But one would be hard-pressed to think anything resembling relief is being felt by the U.S. consumer.

As reported Wednesday (May 15), the CPI released by the Bureau of Labor Statistics noted that prices were 0.3% higher in April as measured against March’s levels, and prices were 3.4% over the prior year’s April.

The recent inflationary readings are, in fact, a deceleration from the March over February increase of 0.4%, while the March 2023 to March 2024 pace was 3.5%.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

The BLS indicated in its release that the index for shelter rose in April and in fact was up 5.5% from a year ago. The energy index was 2.2% higher year over year.

“Combined, these two indexes contributed over 70% of the monthly increase in the index for all items. The energy index rose 1.1 percent over the month. The food index was unchanged in April. The food at home index declined 0.2%, while the food away from home index rose 0.3%” month over month, per the government’s report.

Advertisement: Scroll to Continue

The inflation data came the same day that retail sales were flat, month over month, in April. The read across here is that, if prices are up but sales are flat, then consumers are buying fewer goods, or perhaps trading down.

Those shifts would dovetail with the PYMNTS Intelligence data that showed that, coming into the first few months of 2024, consumers were opting for private label brands, and more then two thirds of paycheck-to-paycheck consumers who say they are already challenged paying their bills found themselves making tradeoffs between “essential” items and those they deem “nice-to-have.” Hence, we saw in the April retail sales data that several categories of spending, such as in sporting goods and at home furnishing — online sales too — declined month over month.

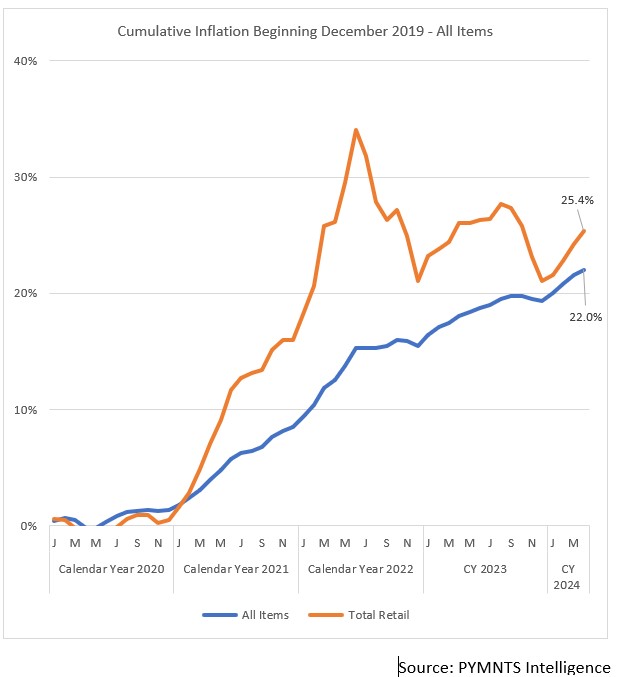

Cumulative Impact of Inflation

PYMNTS Intelligence took the April data and, as seen below, the cumulative effect of inflation since the pandemic has been onerous in many of the most essential categories. Consider that, as the data show, housing is almost 24% more expensive than it was just before COVID-19 hit. Groceries are even more expensive, with a cumulative nearly 27% gain. That means there’s not all that much left over to afford items such as sporting equipment, apparel or entertainment, and each of those spending categories has been marked by double-digit price hikes through the same time frame.

The cumulative bird’s-eye trend is eye-opening, too. Total retail inflation, on a cumulative basis, is still 25% higher than the end of 2019. The basket of all items and services — a composite of the spending that gets us through everyday life (essential spending is in the mix, and so are nonessential categories) has kept rough pace, up 22%.

The cumulative bird’s-eye trend is eye-opening, too. Total retail inflation, on a cumulative basis, is still 25% higher than the end of 2019. The basket of all items and services — a composite of the spending that gets us through everyday life (essential spending is in the mix, and so are nonessential categories) has kept rough pace, up 22%.

The slight ebbing of inflation’s pace in April may be cause for some cheer — perhaps offering a slight psychological boost for consumers, at least for the moment. But the real damage has been done to the pocketbook, and it’ll take more than a month’s slowdown of price increases to undo that damage.

The slight ebbing of inflation’s pace in April may be cause for some cheer — perhaps offering a slight psychological boost for consumers, at least for the moment. But the real damage has been done to the pocketbook, and it’ll take more than a month’s slowdown of price increases to undo that damage.