Though they may have fewer resources than large firms, small and medium-sized businesses (SMBs) and self-employed freelancers are not exempt from business travel. SMBs may need to fly to events and exhibits to draw attention to their solutions, while freelancers may need to travel to visit clients and worksites. However, they rarely command the same level of travel-designated resources enjoyed by larger corporations. As such, they can struggle to organize flight bookings, handle payments, manage trip expense records and more.

The February “Workforce Spend Management Tracker™,” a collaboration with PEX, tracks how solution providers are seeking to bridge this gap to meet the business travel expense management needs of SMBs and freelancers.

The Latest Workforce Spend Management News

The Latest Workforce Spend Management News

To address these needs, expense management software provider Expensify announced a new solution intended to support freelancers. The solution helps self-employed individuals track business expenses and provide the information to their accountants — for filing Schedule C tax deductions.

AirPlus International, a business travel management payment solutions provider, and corporate travel platform provider Pana recently paired up with the intention of resolving pain points for contractors and other non-employees who may need to travel for the companies hiring them. The solutions are designed to enable non-employees to book flights, hotel rooms and car rentals through Pana’s platform, while paying for each one via virtual cards generated by AirPlus. The virtual card payments are then charged to the companies, saving the non-employees from using their own money.

Meanwhile, Indonesia-based Jojonomic is seeking to support both SMBs’ and larger corporations’ payment needs with its  expense management software solutions, in addition to cloud-based productivity, procurement management and operation digitization solutions. The company recently drew an investment from Finch Capital for an undisclosed amount. It intends to use the money to support new product development and improve data integrations.

expense management software solutions, in addition to cloud-based productivity, procurement management and operation digitization solutions. The company recently drew an investment from Finch Capital for an undisclosed amount. It intends to use the money to support new product development and improve data integrations.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Find these and more recent headlines in the Tracker.

Spend Management Solutions to Relieve Disaster Relief Workers

Disaster relief teams need to mobilize quickly to respond to the aftermath of a hurricane or other emergency. Teams must start purchasing supplies needed to get to work, paying for everything from car rentals and equipment to relief worker housing and meals.

For nonprofit Team Rubicon, finding the right workforce spend solution that could help its disaster relief teams operate smoothly was a must. In this month’s feature story, the organizations’ Senior Associate of Finance for Field Operations Jessica Green explained how Team Rubicon turned to a remotely reloadable card spend solution to furnish its teams with funds, as well as reconciliation software to make it easy for the nonprofit to manage its books.

To read the full story, download the Tracker.

Deep Dive: Fighting Corporate Travel Fatigue with Spend Management Solutions

Deep Dive: Fighting Corporate Travel Fatigue with Spend Management Solutions

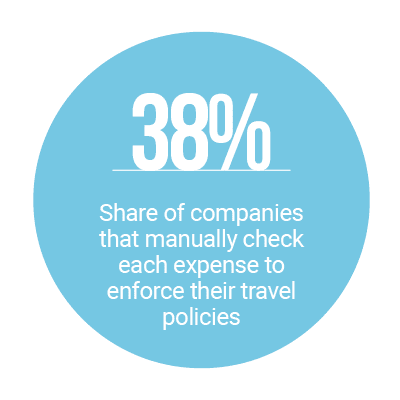

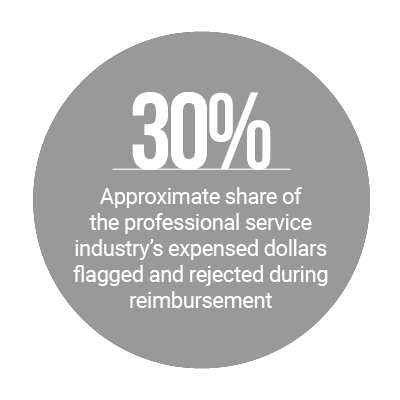

Business travel is a necessity across many industries. Employees must pay for meals, hotel bookings, car rentals and more — and are all too often asked to front the funds, then wait for reimbursement. However, lengthy, paper-based procedures to register and approve corporate travel spend can build resentment among employees who must endure clunky processes and irritating waits to get paid, while managers must manually enter expenses.

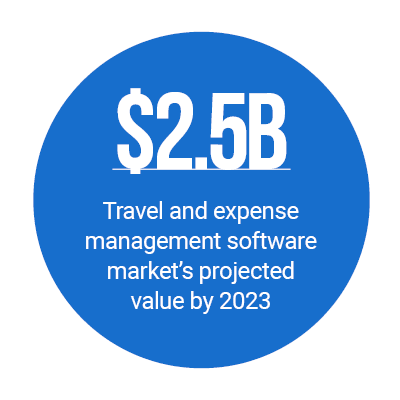

This month’s Deep Dive explores how and why companies are abandoning slow reimbursement practices for cloud-based expense logging and management solutions that are accessible from mobile devices.

About the Tracker

The “Workforce Spend Management Tracker™,” powered by PEX, is a monthly report that examines how corporate spend solutions can empower businesses with mobile workforces to make field-based purchases, and provide deeper insight into how funds are being spent.