PYMNTS Intelligence recently studied Growth Corporates, or mid-market firms, in the APAC region to determine how they leveraged working capital solutions as part of our “2023-2024 Growth Corporates Working Capital Index” series.

The series, which was commissioned by Visa, also examined working capital patterns for companies operating in the Middle East and Africa, Europe; and Latin America and the Caribbean; and North America.

In our APAC Edition, PYMNTS Intelligence focused on 151 mid-market firms in the region and found most either don’t use external financing solutions or — if they do — deploy them mostly for tactical, quick-fix solutions rather than using them strategically to foster long-term growth.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

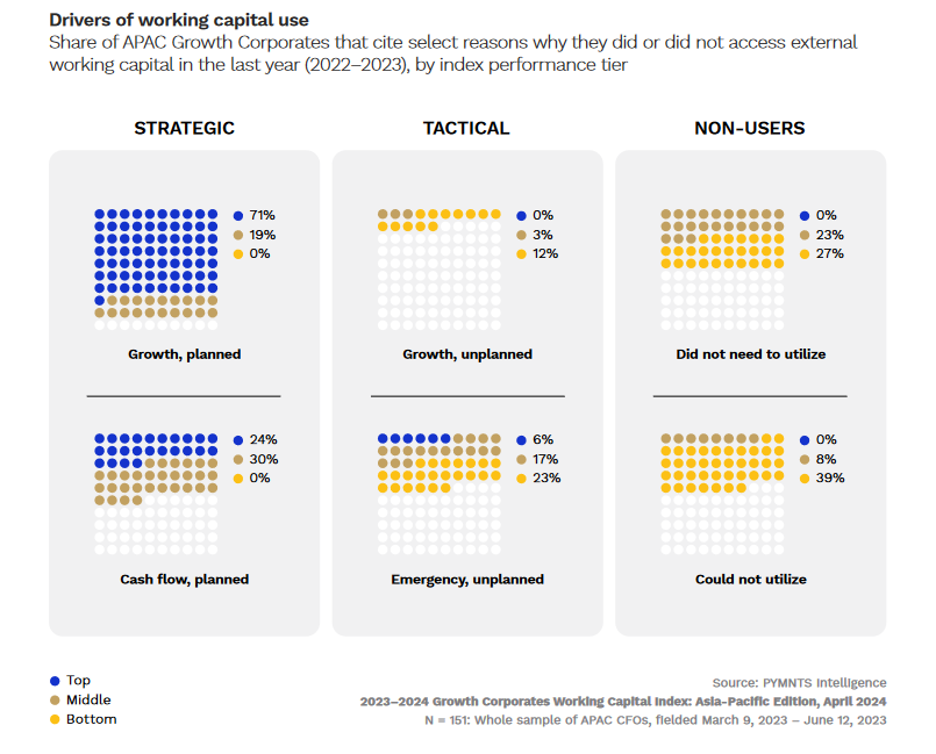

It’s probably no coincidence that the top-performing APAC mid-market firms were also the ones that strategically deployed external resources to address anticipated shortfalls and expand their businesses. None of the bottom-performing companies we looked at did so.

Additionally, PYMNTS Intelligence found that more than eight in 10 of APAC companies that did access working capital solutions also reported seeing improved buyer-supplier relationships and reduced costs for new business initiatives.

Advertisement: Scroll to Continue

What were the deciding factors in determining whether APAC organizations would access working capital during the year before being surveyed?

Seventy-one percent of top-performing middle-market firms in the region used external financing strategically to grow businesses via planned initiatives and upgrades. Among the bottom performers, 74% used external working capital strategically to cover expected cash flow gaps, while 65% of bottom performers did not use external financing at all — and those that did deployed it tactically (as opposed to strategically).

In many cases, the options were limited. Thirty-nine percent of bottom performers simply could not access any solutions over 2022-2023 because they weren’t eligible, or costs hindered their access. A little more than one-third of bottom-performing APAC mid-market firms accessed working capital tactically: 23% for emergencies and 12% to accelerate payments for sudden, unplanned business opportunities.

Overall, PYMNTS Intelligence found most APAC middle-market firms simply don’t appear to be taking full advantage of the external financing solutions available to them.