Retail subscriptions represent a massive growth opportunity for eCommerce merchants. PYMNTS Intelligence data reveals that more and more consumers are choosing to take advantage of the convenience that online retail subscriptions provide.

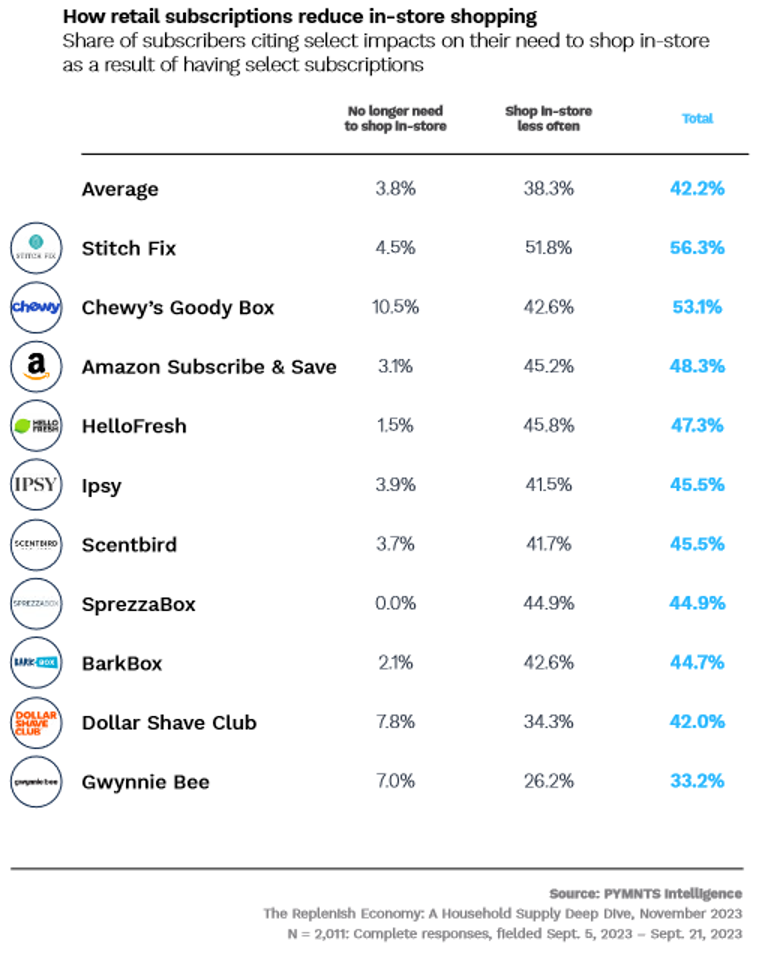

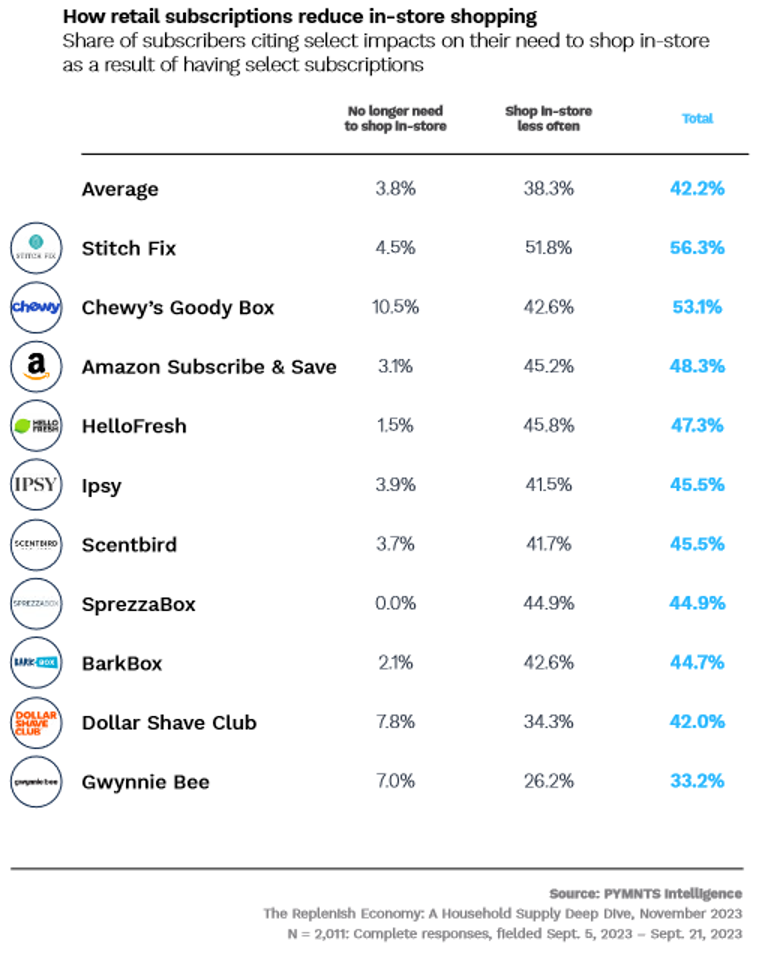

In “The Replenish Economy: A Household Supply Deep Dive,” a report PYMNTS Intelligence compiled based on surveys with more than 2,000 consumers and 188 retail subscription merchants, 42% of retail subscribers told us they shop in-store less frequently because of their subscriptions.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Percentages of those bypassing brick-and-mortar stores were even higher among patrons of Amazon Subscribe & Save (48%) and HelloFresh (47%). However, specialized merchants Stitch Fix (56%) and Chewy’s Goody Box (53%) topped the list of subscribers saying “no” to in-store appearances.

Nearly one-third of subscribers tell us they purchase most or all items using scheduled or auto-fill subscriptions. However, 15% of respondents say they prefer the control that comes from placing manual online orders online when supplies are running thin.

Across the board, younger consumers are more likely than their older peers to rely mainly on retail subscriptions for their everyday shopping needs. Millennials lead at 39%, with bridge millennials right behind them at 38%. Both segments are well above the generational average of 31%, which is where Gen Z subscribers also fall. Just 24% of Gen X subscribers and 17% of baby boomer and senior subscribers rely primarily on subscription services to stock their pantries.

As the accompanying graphic shows, the impact of retail subscriptions on in-store shopping varies. On average, just 3.8% of all subscribers we surveyed say subscriptions have fully eliminated their need to visit stores for relevant purchases. But that sentiment climbs to 11% for those subscribing to Chewy’s Goody Box. Nearly 8% of Dollar Shave Club subscribers say the same, and so do 7% of Gwynnie Bee shoppers and 4% of Ipsy subscribers.

Advertisement: Scroll to Continue

One of the more important findings is that 26% of subscribers tell us they envision a future where they complete all their shopping using scheduled subscriptions. For now, however, 35% of subscribers see no change in their in-store shopping habits. In fact, our research shows that nearly all consumers continue to do at least some in-store shopping — for the time being, anyway. It’s up to the next wave of savvy online merchants to capitalize on changing consumer expectations by offering those in-store hold outs an innovative reason to subscribe to their services.

Add as Preferred Source

Add as Preferred Source