The lion’s share of shoppers wants merchants to let them know what installment plan options are available before the checkout process even begins, and older consumers especially demand this foreknowledge.

By the Numbers

For the September report “Installment Plans Becoming a Key Part of Shopper’s Toolkit,” PYMNTS Intelligence surveyed more than 2,500 U.S. consumers to get a sense of how they use installment plans for common purchases and to better understand their preferences in this area.

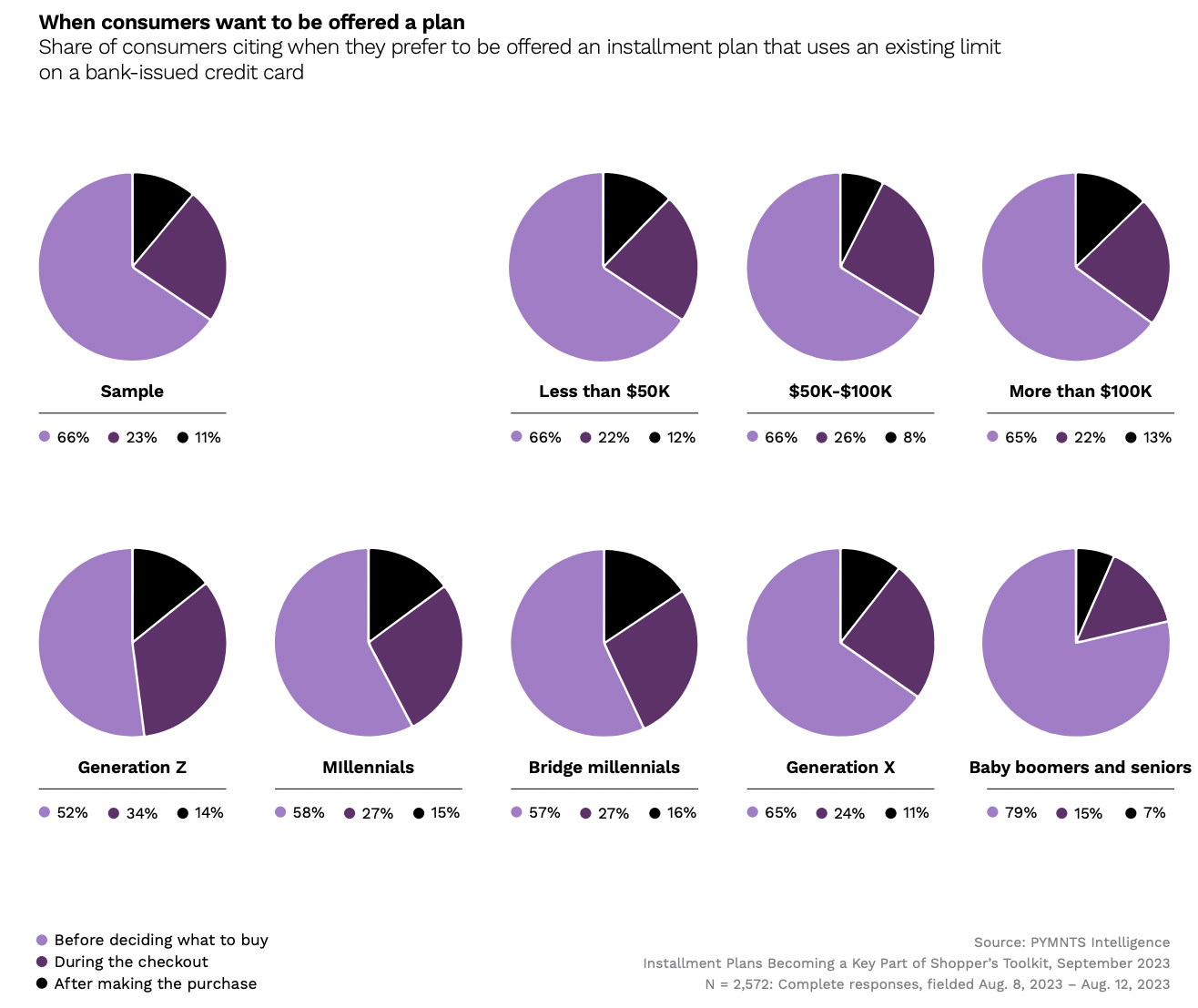

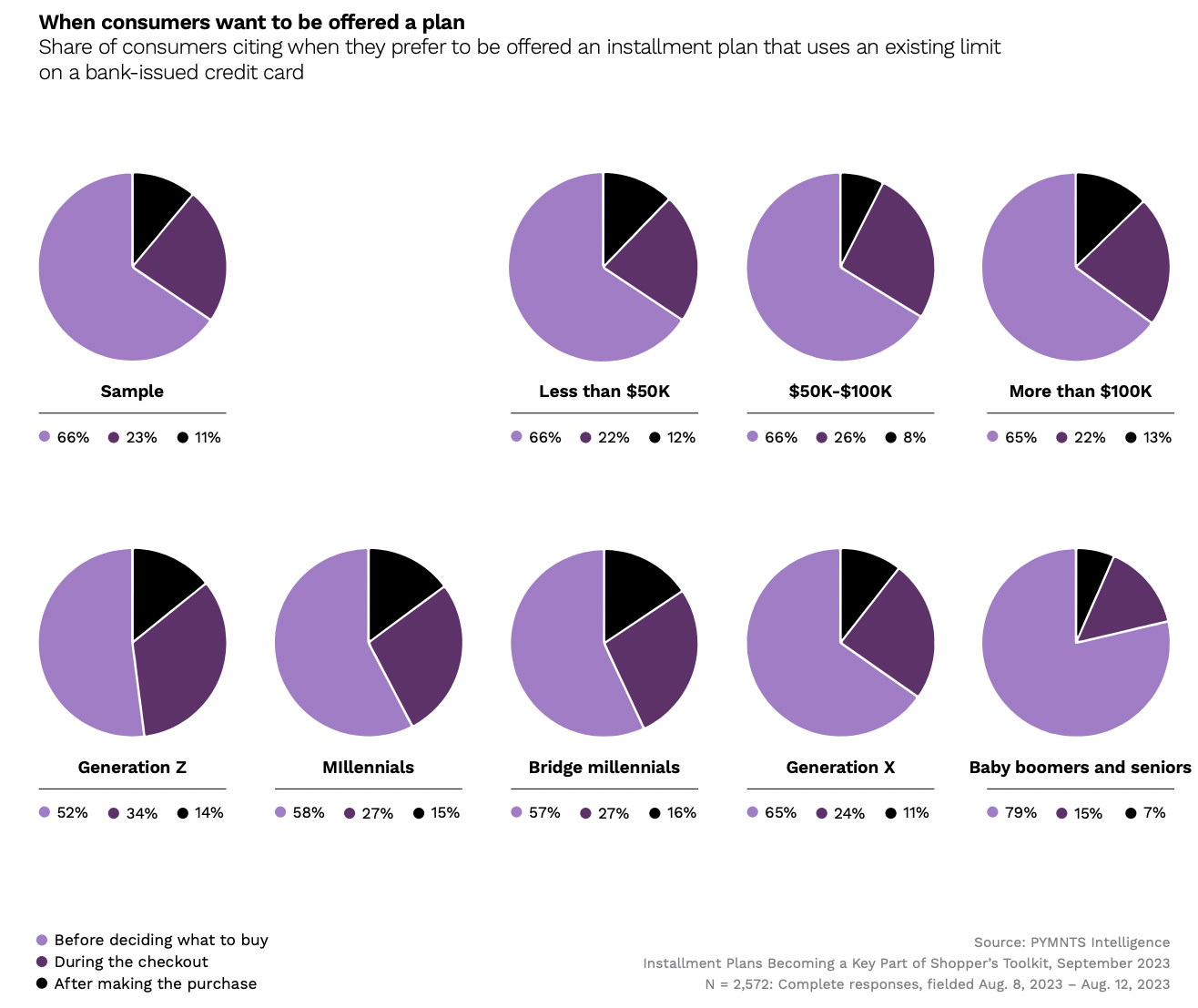

The results revealed that 66% of shoppers prefer to be offered an installment plan that uses an existing limit on a bank-issued credit card before they check out, versus the 23% who prefer to see these offers during checkout and 11% who prefer to see it after.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Older consumers are disproportionately likely to want to be offered these plans in advance, with 79% of baby boomers and seniors preferring to be offered their plan options before deciding what to buy.

A Deeper Dive

The demand for this foreknowledge comes as ongoing economic pressures have consumers making difficult budgeting decisions.

The PYMNTS Intelligence study “New Reality Check: The Paycheck-to-Paycheck Report: Why One-Third of High Earners Live Paycheck to Paycheck” revealed that 82% of consumers said concerns about inflation top their lists of economic woes, and 17% said they hold out any hope that inflation will subside soon. Additionally, the report revealed that 60% of shoppers have cut down on nonessential purchases, and half have turned to cheaper merchants due to retail product price increases.

Advertisement: Scroll to Continue

Plus, findings from an earlier installment of the “New Reality Check: The Paycheck-to-Paycheck Report” revealed that consumers said they deplete 67% of all available savings every four years, on average. Among paycheck-to-paycheck consumers, the average recurrence drops to once every 2.5 years.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.

See More In: Baby Boomers, checkout, checkout conversion, Consumer Spending, credit, ecommerce, economy, installment payments, installments, News, PYMNTS Intelligence, PYMNTS News, PYMNTS Study, Retail

Add as Preferred Source

Add as Preferred Source