Giving Customers What They Want (When They Want It)

Consumers, particularly younger ones, are increasingly likely to buy in context when making their purchases — be it on social media or in their physical backyard. That’s because “simple, on-demand and fast” has become the new pace customers are used to, and they become grumpy when they don’t get that. It’s why the insurance industry is redesigning itself to make waiting on a check a thing of the past. It’s why getting paid for labor is become something that can happen daily — instead of every few weeks. And it’s why the global payments picture is getting more diverse by the day — because when consumers show up to shop, they expect a payment method to greet them when they arrive.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Add as Preferred Source

Add as Preferred Source

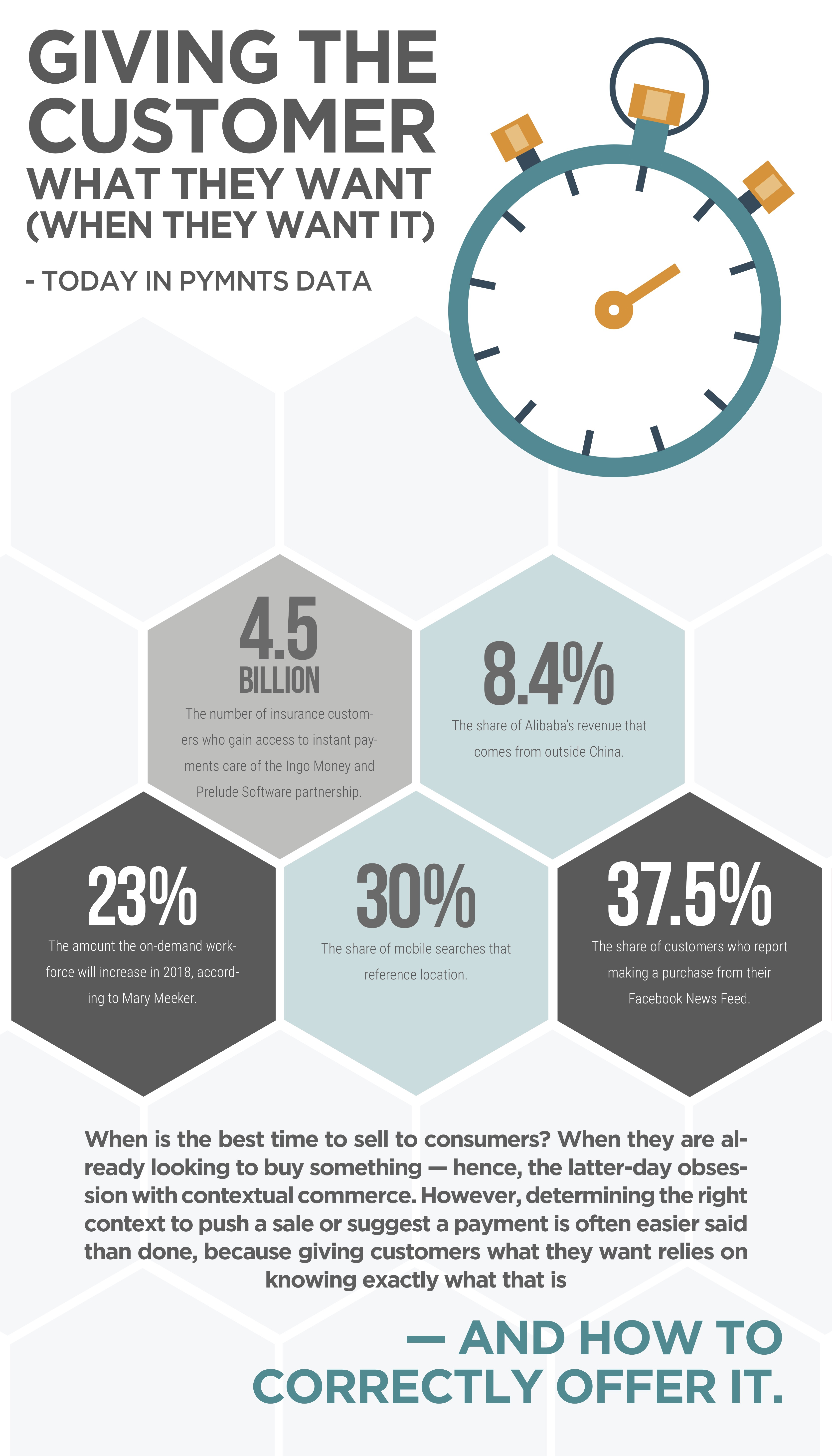

4.5 billion: The number of insurance customers who gain access to instant payments care of the

4.5 billion: The number of insurance customers who gain access to instant payments care of the