There’s a rule of thumb at fast food and quick-serve restaurants (QSR): a seven-second reduction in customer wait time results in an average 1 percent gain in market share. Achieving those mission-critical seconds has never had more options, with the QSR industry in the midst of enjoying a boom in new technologies that promise to reduce wait times while boosting food quality and customer service. Recently, most restaurants are turning to in-store kiosks.

The latest Restaurant Readiness Index revealed that kiosks are seeing the strongest growth among the nine in-store technologies surveyed by PYMNTS’ analysis. In the latest quarter, the percentage of QSRs using kiosks rose four percentage points, to 41 percent of the industry. There’s still plenty of room for growth. A separate recent survey found that only 18 percent of QSR customers surveyed used a self-ordering kiosk in a period of three months, but that 60 percent said they would go to a QSR more frequently if kiosks were offered. The study, by Tillster, a digital service provider to restaurants, said that customers of all ages are open to using kiosks, especially when they’re available during busy times. The study noted that kiosks make customers more inclined to stick around, even if there is a line — a common factor in customers deciding to leave to find a faster experience. A 2014 study by Northwestern University’s Kellogg School of Management found that’s the case, revealing evidence to support that seven-second rule of thumb.

Eliminating lines — and therefore lost sales — is the driving force behind the McDonald’s “Wait Time Zero” initiative and Panera’s aim to reduce choke points in its in-store service. Some QSRs are experimenting with a greater focus on kiosks, in some cases looking to the technology to completely take over functions like ordering and paying. Burger chain Shake Shack opened its first cashless kiosk store in New York City’s Astor Place last autumn, where consumers either order and pay by in-store kiosk or with their mobile phone. The company, started by celebrity chef Danny Meyer, said the kiosks should make staff more available to focus on food preparation and the customer experience. Not to be outdone, famed chef Daniel Boulud is opening his own tech-centric QSR with four Massachusetts Institute of Technology graduates. The restaurant, Spyce, is set to open this spring in central Boston. Customers can order by kiosk and then be served in a completely automated environment, where robots make the food and clean the dishes. An earlier version was opened at an MIT cafeteria.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

While the Restaurant Readiness Index revealed that QSR industry adoption of innovation has been spotty, kiosks were the one area where the best-performing and worst-performing QSRs were making advances. Fully 49 percent of the top 20 percent of restaurants measured by the index had in-store kiosks, only modestly ahead of the bottom 20 percent, where 44 percent of QSRs integrated kiosks. Interestingly, the 20 percent middle-of-the-road innovators had a kiosk implementation rate of just 25 percent, according to PYMNTS’ report.

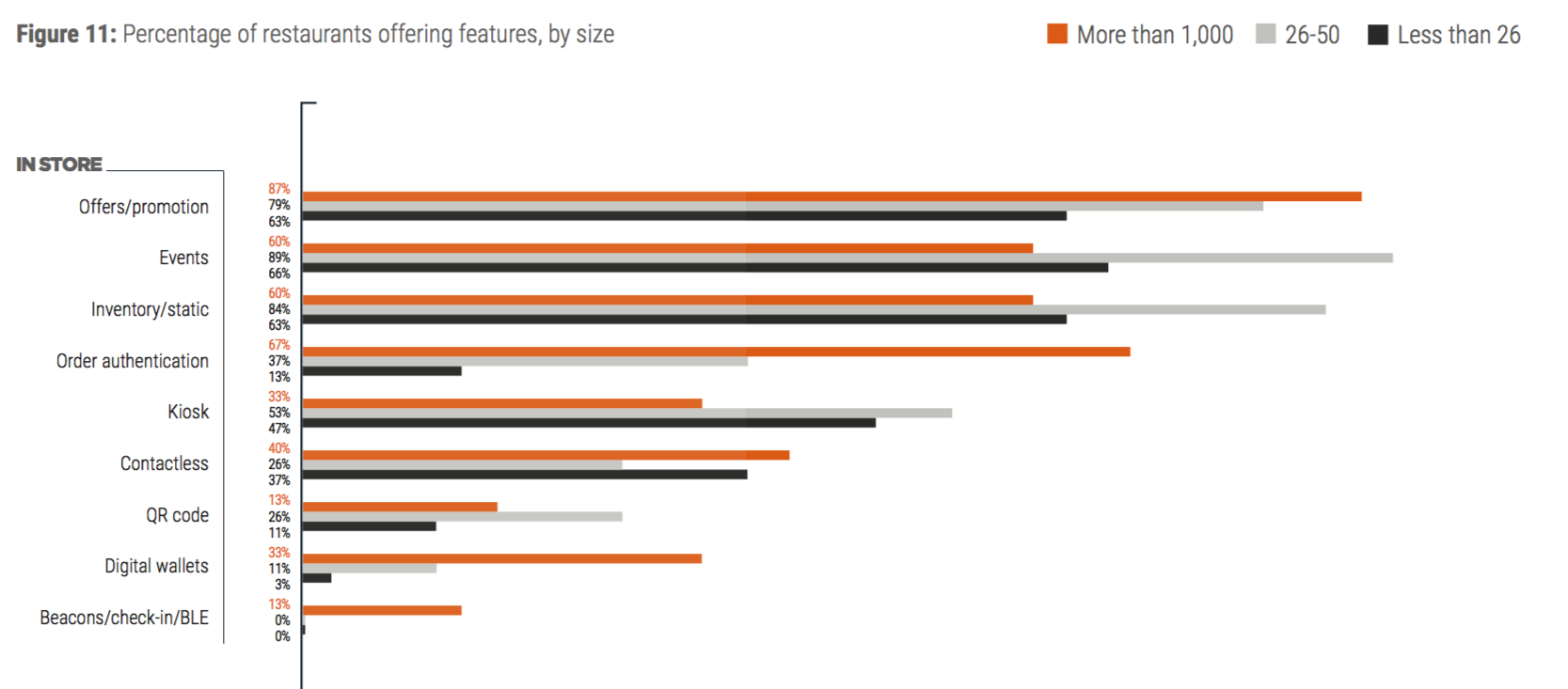

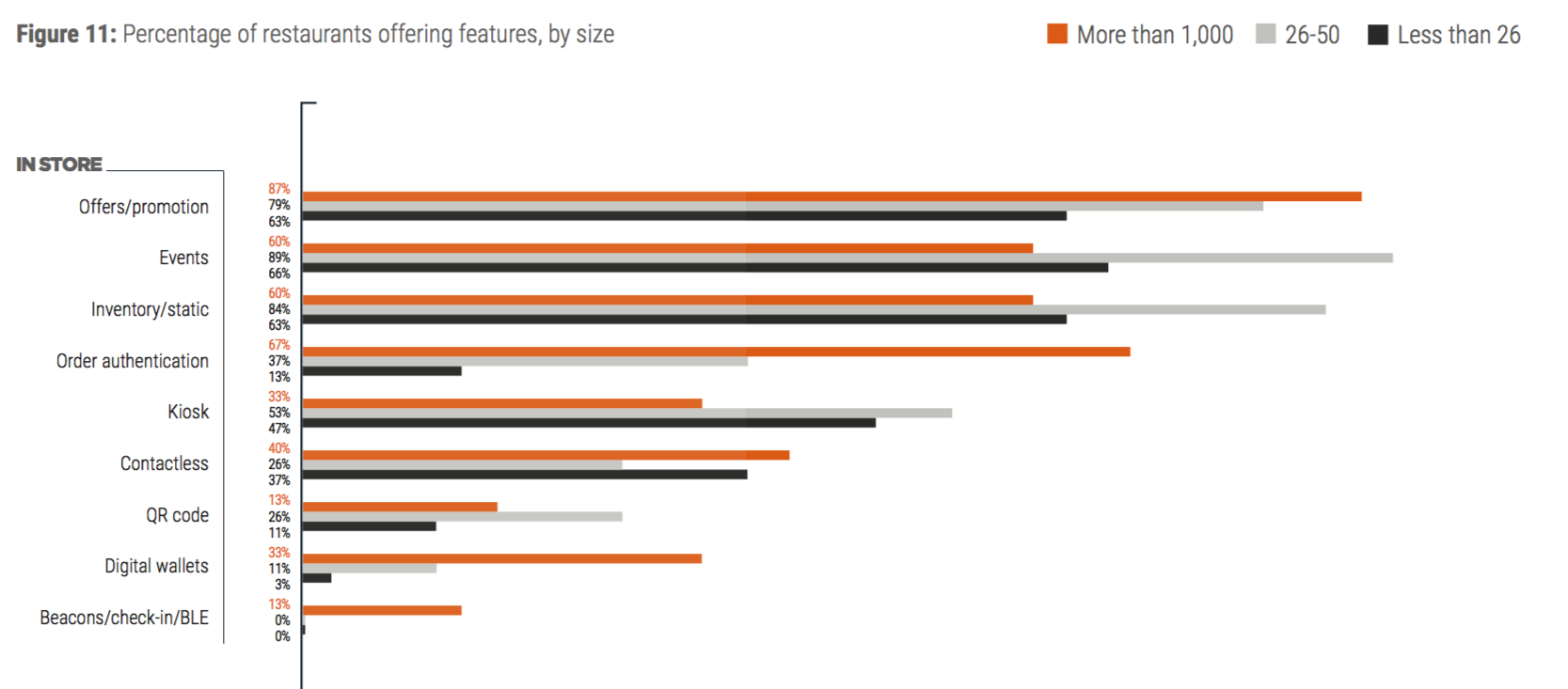

Judged by size, smaller QSRs did a better job at embracing kiosks. Of those chains with fewer than 26 locations, 47 percent had in-store kiosks, according to the study. Slightly larger restaurants, those with 26 to 50 stores, implemented kiosks at a 53 percent clip. Large companies, with more than 1,000 locations, were the laggards in this category, with only 33 percent integrating kiosks into their stores, the Restaurant Readiness Index found. QSRs also embraced popular third-party technology as part of their operations, including at kiosks. Italian QSR Fazoli used Amazon’s Alexa to enable voice ordering at its locations and planned to add Google Assistant and Google Home in the future. The technology was also being used in its mobile apps.

Kiosks should be an integral part of a QSR’s toolkit. However, Harvard Business School Professor Ryan Buell cautioned that technology can make service seem so effortless that it affects customer-perceived value.

“When we’re interacting with a person, we can see what’s being done to create value for us. A lot of the technologies are designed to basically obscure that work from customers,” Buell told the Harvard Business Review.

Advertisement: Scroll to Continue

On the other hand, there may be further benefits from kiosks beyond speed. Research on kiosks in liquor stores in various countries found that kiosks increased the sale of hard-to-pronounce items, while some fast food locations saw results in customers ordering more calorie-rich dishes than they did when speaking to a cashier, apparently to avoid being judged for their dietary habits.

It’s clear that kiosk providers are seeing rising demand. By 2023, the size of the interactive kiosk market is projected to be $34.1 billion, and the self-serve kiosk market will be $1 billion, according to PYMNTS’ April Unattended Retail Tracker report.

Add as Preferred Source

Add as Preferred Source