Cross-border payments, trade finance, smart contracts — blockchain has the potential to disrupt B2B processes, but FinTech players are only beginning to take these concepts onto a real-world stage.

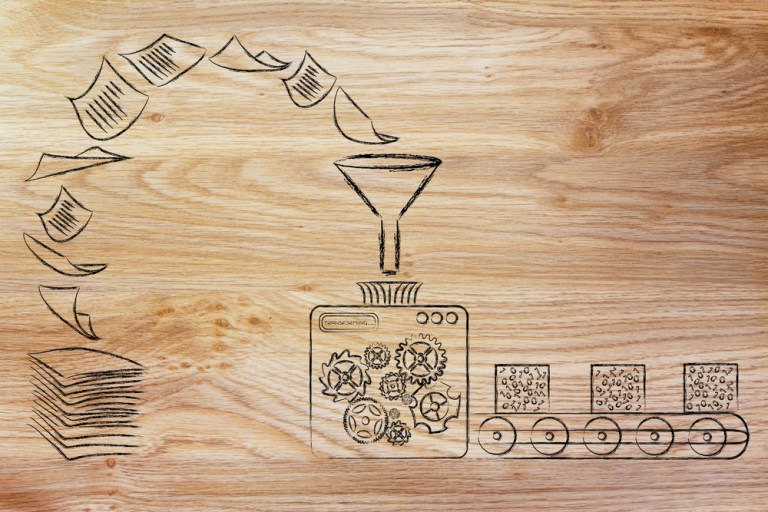

For one firm, Finlync, the key to unlocking the potential of blockchain in B2B processes is unlocking the underlying data of that activity. The company announced earlier this month that it has developed what it claims to be the world’s first technology to integrate blockchain into ERP systems like SAP.

The solution is called Finlync SAP-DL Integrator, and the idea, said Finlync in an interview with PYMNTS, is that the ERP system is the central home to critical data like purchase orders and invoices, business partner payment information and the like.

Being able to transmit this type of data via blockchain would make B2B processes like invoice processing and payments far quicker, the company explained.

Blockchain, said Finlync, “will bring parties such as the buyer, seller, buyer’s bank [and] seller’s bank onto the same value chain,” which enables real-time transmission and analysis of data between these players.

“For this to work,” the firm continued, “the buyer and seller must be an active part of this value chain. Otherwise, how can we manage an effective distributed ledger of data across all parties? Interoperability and integration of the buyer and sellers’ data is therefore essential. Today, that data is stored in their ERP.”

According to Finlync, connecting all of the data within an ERP via blockchain can make business processes like payments far quicker than they are today.

“Processing corporate payments as peer-to-peer, directly on blockchains, gives for instant settlement and, therefore, real-time reconciliation and accounting,” the company said. “That speed is something which, simply, is not possible today.” Real-time payments and reconciliation, the company added, could be a major boost to corporate cash management efforts, too. Further, blockchain, Finlync said, negates the need for participants to align with what the company described as “complex” payments messaging standards like ISO.

But there’s another reason why proponents of blockchain are so confident the technology can make waves in the payments space: security. Finlync told PYMNTS that, in B2B payments especially, fraud is on the rise.

“We have seen increasing instances where company email servers are hacked, fake invoices are introduced into the accounting system and company funds are sent to fraudulent accounts worldwide,” the firm noted. “Blockchain and the distributed ledgers can eliminate international data fraud.”

A Realistic Approach

Faster processes, less complexity, heightened security — it seems like a no-brainer. Of course, the reality is that blockchain is far from ubiquitous, and critics and skeptics of the technology raise challenges for the tool. For Finlync, the market is currently working out a critical question: “Which is the ledger to rule them all?”

“Intra-bank is easier to manage, but inter-bank solutions rely on industry harmonization,” the firm explained when asked about some challenges to the adoption of a solution like this. “Corporates additionally can be running various ERP systems.”

“Hesitation is also coming from the fact [that] banks are traditionally not used to integrating so deeply with their clients’ IT,” Finlync added. “However, this is changing. They see their invoice data as a financial instrument and want real-time visibility on this. To gain a holistic view of their payables, receivables and liquidity means the bank can offer more targeted services better suited to customers’ needs.”

Finlync also acknowledged that corporates, too, are sometimes struggling with blockchain acceptance. The company said “leadership standards” are critical to getting corporates on the value chain to work alongside financial institutions and other financial service players using blockchain tools. According to the company, among the top concerns of its corporate clients is the concept that third parties log into a platform in which they are connected.

“Any new technology adoption will need to be seamless within a company’s existing ERP access,” the firm stated. “For example, we have corporate clients that are blocking access to eBanking products, with all treasury and cash management operations managed within ERP itself.”

Finlync is now in the production phase of its integrator tool, working with bank partners to integrate data from the ERP platform offered by SAP. And while corporates and FIs alike are in need of some convincing to get fully on board with a solution that not only uses an unfamiliar, often uncharted technology like blockchain but also integrates directly into a platform with highly sensitive corporate financial data, Finlync said it is fully confident that the technology will gain traction, especially now that banks have signed onto the project.

“Let’s leave it at this: If history has taught us one thing — e.g. in the case of SWIFT — large SAP companies will be the first to follow suit after the banks,” the company declared.