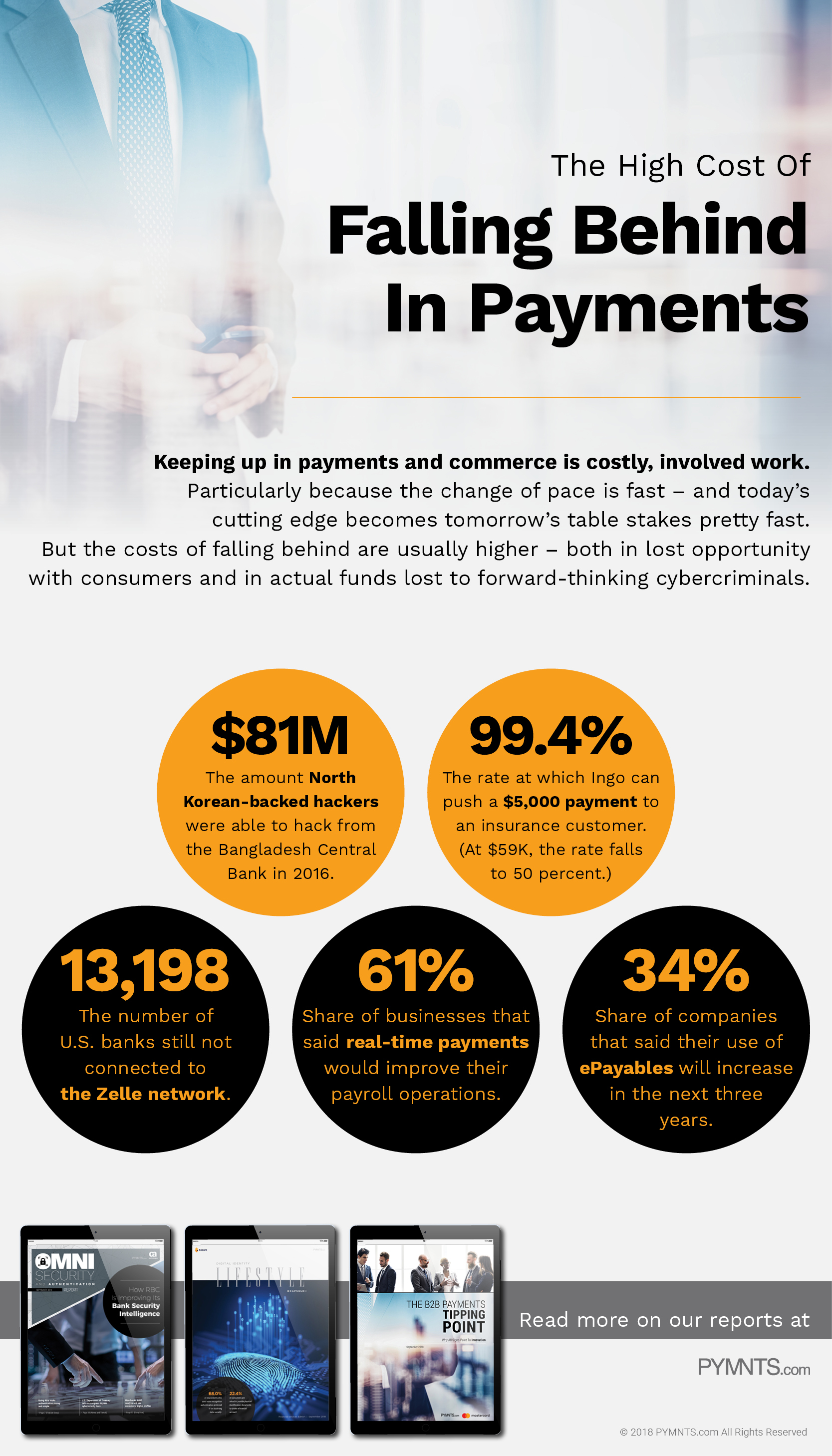

Today In Data: The High Cost Of Falling Behind In Payments

In a world that is moving quickly – and often in a lot of new directions at once – staying caught up is hard, and often costly, work. But the costs of falling behind are generally greater, as consumers and businesses gravitate to providers that can consistently and ubiquitously meet their needs. It’s why real-time payments have become a hot topic, and businesses across the board are rushing to embrace them. But keeping up with what’s next isn’t always easy, particularly for those with legacy systems to overcome. But falling behind is costly, not only in terms of keeping and attracting customers, but also in literal funds. Just ask the team at Bangladesh’s Central Bank, which fell behind hackers two years ago, to disastrous results.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Add as Preferred Source

Add as Preferred Source