Yet, PYMNTS Intelligence data reveals that in recent years, both credit unions (CUs) and community banks have made slow, but steady headway into the consumer credit card space.

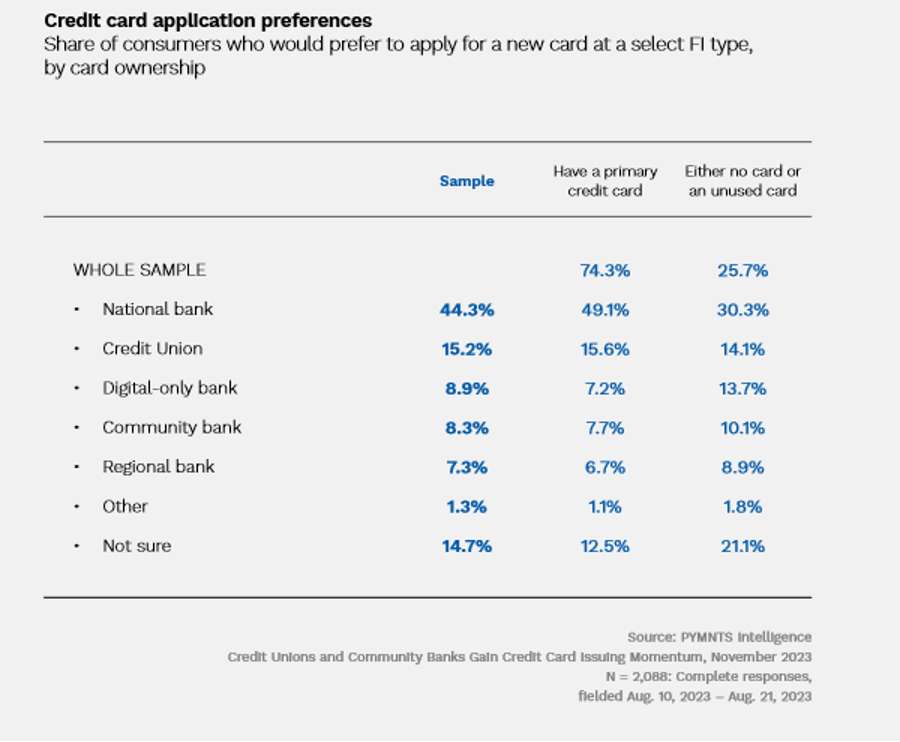

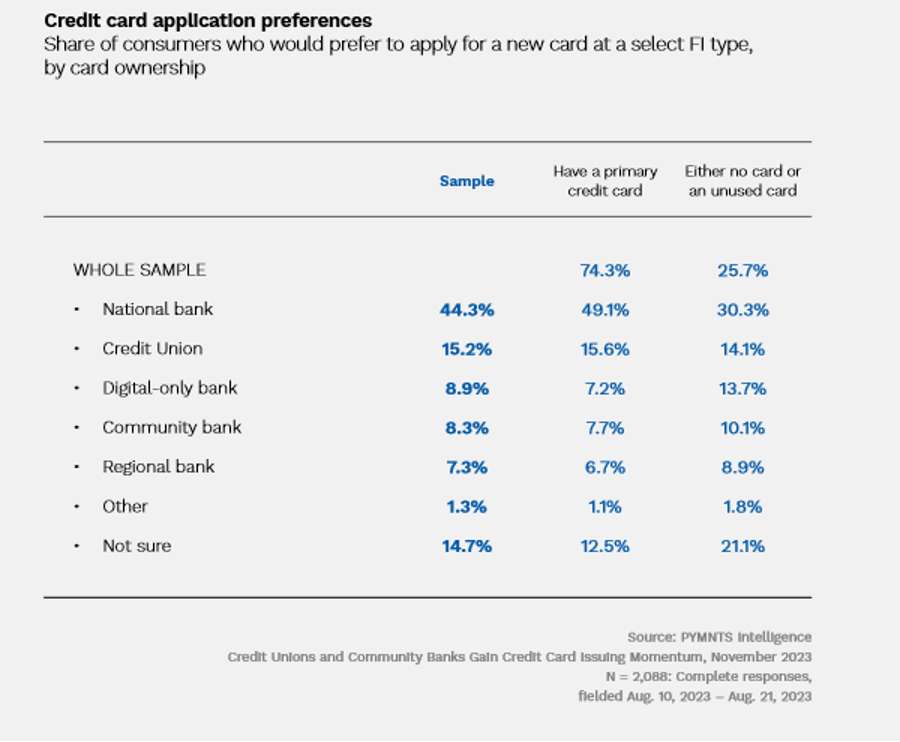

As we shared in “Credit Unions and Community Banks Gain Credit Card Issuing Momentum,” 24% of the more than 2,000 consumers we surveyed told us the next credit card application they complete will likely be with their CU or their community bank.

This may also help explain why our research also revealed that the share of consumers whose primary credit card is associated with their primary national bank has fallen from 76% in 2020 to 68% last year.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

This decline is even more remarkable when factoring in the inherent advantage national banks have when it comes to issuing cards. Not only do national banks lead the market in managing consumer bank accounts, but they also issue the most credit cards in the industry. Among the respondents we surveyed who have their primary bank account with a national bank, 82% also have their primary credit card with that same institution.

Meanwhile, CUs manage less than half this rate, at just 37%, while community banks, with 23%, manage even less.

Advertisement: Scroll to Continue

Despite this disparity, CUs and community banks have been quietly strengthening their positions in the consumer credit card market in recent years. CUs increased their share of primary credit cards from 6% in 2020 to 8.3% in 2023. Community banks more than doubled their shares, moving from 2.3% to 5.1% in the same period. Though modest when compared to the big banks, these shifts represent an undeniable trend.

And both CUs and community banks are poised to continue this upward climb. Across all consumers we surveyed, approximately 15% said they would be most likely to apply for a new credit card from a CU, marking a potential 83% increase versus the share that currently has a primary card from a CU. For community banks, 8.3% indicated the same, 63% more than those who have their primary card issued by a community bank.

Not only do these trends show smaller financial institutions are poised for growth, they also suggest they may be missing out on immediate opportunities to issue credit cards to their customers.

Add as Preferred Source

Add as Preferred Source