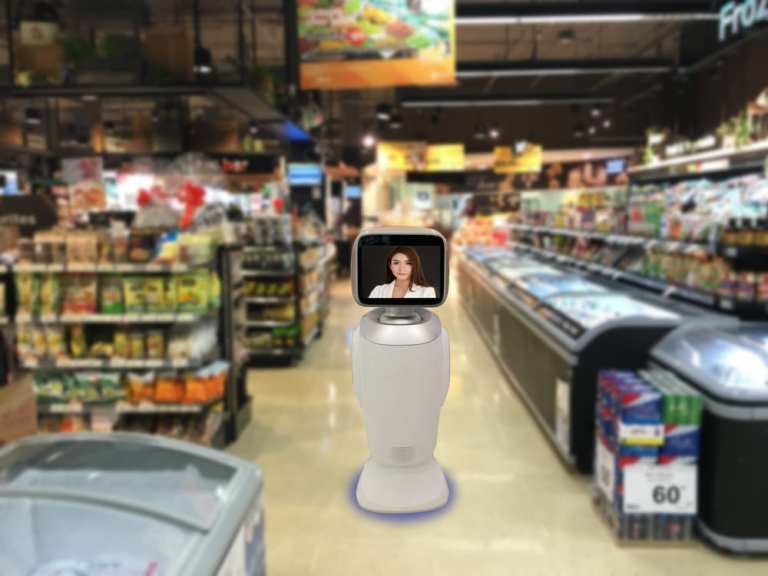

Automated retail might conjure up images of robot cashiers, but beyond a few convenience stores in Japan and Korea, that sci-fi development hasn’t yet become reality for the wider world.

Robotics might take over delivery jobs before they make cashiers redundant in the U.S., though. Last month, Domino’s Pizza announced it would be testing autonomous pizza delivery in Houston with robotics company Nuro. Kroger and Nuro had already partnered on a self-driving grocery delivery service in select cities.

The latest Automated Retail Tracker explores these trends and new developments in the unattended retail space. The automated retail landscape in the U.S. tends to fall into two categories: smart vending machines and cashierless-type stores a la Amazon Go. According to the study, it’s estimated that there are 4.5 million vending machines in the U.S. and 25 percent of those vending machines can accept cashless payments.

Automated, cashierless stores like Amazon Go would seem better suited for dense, urban environments where there is high traffic, limited space and customers demand seamless shopping experiences and convenient payment methods.

However, that is not the case with Farmhouse Market, a cashierless store in New Prague, Minnesota, population roughly 8,000. The store was founded to bring local, organic food to the 40 percent of Minnesota’s population living outside a metropolitan area.

Co-Founder Kendra Rasmusson also wanted to provide convenient, automated service without the expense of staffing around the clock. “We looked to technology to assist us,” she said.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

The store, founded in 2015, works on a membership basis. Paying members receive a keycard to unlock the doors at any hour. The shop’s lighting is motion-activated and triggers when customers enter. Since each customer has their own unique card, the store can track shoppers with an assist from security cameras.

Customers can select items and check themselves out with a tablet-based point-of sale (POS) system that accepts credit and debit cards. The 24-hour access also benefits suppliers who can deliver goods on their own schedules.

Unattended retail is the domain of grocery stores, convenience stores and quick-service restaurants (QSRs), where speed and access matters. And as with Farmhouse Market, these new offerings often operate at intersection of tech and health.

Fresh.Bowl, for example, stocks kiosks with locally sourced nutritionist-approved meals. While the company’s kiosks are limited to a few Manhattan locations like WeWork, the larger idea is to place them train stations, offices, gyms and hospitals. The dishes come in reusable glass jars and when consumers return the jars to the machine, they receive a credit for their next purchase.

Similarly, Alpaca Market has a network of vending machines and smart fridges in Austin, Texas to provide healthy food through a digital touchscreen that allows diners to browse its menu, look at nutritional facts and ingredients and see pictures of the food.

Chicago’s Farmer’s Fridge takes a similar tact and makes fresh food every day and delivers it to a network of automated machines via refrigerated trucks. Farmer’s Fridge Founder and CEO Luke Saunders told PYMNTS in an interview that the machines are designed for practically any setting and are geared to make healthy meals easier to impulse buy at any hour.

The most familiar unattended retail model in the U.S. is likely self-checkout, which has seen its popularity ebb and flow in the U.S. It’s starting to see traction again. Membership-only wholesale retailer Costco stopped using the technology in 2013, but has re-introduced self-checkout options. The retailer added 125 self-service stations in Q1 2019 and plans to have 250 self-serve checkouts in operation by the end of this year.

Automated retail has the potential for wider adoption due to the uptake in mobile payments — especially contactless payments. Merchants are using tactics like rewards and other value-added services to encourage use.

Mobile payments have been slow to take off in the U.S., though, especially compared to countries like China. Between May 2018 and October 2018, more than 79 percent of Chinese smartphone owners used their mobile devices at stores’ POS systems to purchase products. That number was just about 25 percent for U.S. smartphone users.

A vicious cycle has been created where low consumer adoption has made merchants reluctant to offer new tech but when retailers don’t enable mobile payments — like JCPenney discontinuing Apple Pay acceptance earlier this year — it deters mobile payment users.

Add as Preferred Source

Add as Preferred Source