Governments are tightening know your customer (KYC) and anti-money laundering (AML) requirements on various industries out of increasing concern over fraud threats. Cryptocurrency companies that previously let customers remain anonymous will have to change their tunes in some countries, as will online gambling sites that provided fast onboarding at the expense of rigorous identity verification approaches.

The November “AML/KYC Tracker®” details the latest security regulation changes, as well as how companies are leveraging new technologies to remain compliant and strengthen their fraud protections.

Around the AML/KYC World

The Bank of Thailand is exploring new KYC approaches, announcing plans to pilot online biometric KYC checks on customers seeking to open savings accounts. Remotely located customers could enjoy easier access to financial services if the test is deemed successful and the KYC solution is made available to the country’s wider financial industry.

System integration provider NEC XON is also looking into biometric KYC for mobile network operators and financial institutions (FIs). The company announced the launch of self-service kiosks that can collect users’ biometric and personal details to perform KYC checks on them, with the machines then issuing SIM cards and bank cards to consumers whose identities are validated.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Other companies are turning to management and workflow automation tools to improve their KYC and AML efforts. Retail brokerage company Exness recently adopted such solutions from provider Sum&Substance to help the former manage compliance for its two entities. The pair are located in different regulatory jurisdictions and thus present different compliance needs.

Find more on these and other recent headlines in the Tracker.

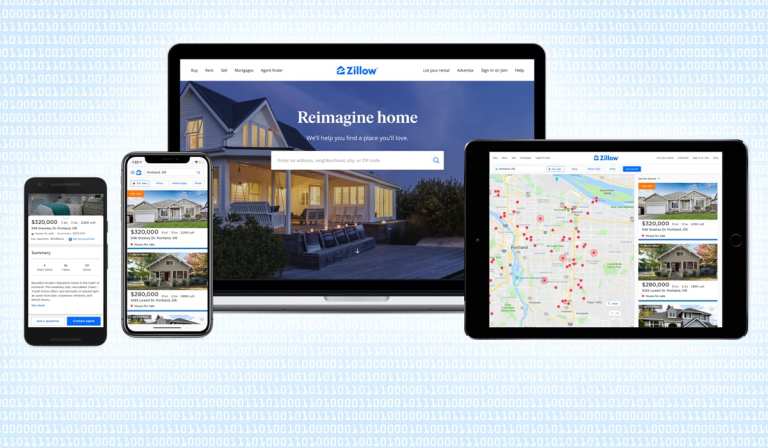

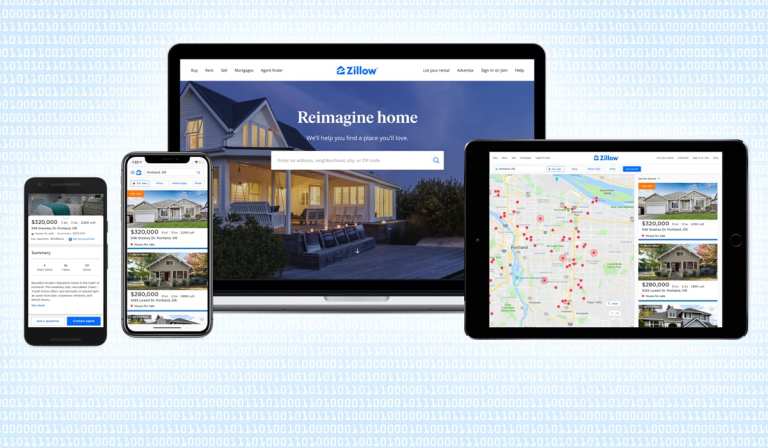

How Zillow Combats Real Estate Fraud

Real estate platforms are frequent targets for money laundering attempts, with fraudsters seeking to hide and transfer ill-gotten gains through home purchases or rental payments. Platforms must have robust AML and KYC procedures in place to ensure they are not taken advantage of, while also working to keep onboarding swift and convenient for legitimate customers.

In this month’s Feature Story, Zillow Director of Product Development Justin Farris discusses how the platform protects customers without making security measures burdensome.

Deep Dive: Can Video KYC Solve FIs Remote Onboarding Woes?

FIs that wish to serve global customer bases must find ways to quickly and securely onboard remote users, no matter where they live. These companies are increasingly interested in video KYC solutions that provide remote ID verification by comparing videos of customers to the images on their identification documents.

FIs that wish to serve global customer bases must find ways to quickly and securely onboard remote users, no matter where they live. These companies are increasingly interested in video KYC solutions that provide remote ID verification by comparing videos of customers to the images on their identification documents.

The method is more secure than photo-based remote KYC solutions, but companies intending to use it must first resolve complicated decisions about execution, including whether to have live video calls and how their processes will protect against deepfakes.

This month’s Deep Dive explores the advantages, limits and complexities of video KYC for remote customer onboarding.

About The Tracker

The “AML/KYC Tracker®,” a PYMNTS and Trulioo collaboration, provides an in-depth examination of current efforts to stop money laundering, fight fraud and improve customer identity authentication in the financial services space.