British digital bank Monzo is launching a free account for children under 16.

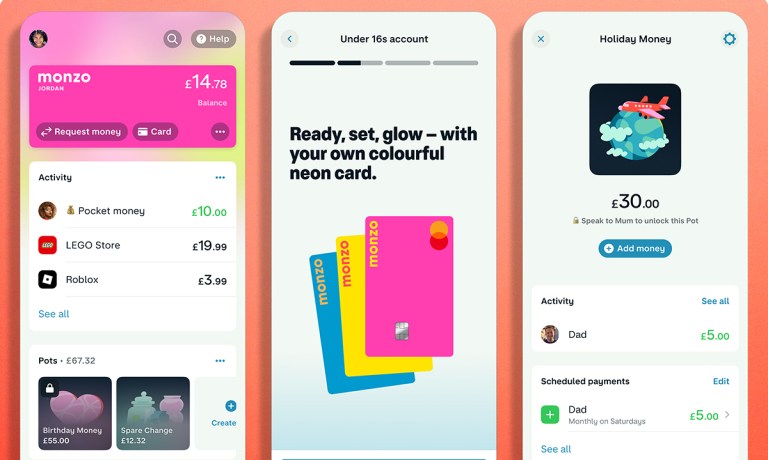

The bank on Wednesday announced the waitlist for Monzo for Under 16s, designed to offer money management tools to kids between the ages of 6 and 15.

“The account gives children the opportunity to experience magic money firsts like saving, budgeting, receiving pocket money or using a card to pay in a shop, all while giving parents or guardians complete control and visibility to ensure they’re managing their money safely,” Monzo said in a news release.

According to the release, the program lets kids sign up without paying fees for top-ups, subscriptions or spending abroad. Children can set savings goals and receive scheduled pocket money, while their parents can have these accounts linked to their own to control spending, online payments and cash withdrawals.

Monzo says the Under 16s accounts also offer guidance on things like saving, budgeting and spending safely online and allow children to move up to a 16-17s account and again to a full Monzo account upon reaching adulthood.

Monzo’s efforts to help educate younger customers come at a time when many teenagers in more prosperous countries — such as the UK and U.S. — are behind in financial literacy.

Although more than two-thirds of students regularly use financial products and services, levels of financial literacy are too low to make sure they can escape financial risks, the Organization for Economic Cooperation and Development (OECD) said last month after releasing the latest volume of its financial literacy assessment.

That study examined the financial skills of 15-year-olds in 14 OECD and six partner countries and economies and determined that many of them engage in basic financial activities from a young age.

“However, many still lack the skills and knowledge needed to make sound financial decisions: nearly one out of five students on average in participating OECD countries and economies, did not achieve baseline proficiency levels in financial literacy,” the organization said.

Meanwhile, research by PYMNTS Intelligence has found that many consumers want more financial expertise, and often look to financial institutions (FIs) for guidance, with many younger consumers being unaware of things like their credit scores.

“This may not be surprising, considering that 79% of Gen Z and millennials say they get their financial advice through social media,” PYMNTS wrote recently. “Only 11% say they use financial advisers to get the direction they need.”