The Fed held sway this past week as the guessing game about when — or whether — the central bank will cut rates continued. Fed officials seemed to indicate that rates may be lowered sooner rather than later. However, strong jobs data this week seemed to splash some cold water on that sentiment, which may mean that cuts will be pushed out.

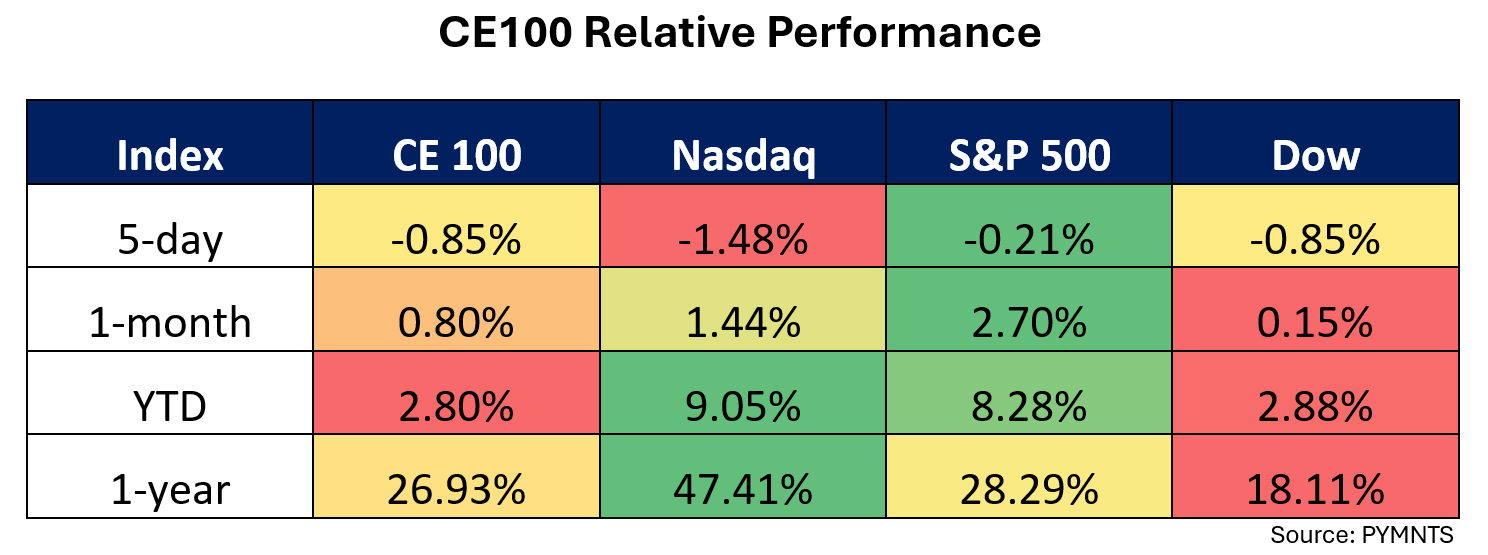

Major indices slipped for the week, and the CE 100 Index lost 0.9%.

The Communications pillar was up 3.7%.

Snap shares gained 10.1%.

The company’s rally comes on the heels of volatility post-earnings. We noted that the company’s fourth-quarter earnings showed average revenue per user (ARPU) dipped 5% year over year in the quarter, even as it rose by 2% in North America.

Looking toward “accelerating and diversifying” its revenue growth going forward, the company highlighted its Snapchat+ subscription as a key growth area, adding more AI offerings to the program to make it more appealing to potential subscribers.

India’s Bharti Airtel shares surged 6.5%, further bolstering the Communications pillar’s gains.

The Wall Street Journal reported this week that Singapore Telecommunications is selling a 0.8% stake in Bharti Airtel to U.S.-based investment firm GQG Partners for just under the USD equivalent of $710 million.

The sale brings Bharti Airtel’s “recycled” capital to $8 billion in the past three years. The capital, according to reports, will be used to fund data and IT services while reducing net debt. The sale will mean that Singtel holds a 29% stake in Bharti Airtel.

Elsewhere, Nvidia shares were up 6.4% but was not enough to boost the fortunes of the Enablers Group, which gave up 3.2%.

As reported here, Nvidia and Apple have been jockeying for position as the world’s second-most valuable company, as measured by market capitalization. Excitement over AI, and specifically AI chips, has pushed Nvidia’s market cap from $1 trillion to over $2 trillion in nine months — a feat that has seen it overtake Amazon, Google’s parent company Alphabet and Saudi Aramco.

But Nvidia’s boost was blunted by Cogent’s share declines, which led the Enablers pillar to the downside. The company’s stock lost 13.6%. The company’s latest earnings showed that in the wake of the company’s acquisition of Sprint’s Wireline business, service revenue decreased quarter over quarter by 1.2% to $272.1 million. Year on year the top line was up 79%. Non-core revenue decreased 43% quarter on quarter.

Tesla followed close behind, with a 13.5% slide. Fortune reported that Rivian Automotive is shifting production of its R2 model to an existing facility and will come to market with the EV earlier than had been projected, with deliveries scheduled to begin in the first half of 2026.

Xero shares took the Work segment down 2.5%, and the stock was down 13.4%.

PYMNTS reported this past week that Xero will enhance its accounts payable (AP) capabilities for its U.S. customers through a new partnership with BILL, a financial operations platform for small and medium-sized businesses. This partnership will bring a bill pay solution from BILL directly into the Xero platform, the companies said last week.

The embedded bill-pay solution will allow customers to pay bills seamlessly without the need to make manual bank transfers, write checks, or enter credit card details, per the release. Customers will also have access to BILL’s network of 5.8 million members, making it easier to find and pay vendors.