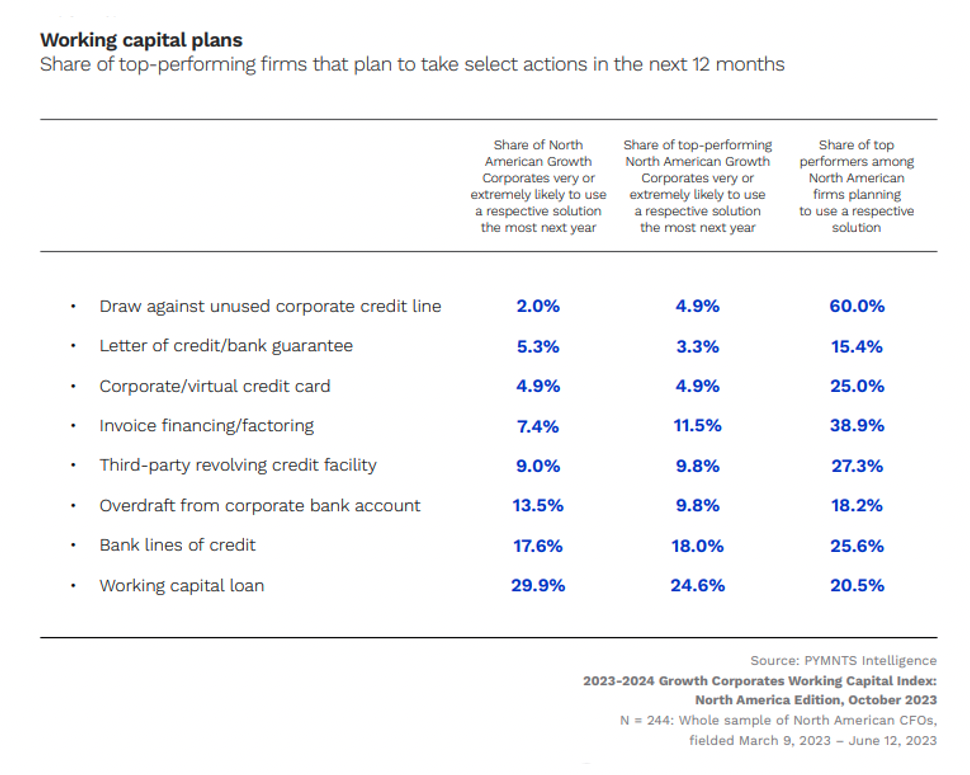

Additionally, 6 in 10 respondents said they plan to “draw against unused corporate credit lines” to meet their business needs in the year ahead. Another 25% anticipate using corporate or virtual credit cards while nearly 26% said they may tap into bank lines of credit. Eighteen percent said using overdrafts from corporate accounts may be necessary.

In other words, having access to credit cards is a necessity for some and a useful growth lever for others. Because the CFPB’s new rule does not prevent card issuers from raising interest rates, reducing credit lines, or taking other actions to deter late payments, some cash-strapped consumers and businesses may decide the new fee cap misses the mark.