The financial world is awash in hot tech topics these days, from blockchain to artificial intelligence (AI). However, financial institutions (FIs) are getting better at separating vital areas of innovation from the hype.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Banks are increasingly focusing on the fundamentals when determining their innovation agendas. This starts with payment technology, the essential infrastructure needed to support current and future digital payment developments, from contactless and push payments to transactions on real-time payment rails.

Banks are increasingly focusing on the fundamentals when determining their innovation agendas. This starts with payment technology, the essential infrastructure needed to support current and future digital payment developments, from contactless and push payments to transactions on real-time payment rails.

This is among the key findings of the latest Innovation Readiness Playbook: The Evolving Innovation Priorities Of FIs Edition, a collaboration with i2c. PYMNTS surveyed more than 200 FI decision-makers to examine the specific innovation areas in which banks are focusing on, now, and in the years ahead. We also analyzed how the areas that FIs are focusing on relate to such factors as level of investment, on-time performance and innovation strategy.

Payment technology is in many ways the flagship among the fleet of innovations that banks are pursuing. According to PYM NTS’ research, 57 percent of all FIs will focus on this area over the next three years, making it the highest item on an agenda that also includes user experience, consumer engagement, and fraud and security. It is an especially keen interest for the top performers in our Index: more than 73 percent of them will invest in payment technology, a 22 percent increase over the past three years.

NTS’ research, 57 percent of all FIs will focus on this area over the next three years, making it the highest item on an agenda that also includes user experience, consumer engagement, and fraud and security. It is an especially keen interest for the top performers in our Index: more than 73 percent of them will invest in payment technology, a 22 percent increase over the past three years.

Data analytics, which leverages AI and other sophisticated computational tools to enable banks to make better decisions about which new products and features to develop, is also a key priority for top-performing FIs. Our research shows that 80 percent of them will focus on data analytics, far surpassing lower-performing FIs. All FIs, however, will make data analytics a greater priority in the coming years. In fact, the share of bottom performers that plan to innovate in this area is projected to grow by more than 166 percent over the next three years.

Advertisement: Scroll to Continue

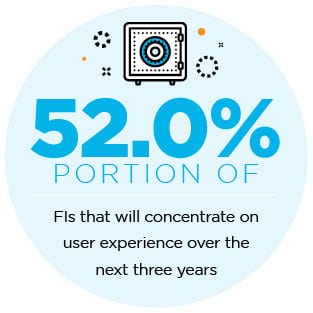

A significant share of FIs will turn their focus in a different direction, however, to user experience (UX) — how users interface with banking products and features. We found that 52 percent of all FIs will concentrate on this area over the next three years. This area will be especially important for the FIs that scored lower in our Index: 62.5 percent of bottom performers will invest in UX.

A significant share of FIs will turn their focus in a different direction, however, to user experience (UX) — how users interface with banking products and features. We found that 52 percent of all FIs will concentrate on this area over the next three years. This area will be especially important for the FIs that scored lower in our Index: 62.5 percent of bottom performers will invest in UX.

Despite these differences among FIs, PYMNTS’ research shows that banks on the whole are getting more serious and strategic in how they are approaching innovation. By focusing on areas like payment technology and data analytics, they are turning away from the buzz and toward the fundamentals of intelligence and infrastructure.

To learn more about the motives and strategies behind FIs’ evolving innovation priorities, download the report.