Cars and quick-service restaurants (QSRs) have been interconnected since drive-ins were the latest innovation. QSRs thrive on speed and convenience, and that once meant catering to customers in cars via drive-thru windows.

Now cars have transformed from vehicle to ordering platform, and QSRs have been on the forefront of this transformation.

Consumers increasingly rely on mobile for ordering food, and in-car connected services are making this behavior even easier. According to the PYMNTS Commerce Connected Playbook, mobile usage in-car is already common, especially at QSRs: One quarter (25 percent) of drivers are already on their phones when pulling into drive-thru lanes.

How Commuters Use Connected Commerce

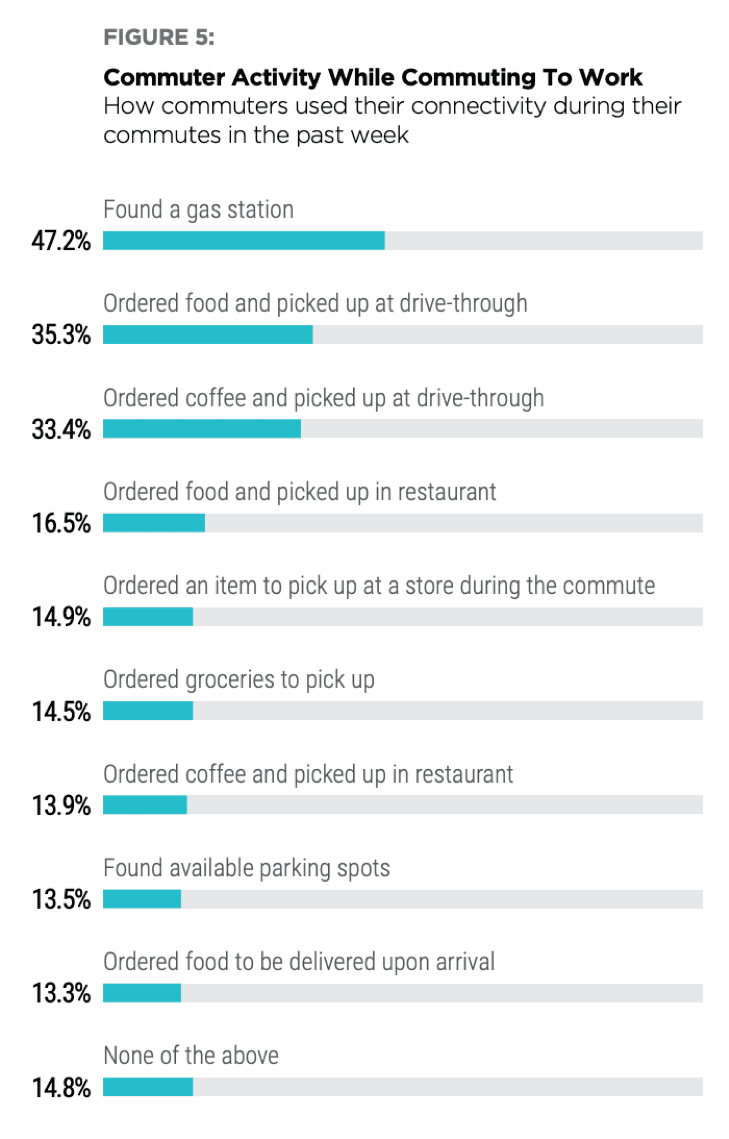

And ordering food while driving is one of the most common connected activities per PYMNTS’ Digital Drive report. More than one-third (35.3 percent) of commuters had ordered food and picked it up at a drive-thru in the past week, while a slightly lower number (33.4 percent) had ordered and picked up coffee the same way.

Manufacturers and merchants have a symbiotic relationship. QSRs might offer mobile ordering apps but unless auto manufacturers build connected features into cars, restaurants aren’t able to take advantage of them.

Most commuters in the Digital Drive report used voice assistants provided by the auto manufacturer (64.9 percent). Accessing Amazon’s Alexa (13 percent) and Google Assistant (12 percent) through the dashboard were far less popular. But in-dash Google Assistant had a good deal of future interest: 31.9 percent said they would engage in commuter commerce if this option was available.

Google’s recent connected commerce play speaks to this with its debut of voice-enabled ordering ability via Google Maps with Google Pay as the payment method.

QSRs and Coffee Chains Have Been Early Adopters

QSRs and coffee merchants have been some of the most prominent testers in the connected commerce market, likely because those are the two categories that are most active among commuter commerce users. In 2017, Starbucks launched ordering integration with Ford’s SYNC3, the automaker’s voice-activated technology powered by Alexa.

Just a few months ago, Domino’s announced a partnership with Xevo to launch a pizza-ordering platform via dashboard touchscreen that will be preloaded in cars this year. Domino’s had already enabled in-car ordering with Ford’s Sync AppLink back in 2014.

Pizza chains are often early adopters, partly because consumers are accustomed to ordering pizza by phone instead of while physically at a store. In fact, Pizza Hut’s claim to fame is that it sold its first online order way back in 1994.

This is just the beginning of a new wave in digital commerce; 64 million shipments of connected cars are forecast for 2019, up from 33 million in 2017. By 2020, nearly all (98 percent) new cars will offer internet and cellular and wireless connectivity.

Connected cars have obvious implications for autonomous vehicles, but this tech might also having an impact on the sharing economy. Startup Cargo has been piloting ordering experiences designed for an Uber or Lyft where riders can purchase things like candy, drinks or phone chargers in-car through a mobile app.

Mobile Ordering Appeals to Millennials

Meeting consumer demand is vital. According to the PYMNTS Commerce Connected Playbook, nearly half (48 percent) of millennials said they would rather not eat at all than wait in long QSR lines. This is the audience for mobile ordering. In the Digital Drive report, bridge millennials, ages 30 to 40, had higher than average use of placing orders while in a car — 48.1 percent vs. 45.8 percent.

Mobile also has sales implications. Taco Bell has reported that mobile order values were 30 percent higher than in-store orders. Mobile ordering doesn’t necessarily replace in-store, though. Many apps drive in-store traffic, as well as creating engagement and loyalty. In the Digital Drive report, roughly twice as many ordered food while commuting to pick up in a drive-thru (35.3 percent) than ordering and picking up in-store (16.5 percent) but both behaviors can be targeted. More channels mean more customer touchpoints.